Chicago-based United Continental Holdings (NYSE:UAL) , the parent company of United Airlines, reported impressive traffic numbers for the month of June with load factor (% of seats filled by passengers) rising as traffic growth outpaced capacity expansion. More than the traffic numbers, the better second-quarter outlook for consolidated passenger revenue per available seat mile (PRASM: a key measure of unit revenue) drove the stock in after-market trading on Jul 11.

Traffic

Traffic – measured in revenue passenger miles (RPMs) – stood at 19.6 billion, up 1.4% from 19.4 billion recorded a year ago. On a year-over-year basis, consolidated capacity (or available seat miles/ASMs) inched up 0.5% to 22.5 billion. Meanwhile, the load factor increased to 87.1% from 86.3% a year ago.

At the end of the first six months of 2016, the carrier recorded RPMs of 100.6 billion (down 0.1% year over year) and ASMs of 123 billion (up 0.9% year over year). Load factor contracted 80 basis points to 81.8% in the month of June.

Unit Revenue View

The carrier said that it expects consolidated PRASM in the second quarter to decline in the band of 6.50% to 6.75% (the previous outlook had projected a decline in the band of 6.50% to 7.5%). The company attributed better-than-expected international yields and a surge in business travel in the final week of June (aided by the holiday period leading to the Fourth of July), as the reasons behind the enhanced outlook.

Pre-tax margin is expected in the band of 14% to 14.5%. Fuel Price (inclusive of all cash settled hedges) is projected at $1.44 per gallon (old guidance: $1.45 to $1.50).

Zacks Rank & Stocks to Consider

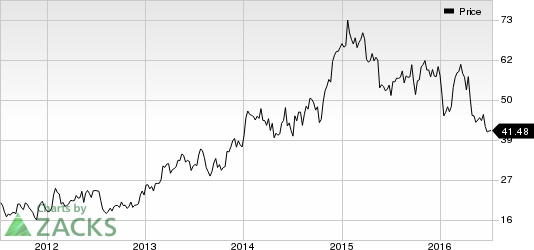

United Continental currently carries a Zacks Rank #5 (Strong Sell). The carrier’s bearish rank can be attributed to fears of travel demand slackening following the Brexit vote and the surge in terror attacks. Investors interested in the airline space may consider GOL Linhas (NYSE:GOL) and Cathay Pacific Airways Limited (OTC:CPCAY) , both of which sport a Zacks Rank #1 (Strong Buy). ANA Holdings Inc. (OTC:ALNPY) carries a Zacks Rank# 2 (Buy).

GOL LINHAS-ADR (GOL): Free Stock Analysis Report

CATHAY PAC AIR (CPCAY): Free Stock Analysis Report

ANA HOLDINGS (ALNPY): Free Stock Analysis Report

UNITED CONT HLD (UAL): Free Stock Analysis Report

Original post

Zacks Investment Research