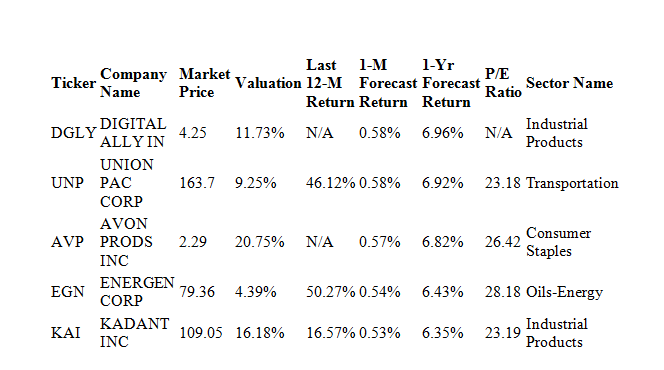

For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. There were no STRONG BUY upgrades today. All of the stocks below are rated BUY.

Today, we take a look at Union Pacific (UNP). Union Pacific Corporation (NYSE:UNP) is one of America’s leading transportation companies. Its principal operating company, Union Pacific Railroad, is North America’s premier railroad franchise, covering 23 states across the western two-thirds of the United States. One of America’s most recognized companies, Union Pacific Railroad proves a critical link in the global supply chain. Union Pacific’s network and operations is to support America’s transportation infrastructure. The railroad’s diversified business mix is classified into its Agricultural Products, Energy, Industrial and Premium business groups. Union Pacific serves many of the fastest-growing U.S. population centers, operates from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada’s rail systems and is the only railroad serving all six major Mexico gateways. Union Pacific provides value to its customers by delivering products in a safe, reliable, fuel-efficient and environmentally responsible manner.

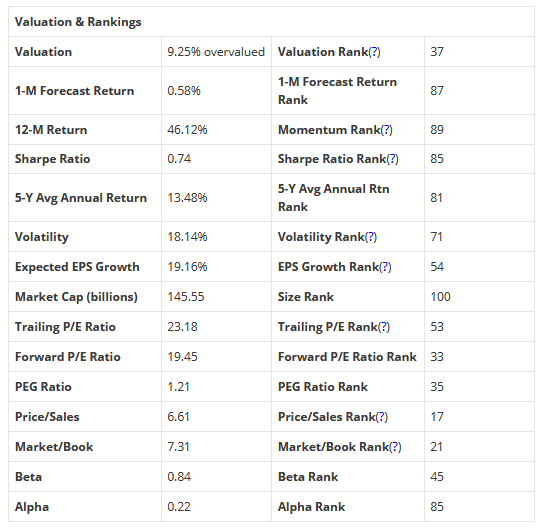

Union Pacific has been on a tear much of the year and is currently at or near its 52-week high. A strong economy typically features strong transportation stocks, and we certainly see that with this company. All of their numbers look strong and the guidance for the year is impressive.

Analysts have also raised their consensus estimates for earnings lately. Revenues also look strong with decent growth. IN addition, the company features a good dividend and that dividend has been increasing as the company rewards shareholders.

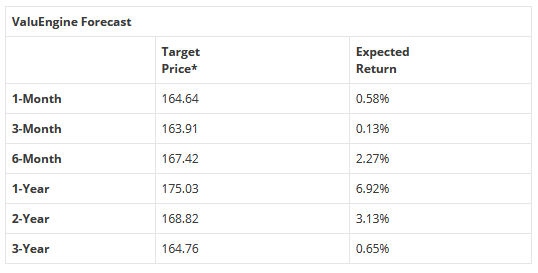

ValuEngine updated its recommendation from HOLD to BUY for UNION PAC CORP on 2018-09-18. Based on the information we have gathered and our resulting research, we feel that UNION PAC CORP has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Momentum.

You can download a free copy of detailed report on Union Pacific (UNP) from the link below.