Unilever (LON:ULVR) N.V. (NYSE:UN) posted sales growth of 4.9% in second-quarter 2017, on the back of favorable currency and gains from acquisitions. Organic sales increased 3.0% on a constant currency basis, better than the preceding quarter’s growth of 2.9%, driven by higher pricing of 3.0% and flat volumes. As per Reuters, organic sales growth was slightly lower than expected growth of 3.2%. Excluding the spreads business (which was announced to exit on Apr 6), organic sales growth was 3.3% with volume growth of 0.3% and a higher pricing of 3.1%.

The company witnessed organic sales growth and improved pricing in the categories of Personal Care, Refreshment, Home Care and Foods. Except Foods and Personal Care, volumes improved in the rest of the categories. Foods volume declined 1.3% in the quarter, and excluding spreads business, foods segment declined 0.4%. Volumes in Personal Care also declined 0.3% in the second quarter.

Performance in Emerging and Developed Markets

Organic sales in emerging markets grew 4.8%, lower than the preceding quarter’s growth of 6.1%. We note that emerging markets account for about two-thirds of the company’s total revenue. Though being volatile, these markets offer long-term growth prospects. Sales in the emerging markets grew owing to pricing growth offset by 0.1% decline in volumes. The economic crisis in Brazil continued to remain a headwind. In India, trade stock levels were reduced ahead of the implementation of the Goods and Services Tax while markets in Indonesia were affected by fewer trading days due to public holidays.

Nevertheless, organic sales at developed markets grew 0.7% in the second quarter, driven by rise in both pricing and volumes. The growth was favorable in comparison with a decline of 1.5% in the preceding quarter. While performance of both Latin America and North America improved in the second quarter, consumer demand continued to remain weak amid challenging retail environment in Europe,. Excluding spreads business, developed markets increased 1.2% in the quarter.

First Half Results

Underlying earnings grew 14%, while underlying sales growth were 3% in the first half of 2017. Excluding spreads, underlying sales growth was 3.4%.

Underlying operating margins was up by 180 basis points to 17.8%, driven by faster savings delivery and phasing of investment.

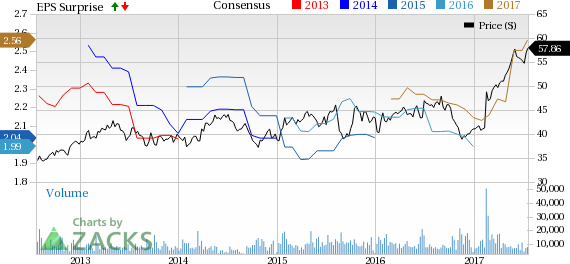

Stock Price Movement

A glimpse of Unilever’s stock performance shows that its shares have been rallying since the past six months. Shares have increased 37.7% over the past six months, outperforming the Zacks categorized industry, which gained 12.7%. Notably, the industry is part of the top 3% of the Zacks Classified industries (7 out of the 265).

Growth Drivers

The strong results came on the back of its recent strategic business reviews, focus to deliver profits and boost shareholder value amid sluggish growth and increasing competition in the global packaged goods industry. The strategic review was conducted to gain investor support following the unsolicited $143 billion takeover offer by Kraft Heinz Co. (KHC) in Feb 2017.

Consequently, the consumer products giant decided to sell its spreads business, including brands like Flora and Stork butter. The business has been witnessing a slowdown for the past few quarters. The divestiture process is progressing well and the company’s board expects to decide the outcome before the end of the year.

Unilever also plans to integrate its food and refreshment businesses into a Netherlands-based unit. Since the company is listed both in Amsterdam and London, it is looking to simplify its corporate structure to ease the process of buying or disposing of businesses.

Furthermore, the maker of Dove products and Ben & Jerry announced that it would buy back shares, hike dividends and generate cost savings through its Connected 4 Growth (C4G) program announced last year. The program was undertaken to reduce costs, under which individual expenses are reviewed during each accounting period rather than rolled over. This has generated savings of more than €1 billion in the first half of year 2017, which is a step closer towards its target of €6 billion and a targeted underlying operating margin of 20% by 2020.

Moreover, it has set a target for net debt of two times EBITDA, which would mean enough flexibility for acquisitions or returning cash to shareholders.

Outlook

The company expects these actions to deliver another year of underlying sales growth in the 3–5% range. The company anticipates accelerating growth in the second half of the year driven by the phasing of the innovation plans and a step-up in brand and marketing investment. For 2017, the company also expects an improvement in underlying operating margin of at least 100 basis points and strong cash flow.

Zacks Rank & Other Stocks to Consider

Unilever currently sports a Zacks Rank #1 (Strong Buy). We believe there is still much value left in the stock, which is quite evident from its VGM Score of ‘A’.

Investors interested in the consumer staple space can also consider Post Holdings, Inc. (NYSE:POST) , Kellogg Company (NYSE:K) and Lamb Weston Holdings Inc. (NYSE:LW) . While Post Holdings sports a Zacks Rank #1 (Strong Buy), both Kellogg and Lamb Weston hold a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kellogg Company and Post Holdings have long-term earnings growth rate of 5.96% and 14.00%, respectively. Lamb Weston has an average positive earnings surprise of 11.9% in the trailing four quarters.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Kellogg Company (K): Free Stock Analysis Report

Post Holdings, Inc. (POST): Free Stock Analysis Report

Unilever NV (UN): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Zacks Investment Research