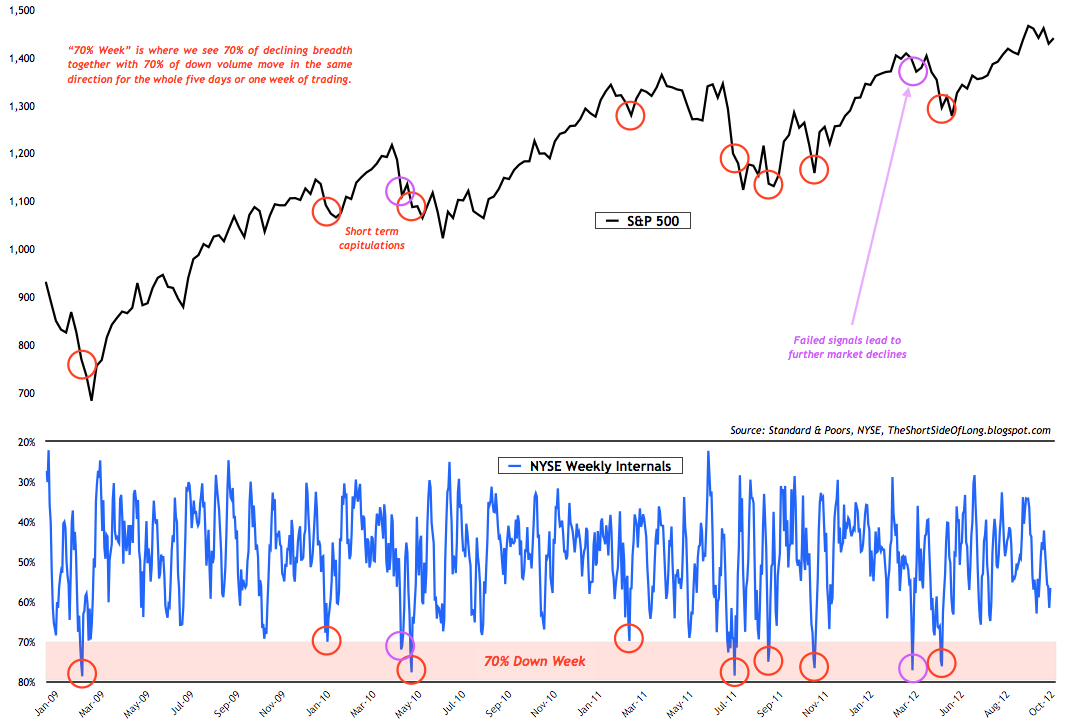

- The chart above shows the S&P 500 together with an indicator I call Weekly Internals. Basically it tracks the direction of the NYSE breadth and volume readings over five trading days or one week. Readings above 70% (inverse on the chart) tend to signal short term wash out. With the recent S&P decline of about 3%, many have proclaimed that the correction is over. However, according to the Weekly Internals, the stock market is not even remotely close to being oversold over the short term, let alone long term oversold. While this does not tell us the future direction of the market, it disregards the notion that the market is ripe for a rebound based on technical merits alone, as many pundits on CNBC would have us believe.

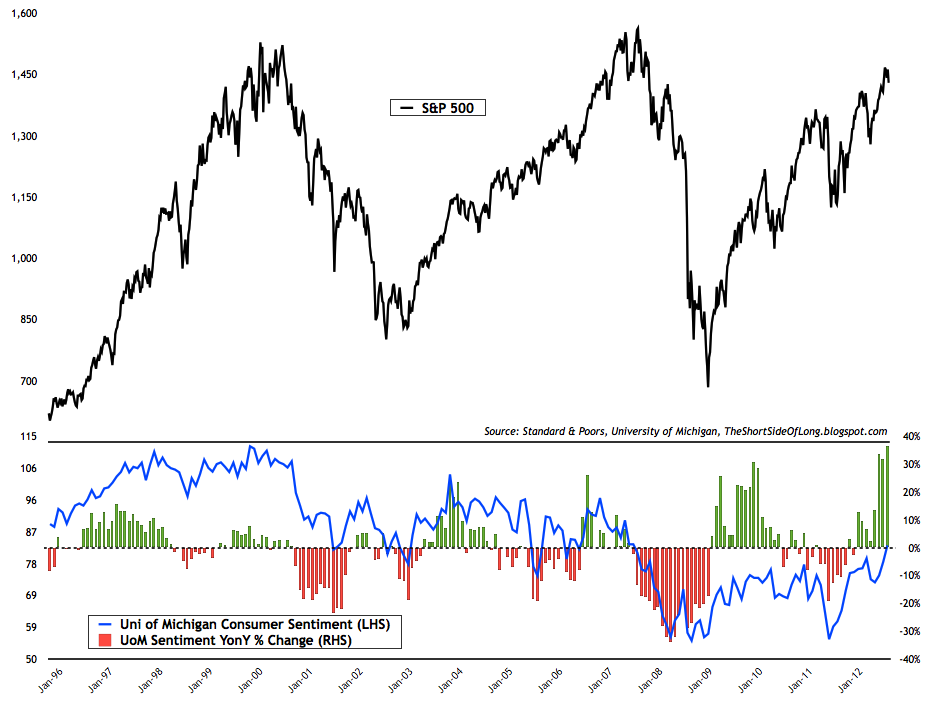

- The recent consumer data from the University of Michigan showed that confidence has now reached a five year high. Economists, investment bankers, strategists and advisors all claim that this is a very bullish signal. I disagree. This is actually a contrarian signal to sell. First, I wouldn't invest in stocks when consumer confidence is at five year highs, but rather when it reaches five year lows. Second, one should notice that the public is almost always wrong near major stock market turning points. Third, the current secular trend for consumer confidence is still negative since the bear market started in March 2000 and it will most likely continue to trend downwards until the middle of the decade.

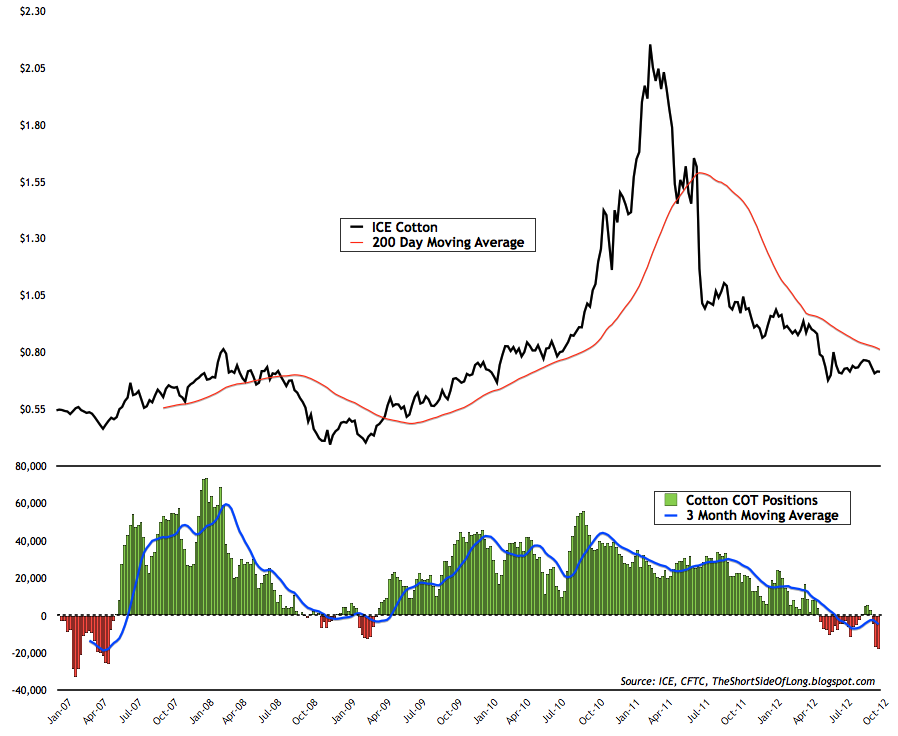

- The recent CFTC Commitment of Traders report showed that hedge funds and other speculators increased bearish bets against Cotton, with the largest net short positioning since the middle of 2007. Such bearish conditions must have at least something to do with Cotton world inventory estimates being raised yet again by the recent report by the USDA. As a matter of fact, Commonwealth Bank of Australia commodities analyst Luke Mathews termed Cotton's stocks-to-use ratio as "staggering". Another investment bank analyst stated that he was "amazed" with Cotton's price resilience, saying that: "I am perplexed. We keep thinking the market ought to take a tumble to about the low-50s cents a pound." Despite such negative supply news, the price is failing to make a new low. Why, when the conditions are so bad? It was Marc Faber who first taught me that when the price of an asset fails to make a new low on unfavourable news, it could be starting to price in more favourable conditions. The inverse is true for an asset that fails to make a new high, under very favourable conditions.

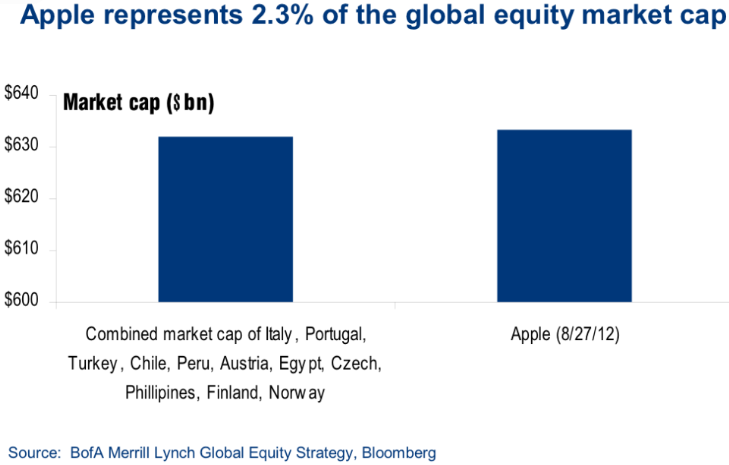

- Many of you already know that I have shorted Apple (AAPL) with long dated Puts at the end of August as already disclosed here. Doing my regular four to five hours of reading per day, I came across an interesting chart from Merrill Lynch's research department showing that as of late August, Apple's market cap was worth more than the whole of Italy, Portugal, Turkey, Chile, Peru, Austria, Egypt, Czech Republic, Philippines, Finland and Norway combined. That is right... combined! At its peak of $700, Apple was up more than 110 times since its 2003 lows. Regardless of any reasoning anyone comes up with (PE ratio, cashflow, market share, balance sheet, iPhone demand, etc etc etc), when an asset goes up 110 times in a space of less than a decade... I'm pretty sure it is in a MEGA MANIA!

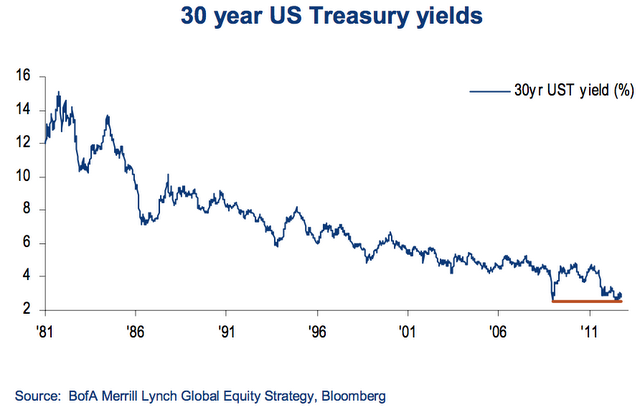

How many times have you heard the phrase "bond bubble" over the last 12 months? I'd assume probably a lot, enough that you couldn't keep count. I do not blame you because the phrase is thrown around just about every day on any major financial media outlet. I guess I am in the consensus right here, but I too believe bonds are in a bubble, especially when one reads that Fidelity (a famous stock shop from the 80s and 90s) now has more Assets Under Management (AUM) in bonds compared to stocks. Therefore, it shouldn't be to hard to conclude that we are slowly nearing the end of the secular bond bull market, which started in September 1981. Interestingly, since we are now in October 2012, the chart above shows that the great bond bull market just recently turned 31 years of age.

Now, this post has started just about similar to every other blog post which usually warns you about how risky Treasuries are, states that all the money has been leaving stock funds for bond funds and concludes how you should open up short Treasury position. No, I am not doing any of those... even though you might make a serious fortune over the next couple of decades if you did decide to do that.

What I will do is discuss the "other" bonds also known as the riskier, higher beta, higher yielders, which mostly aren't discussed. These include High Yield Junk Grade Bonds, Corporate Grade Bonds and Global Emerging Market Bonds. So let us begin. The most common phrase you hear from an average investor, especially those that are bullish on equities, goes something like this:

"Negativity persists among investors, as evidenced by the ongoing stream of money leaving equity funds into bond funds."

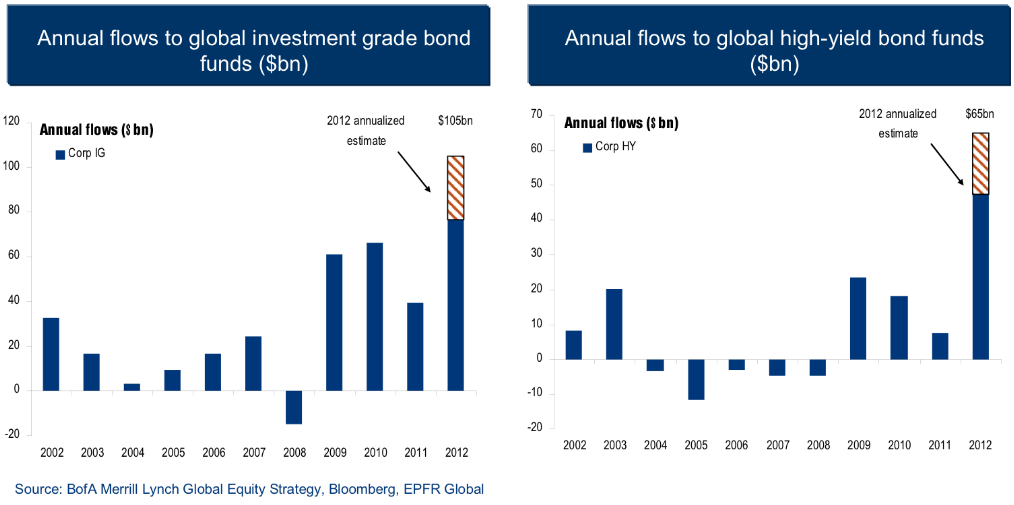

Now, while that is not a wrong statement, it is taken out of context and not properly explained. When that statement is made, the majority of retail investors think that because money is leaving equities for bonds, one should buy equities as a "contrarian" investment because Treasuries yield next to nothing. But who said anything about Treasuries? Treasuries are not the only bonds in town and here is where the misconceptions and misunderstanding occurs.

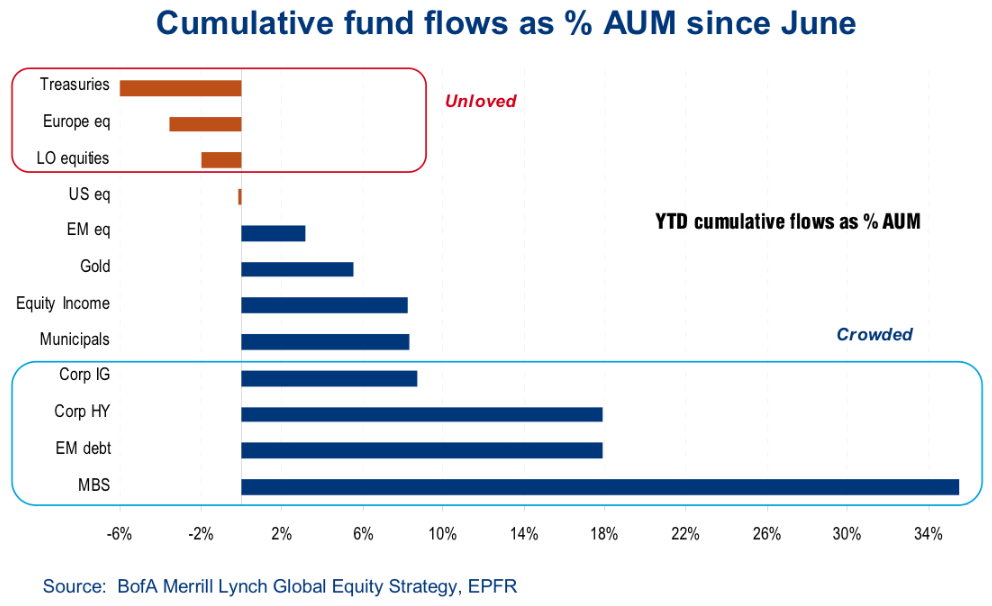

Yes, moms and pops are leaving equity funds and yes, they are putting their money into bond funds, but the more important question is... which bond funds? According to EPFR Global, a world leading fund flow tracking company, the majority of the billions leaving equity funds are going into Corporate and Junk Bonds (not just Treasuries as you may have thought).

There is a bubble building in these risky bonds and its fooling the majority of the investors into thinking they are buying safe assets. This can be far from the truth.

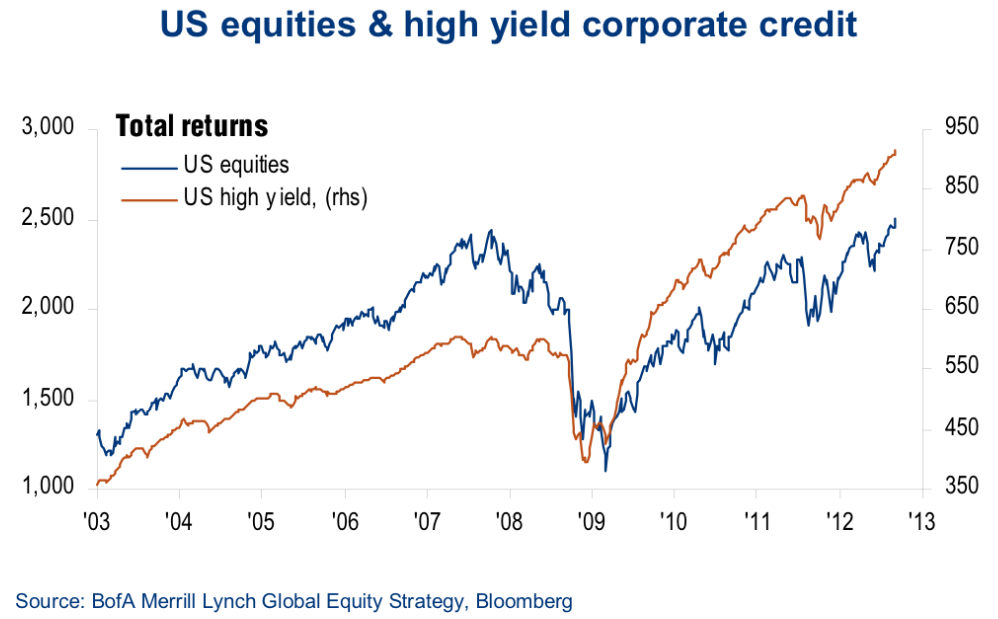

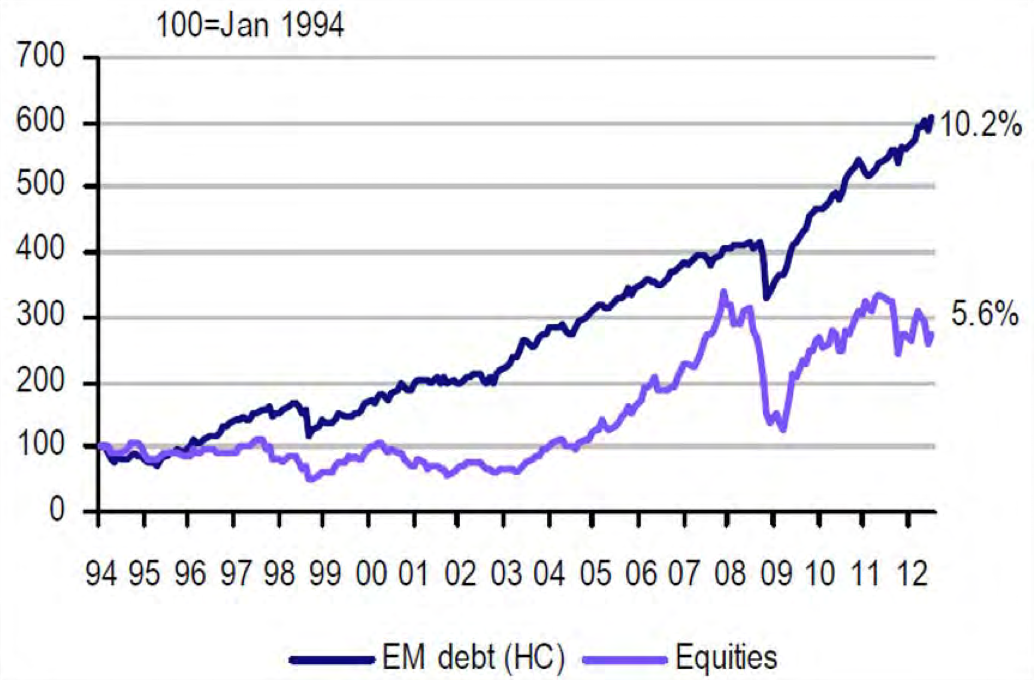

The chart above shows that Junk Bonds do not display government bond-like behaviour but rather display equity-like behaviour. In other words, moms and pops are taking money out of one risky asset (equities) and putting that money into another risk asset that correlates at a 90% rate (junk bonds), because their "financial advisor" told them bonds were much safer than equities.

And then we have the so called "contrarians" amongst us, who constantly say: "equities are experiencing outflows, while bonds are experiencing inflows". The question I have for these so called "contrarians" is: what do you think will happen to the stock market when the Corporate Bond bubble bursts?

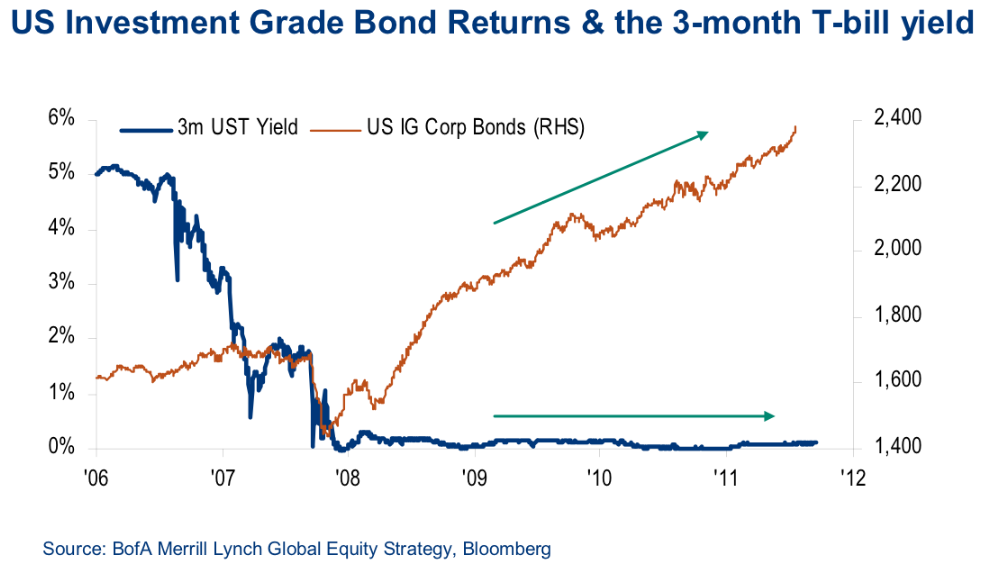

It goes without saying that monetary policy has unintended consequences. By lowering rates to virtually zilch, so that the debt burden becomes easier to bear for borrowers, Ben "Helicopter" Bernanke has created a condition where savers such as pension funds find themselves chasing yield further up the risk spectrum.

Funds which use to mainly invest in 10 Year Treasury Notes yielding around 4 to 5 percent only a few years ago, now find themselves starving for yield and taking more risk on board by participating in the Corporate Bond or Emerging Market Bond chase. And the funds which use to mainly invest in Corporate Bonds yielding around 6 to 7 percent only a few years ago, now find themselves starving for yield and taking more risk on board by participating in the Junk Bond chase. And the list goes on. However, as already stated above, these bonds have equity like behaviour and aren't as "safe" as the majority think.

The current conditions within the risky bond market are such that valuations are at extremes with Investment Grade (IG) and High Yield (HY) bond yields reaching historical record lows, the issuance (supply) is starting to overwhelm the market, credit quality is starting to deteriorate and investor optimism is ridiculously high. Consider some of the following articles I have been reading in recent times on these topics:

- Bolivia plans first bond since early 1900s

- Bubble-Era Financing Returns as Profits Falter

- Investors Indulge in Below-Grade Bonds

- Investment Grade Corporate Bonds Are Priced To Perfection

- Junk Fervor Blinds Buyers as Loan Gap Vanishes

- Junk-Bond Bears Squeezed With Fed Unleashing QE3

- The US HY bond market looks overheated

- Junk Bond Stress At Record Low As Defaults Slow

- BofA Cools on Junk Priciest to Stocks Since ’93

- Lack of product... driving HY valuations to new highs

- Junk Yields Fail to Deter Investors Seeing No Recession

The simple fact is that the majority of the money that is rushing into the so called bond funds, is finding home in the riskier bond assets including; Emerging Market, High Yield and Investment Grade Bonds. These bonds are not as "safe" as the retail and institutional crowd think, so when the next downturn does come, the losses in this sector will be very similar to that of the Nasdaq bubble in 2000 and housing bubble of 2006.

Bernanke's policy action has created unintended consequences within the bond market, where pension funds and savers are now investing in riskier asset classes that behave like stocks... and trust me these retirees and risk averse investors cannot hold through a 20% or 30% drawdown. Bernanke's policy actions will once again end in tears... but this time most likely on the Chairman's watch (which he will be blamed for).

If we see an economic downturn starting soon, money will leave both stock and bond funds very rapidly and will most likely move into Treasuries for safety. While I am not advising buying into the overvalued Treasury market either, it is quite interesting that this asset class has been one of the most unloved areas of investment since the S&P 500 market bottom @ 1,266 in June 2012. I personally do not hold any bonds in my portfolio and have also been short Junk Bonds since late July of this year (as I've already noted many times before). Finally, make sure you stay away from Bolivian Bonds!

As a side note, the next time a person tells you, he or she is bullish on stocks because money is flowing into bonds, just ask them what bonds do they mean precisely? Because when investors herd, the mob mentality repeats similar phrases time and time again, but without actually doing any thinking (or researching) themselves.