Housing stocks have had a good year on the charts, and the group is in focus again today thanks to Lennar Corporation (NYSE:LEN) earnings beat this morning. Some analysts were predicting more strength out of the housing sector, and for those interested in betting bullishly, one name to consider is LGI Homes (NASDAQ:LGIH), which just flashed in the study performed for our Indicator of the Week.

In short, there's a ton of pessimism around LGIH shares, even though they're up more than 80% on a year-to-date basis, riding a nearly perfect uptrend along the way and touching a record high of $87.19 on Sept. 26. The stock was last seen at $81.94, putting it above the average 12-month analyst price target of $80.90, meaning some brokerage firms could come through and raise their views on the security.

The next notable data point for LGI Homes is the short interest ratio of 14.80, showing almost three weeks' worth of buying power in the hands of short sellers, going by average trading volumes. We tend to view any reading above 5.0 as elevated, so clearly LGIH's number suggests short covering could serve as another tailwind for the stock.

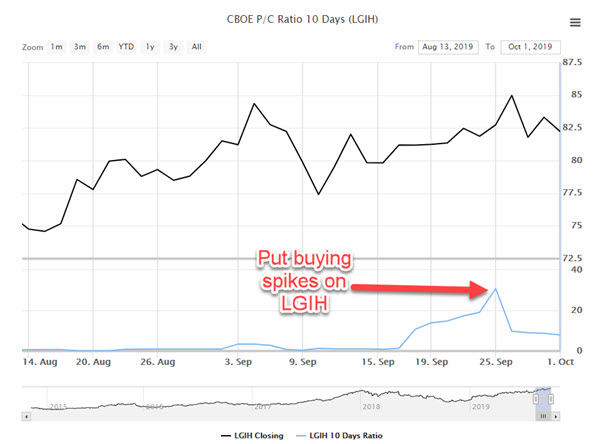

There's even extreme pessimism in the options pits, as put buying has dominated at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) during the past two weeks. The 10-day put/call volume ratio of 7.93 still ranks in the 80th annual percentile, even though the ratio's been fading since a massive spike late last month. To close out, it's worth noting that peak put open interest in the front-month October series sits just below at the 80 strike.