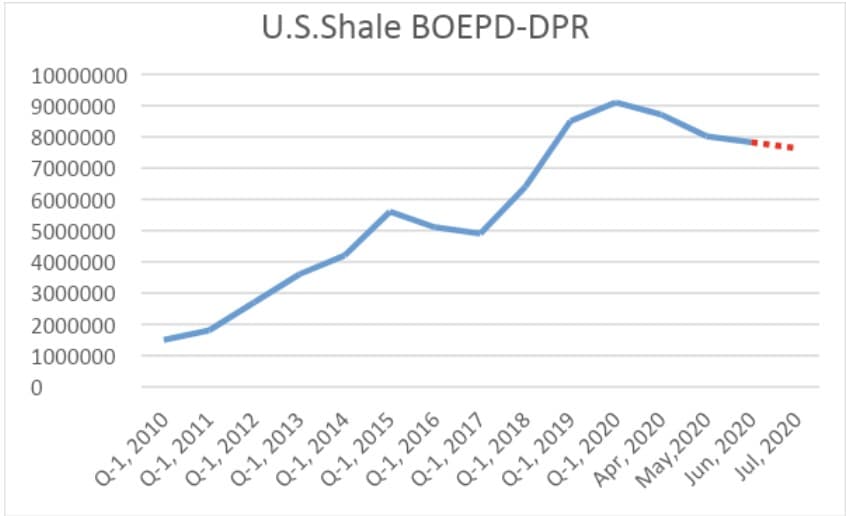

The most recent edition of the Energy Information Agency monthly Drilling Productivity report confirmed what news reports had anecdotally told us. U.S. domestic shale production is on a decline, and one I think, from which it will never recover. Is it going to round trip to 2010 levels? No, I am not predicting that, and will discuss where I think shale production is heading later in this article.

First, a brief recap. I have discussed the problems and fallacies associated with shale in a number of OilPrice articles over the last year.

Note-I typically delve into a lot of technical and geologic detail in these articles. In previous articles, I began pointing out some problems, and how certain companies were poised to overcome them.

- Parent/Child well performance declines

- Early-onset of water production

- Lack of Tier-1 rock to drill

- Oversupply of frac spreads and drilling rigs

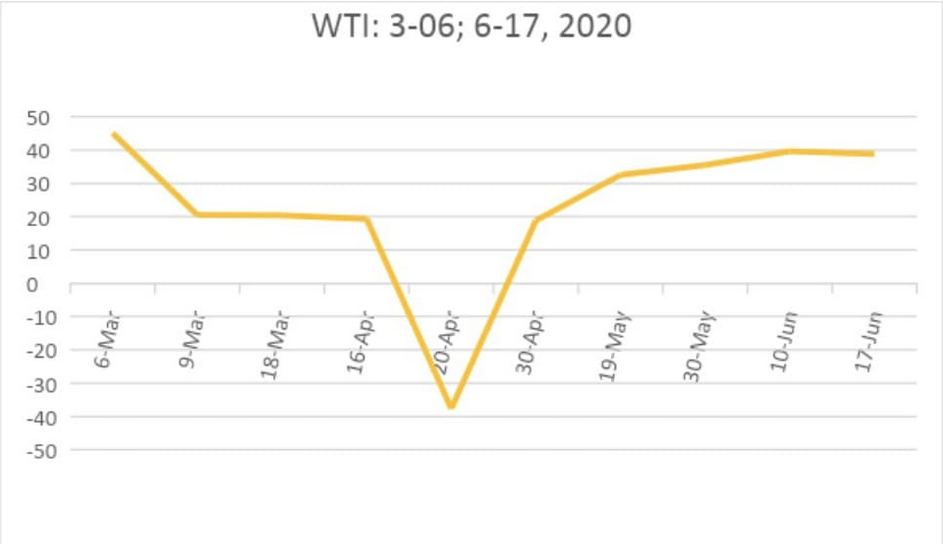

These problems weren’t readily apparent as production was building toward its eventual peak of 9.3 mm BOPD, as shown in the chart above. It took a one-two punch from the Wuhan coronavirus and temporary collapse of the alignment between Russia and Saudi Arabia in March of 2020. Following that little spat, which lasted only briefly, crude prices began a plunge that didn’t stop until April 20th, where the NYMEX forward contract fell to a -$37/bbl, meaning sellers were willing to pay buyers to take oil off their hands to avoid taking physical delivery. A profound, and never seen before the moment in oil trading.

Chart by author

As you can see prices staged an amazing, and again, never before seen recovery over the next 6-weeks. This begs the question, what is going on in the oil market for expectations to shift from massive oversupply with VLCC’s backed up in the Port of Long Beach, to concerns about impending shortage as we exit the year?

In this article we will address what we see as an emerging trend that will affect oil supplies for years down the road. Looking first at one key International operator that just announced major write-downs for the second quarter, and then what the might portend for future energy supplies.

BP’s $13-17.5 billion dollar asset write-down may signal new directions for the company

The company announced the other day that it would take a stunning asset write-down when it reports second-quarter earnings. One that reduce its assets value by about 10% and raise its gearing level to about 48%, far beyond the 30% number they’ve said was comfortable.

As noted in the linked Reuter’s article BP (NYSE:BP) has revised its view toward oil prices going forward, and these changes may likely put a dividend in cut into play, as noted by RBC Capital markets in the article.

“BP said the new price assumptions will lead to non-cash impairment charges and write-offs in second-quarter earnings, due on Aug. 4, in a range of $13 billion to $17.5 billion after tax. It said it would also now review its plans for some oil and gas projects that are at early exploration stages.”

This also means that as they review their exploration portfolio things that are not consistent with debt reduction, and a focus toward cleaner energy solutions, will go on the chopping block.

Source: BP site

This picture taken from BP’s site shows upstream projects under review and some of the company could be considering for this write-down and possible asset disposition.

For those looking for an inkling of where this might take the company’s focus, this quote, again from the Reuter's article may be illustrative.

“BP is set to increasingly shift its fossil fuel production from oil to natural gas, which is expected to play a key role in supplying growing demand for electricity.”

Areas that would appear to be safe from the chopping block would be BP’s short-cycle shale assets acquired from BHP in 2018. This was a deal engineered by BP’s new CEO, Bernard Looney, to deliver cash flow with minimal investment. Looney comments from 2018

“By every measure, this is a transformational deal for our Lower 48 business. It is an important step in our strategy of growing value in Upstream and a world-class addition to BP’s global portfolio,” We look forward now to safely integrating these great assets into our business and are excited about the potential they have for delivering growth well into the next decade.”

Gulf of Mexico deepwater assets also appear to be safe given BP’s huge infrastructure advantage in this area. I discussed “Advantaged Oil” in a previous OilPrice article a few months back. It’s worth a read for background on deepwater cost structure, if you missed it.

Through reengineering, the company has reduced break evens for these long-cycle assets to below $35/bbl as Looney noted in a recent article in Reuters.

“BP seeks to sharply reduce its spending and costs to be able to generate profit at oil prices below $35 a barrel by next year compared with $56 a barrel last year.”

So, if shale and advantaged deepwater focused on gas are safe, where might BP be looking shed assets?

Brazil might be one area. After striking out in 2019, in the Peroba drilling campaign, BP sat out additional leasing that year. As the linked World Oil article notes-

“Still, BP has plenty of chances left in Brazil. In July, the ANP approved an exploration plan for Pau Brasil, a pre-salt prospect that the company acquired in 2018 where it controls operations. It has stakes in 25 blocks in the nation and operates 6 of them, according to its website. And the country has three more deepwater auction rounds scheduled for this year, with one offering access to proven reserves.”

Given the liquids-rich nature of Brazil’s deepwater pre-salt plays, BP may just include the assets in its upcoming write-downs and sales. We should have long to wait for confirmation, as second-quarter results are due in early August.

What does this signal for future energy investing?

BP’s recent and upcoming pre-announcements may portend broader directions for the energy industry.

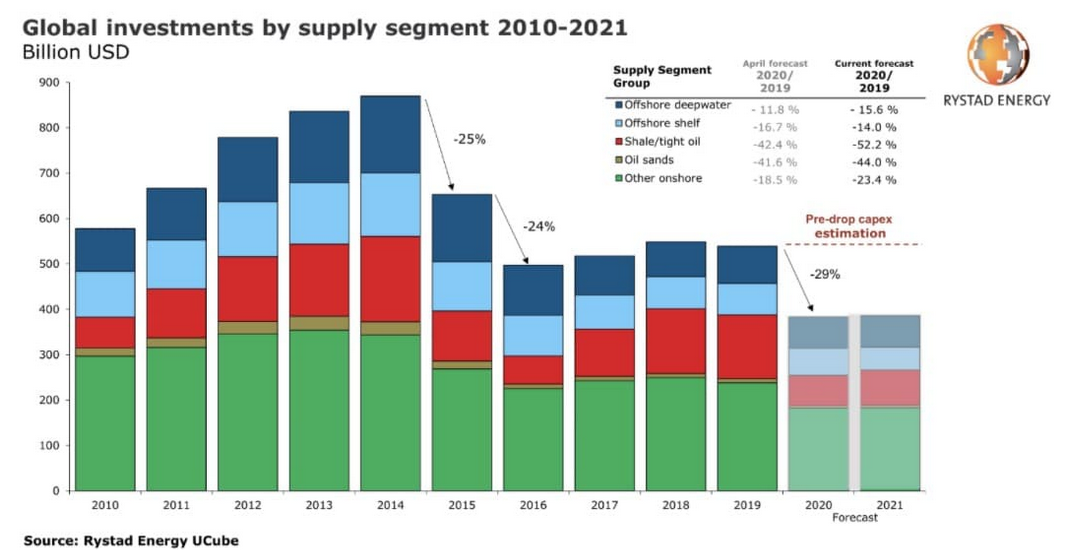

As Rystad notes in the graphic on the next page the decline in oil and gas prices has led to a dramatic under-funding of energy resources as oil firms curtailed upstream energy investments to shore up balance sheets.

Source: Rystad

Two areas that have seen sharp funding declines are Shale Tight-Oil, and Other-onshore, which usually refers to gas production.

What that may mean is that capital may flow in this direction soon with the rise in oil prices. These assets typically require little in the way of infrastructure development and can be scaled up or down quickly depending on the trend for oil. This could lead to a resurgence in drilling activity from the current levels.

In a prior article, which focused on Occidental Petroleum (NYSE:OXY), we noted that there is a supply/demand gap emerging for crude oil that is not widely recognized by the market at present. As this trend becomes more and more pronounced through year, shares of OXY could see a rebound.

Your takeaway

The future of oil prices has been written in the under-investment in virtually every aspect of oil and gas production. As legacy fields decline, and new production falls below the replacement rate for new wells, oil and gas prices will see an uplift.

Supermajor oil companies, like BP, no longer provide a safe dividend and may experience share price deterioration as a result.

As we exit 2020, there will be a supply gap of between 10-15 mm BOPD causing prices to rise well beyond their current $30-40/bbl range.