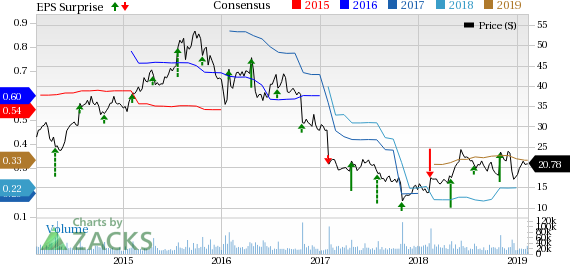

Under Armour, Inc. (NYSE:UAA) reported solid fourth-quarter 2018 results, with both top and bottom lines rising year over year and cruising ahead of the Zacks Consensus Estimate. In fact, this marked the company’s fifth and second consecutive quarters of top and bottom-line beat, respectively. The solid quarter and a decent outlook seem to have raised investors’ confidence.

Notably, shares of the company were up roughly 2.3%, during the pre-market trading hours. Further, this Zacks Rank #2 (Buy) stock has rallied 24.4% in a year, outpacing the industry’s growth of 15%.

Well, management envisions 2019 adjusted earnings per share of 31-33 cents. The mid-point of 32 cents stands just a notch below the current Zacks Consensus Estimate.

Let’s Delve Deep

Under Armour’s adjusted earnings came in at 9 cents a share, which crushed the Zacks Consensus Estimate of 4 cents. The company reported break-even results in the year-ago quarter. The year-over-year upside can be attributed to enhanced revenues, improved gross margin and lower interest expenses.

Net revenues rose 1.5% (up 3% on a currency neutral basis) to nearly $1,390 million, which surpassed the Zacks Consensus Estimate of $1,376 million. Revenues largely gained from solid EMEA and Asia-Pacific sales.

Apparel sales rose 2% to $970.4 million, while net revenues in the Footwear and Accessories categories declined 4.5% to $235.2 million and 2.2% to $108.2 million, respectively. Meanwhile, Licensing revenues surged 39.4% year over year to $45.9 million, whereas the company’s Connected Fitness segment reported an increase of 9.1% to $30.3 million.

Net revenues from North America fell 5.8% (down 5.6% on a currency neutral basis) to $964.8 million. Remarkably, international business continued to witness sturdy growth, rising 24.5% (up 28.2% on a currency-neutral basis). Within international business, net revenues from EMEA and Asia-Pacific regions grew 31.7% and 35.2% to $178.2 million and $167.5 million, respectively, while Latin America revenues tumbled 15.1% to $49.2 million.

The company’s adjusted gross margin expanded 160 basis points (bps) to 45.1%, courtesy of improved regional and channel mix, lower product costs, reduced promotions, and a decline in air freight expenses. This was partly negated by foreign currency headwinds.

SG&A expenses fell 1% to $587 million, while, as a percentage of net revenues, the same contracted 110 bps to 42.3%.

Net interest expenses declined 21.5% to $7.3 million, and restructuring and impairment charges fell 34.1% to $48.2 million.

Other Financial Details

Under Armour ended the quarter with cash and cash equivalents of $557.4 million, long-term debt (net of current maturities) of $703.8 million and total shareholders' equity of $2,016.9 million.

During 2018, the company generated $628.2 million as net cash from operating activities.

Restructuring Plan

Under Armour is on track with its 2018 restructuring plan. In 2018, the company incurred pre-tax charges of $204 million, with $50 million reported in the fourth quarter.

Guidance

Management is pleased with its quarterly outcome, which reflects good progress of Under Armour’s multi-year transformation plan. The company is focused on strengthening its brand through enhanced customer connections, effective innovations and strict go-to-market process. All said, the company reiterated its 2019 guidance, which was announced at its investor day in December 2018.

Management envisions 2019 net revenues to increase 3-4%. Revenues from North America are likely to remain flat. The company projects international revenues to increase in low-double digits.

Under Armour expects gross margin to improve 60-80 bps from the 2018 adjusted gross margin. The expansion is expected to be backed by favorable channel mix, stemming from reduced planned sales to off-price networks and increased proportion of direct-to-consumer sales. Also, reduced product expenses, owing to supply-chain efforts, are expected to boost gross margin.

Operating income is anticipated to be around $210-$230 million. The company projects net interest and other expenses of $40 million.

The company expects to incur capital expenditures of nearly $210 million in 2019.

Don’t Miss These Solid Apparel Stocks

Columbia Sportswear (NASDAQ:COLM) , with long-term earnings per share growth rate of 10.9%, carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ralph Lauren (NYSE:RL) has long-term earnings per share growth rate of 10.3% and a Zacks Rank #1.

Crocs (NASDAQ:CROX) has long-term earnings per share growth rate of 15% and a Zacks Rank #1.

Zacks' Best Stock-Picking Strategy

It's hard to believe, even for us at Zacks. But from 2000-2018, while the market gained +4.8% per year, our top stock-picking strategy averaged +54.3% per year.

How has that screen done lately? From 2017-2018, it sextupled the market's +15.8% gain with a soaring +98.3% return.

Free – See the Stocks It Turned Up for Today >>

Under Armour, Inc. (UAA): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

Ralph Lauren Corporation (RL): Free Stock Analysis Report

Columbia Sportswear Company (COLM): Free Stock Analysis Report

Original post

Zacks Investment Research