Investing.com’s stocks of the week

Risky assets had a much welcomed return to form yesterday as a seemingly more pro-active Spain stirred markets. The proposed line of credit to Spain served to rally markets which saw EUR open strongly despite the cloud of ambiguity that hangs over the detail, or in fact the longer term implications of this proposal. The pending elections suggest the possibility of playing to the masses or giving the people what they want (not imposing harsh austerity until after the elections).We would expect that this be a temporary measure which would not serve to act as an alternative to a full blown bailout. It would require much more to save the Spanish from their road to perdition.

This facility offers a much more positive compromise than the options laid out for past recipients of the bailout. Under the agreement as it stands, they serve to benefit from the yield reduction through the OMT programme, they retain access to the debt markets and they won’t be subject to such ruthless austerity through this credit line facility. Given Rajoy’s reluctance to seek help until now, one is inclined to think that this could perhaps delay the official request for help past the anticipated November date. It is imperative that before Spain sees a penny that a binding agreement be put in place to avoid future hesitation to actively seeking help.

This was enough to see EURUSD hit a one month high surpassing 1.30 with GBPEUR sitting smugly in the low 1.23’s, a new 4 month low. There is still plenty of time for further speculation and more he said, she said surrounding Spain before tomorrow’s EU summit in Brussels.

A slightly healthier EZ trade balance figure, harnessed by a much stronger business expectations figure from the Germans suggests that the Eurozone is willing to entertain the idea of future economic growth. Having said this, dismal car sales figures released early yesterday (down 11% on Sept 2011) suggest to the contrary but at least a hint of optimism is beginning to return.

UK inflation did exactly what it said on the tin, aligning with median forecasts of 2.2% just a whisker away from the 2% target set by the BoE. It is the lowest rate since late 2009 and keeps things on track for its 2014 target and keeps the door open for future QE. US inflation was higher than expected, attributable in large to rising energy prices. The rise is seen as manageable with little inflationary pressure expected in the short term.

Talks in Greece broke down again as Troika officials walked out on the meeting with the Greek labour minister. That was the second time that day, with Greek officials citing the fallout arose over minimum wage and severance pay.

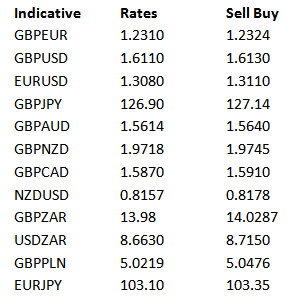

Latest exchange rates at time of writing

This facility offers a much more positive compromise than the options laid out for past recipients of the bailout. Under the agreement as it stands, they serve to benefit from the yield reduction through the OMT programme, they retain access to the debt markets and they won’t be subject to such ruthless austerity through this credit line facility. Given Rajoy’s reluctance to seek help until now, one is inclined to think that this could perhaps delay the official request for help past the anticipated November date. It is imperative that before Spain sees a penny that a binding agreement be put in place to avoid future hesitation to actively seeking help.

This was enough to see EURUSD hit a one month high surpassing 1.30 with GBPEUR sitting smugly in the low 1.23’s, a new 4 month low. There is still plenty of time for further speculation and more he said, she said surrounding Spain before tomorrow’s EU summit in Brussels.

A slightly healthier EZ trade balance figure, harnessed by a much stronger business expectations figure from the Germans suggests that the Eurozone is willing to entertain the idea of future economic growth. Having said this, dismal car sales figures released early yesterday (down 11% on Sept 2011) suggest to the contrary but at least a hint of optimism is beginning to return.

UK inflation did exactly what it said on the tin, aligning with median forecasts of 2.2% just a whisker away from the 2% target set by the BoE. It is the lowest rate since late 2009 and keeps things on track for its 2014 target and keeps the door open for future QE. US inflation was higher than expected, attributable in large to rising energy prices. The rise is seen as manageable with little inflationary pressure expected in the short term.

Talks in Greece broke down again as Troika officials walked out on the meeting with the Greek labour minister. That was the second time that day, with Greek officials citing the fallout arose over minimum wage and severance pay.

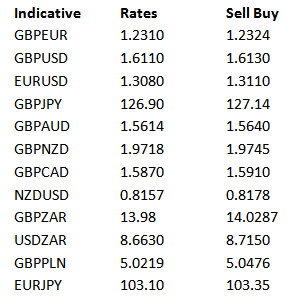

Latest exchange rates at time of writing