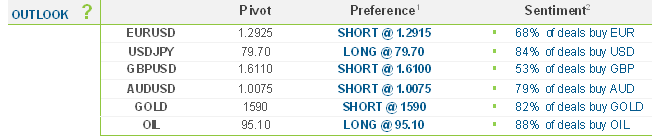

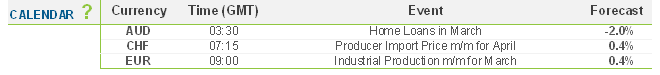

The euro (EUR) commenced the week with noticeable selling pressure following the weekend, where Greek politicians failed to form a government and uncertainty heightened. The nation’s President – mostly a ceremonial position – Papoulias, is now holding a series of talks among party leaders, aiming to form a unity government. Market analysts do not expect any breakthrough whatsoever and this will lead Greece to new election in a month’s time. The Swiss Producer Import Price figures will be released at 07:15 GMT, as the euro against the Swiss franc (CHF) remains in a narrow band just above the 1.20 floor. The Swiss National Bank (SNB) Chairman is due to speak at 15:45 GMT and investors are expected to closely monitor his remarks.

The US dollar (USD) appears strong as markets open following the weekend break, with no economic data release expected today. The Australian dollar (AUD) remains in a strong downtrend but a catalyst is needed to record fresh lows against the greenback. China cut its reserve requirement ratio (RRR) for the 3rd time in 6 months showing clear intention by the government to avoid a slowdown. The cut, effective from May 18, is expected to influence the already strong trading ties between Australia and China

Oil opened at 94.89 dollars a barrel from 95.50. Gold (XAU) opened at 1579.08 US dollars an ounce from 1579.05. Against the euro, gold rose to 1222.66 from 1232.24 an ounce. Silver (XAG) opened at 28.8915 dollars an ounce from 28.8921.

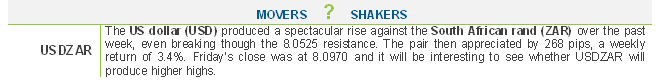

USD/ZAR" title="USD/ZAR" width="660" height="82">

USD/ZAR" title="USD/ZAR" width="660" height="82">

Disclarimer: Please note that Forex trading (OTC Trading) involves substantial risk of loss, and may not be suitable for everyone. The information provided is based on data generated by third party investment research providers. easy-forex® does not assume any liability as to the accuracy of such information. This information shall be used for reference only and it is not binding on easy-forex®. This is not an advertisement or a recommendation by easy-forex® in engaging/binding you in any forex transactions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Uncertainty Lingers In The Markets

Published 05/14/2012, 03:04 AM

Updated 03/09/2019, 08:30 AM

Uncertainty Lingers In The Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.