Fasten your seatbelt, dear reader. We’re in for a global financial crisis, a currency fiasco, and a stock market collapse all in the same year!

I’m being too bearish? Not after you read this…

In their search for economic growth in 2009, the Federal Reserve and other major central banks in the global economy started lowering interest rates and printing paper money.

While the central banks of the world wanted economic growth, they inadvertently created the “trade” for big investors like financial institutions and banks. I talked about this last Friday.

The “trade” had investors borrowing money from low interest rate countries and buying bonds in high interest rate countries, pocketing the spread. In the world of finance, this is often referred to as the “carry trade.” It works as long as the currencies of the low interest rate country and the higher interest rate country stay stable.

But now, the “trade” is backfiring as the currencies of emerging markets go into free fall.

China, the biggest economy in the emerging markets and second-biggest in the global economy, got most of the “trade” money. According to the Bank for International Settlements, in 2013, foreign currency loans and borrowing by Chinese companies from other countries was close to a trillion dollars. In 2009, it was only $270 billion. (Source: Telegraph, February 1, 2014.)

European banks have the biggest exposure to emerging markets, having lent them $3.0 trillion. Breaking down this number even further, British banks have loaned $518 billion to the emerging markets; Spanish banks come in second with $475 billion of exposure; and French and Italian banks have each lent $200 billion to emerging markets. (Source: Reuters, February 3, 2014.) Big banks in the U.S. economy didn’t really follow in the footsteps of their European counterparts, which is a good thing.

The bottom line is that the money that was channeled into the emerging markets needs to eventually come back; but if currency prices in those emerging markets collapse, the question becomes whether the money can be paid back.

In China, the shadow banking sector in that country has become one big headache. If companies in the Chinese economy default on their loans, the banks that loaned them money will be on the hook.

The misery doesn’t end in China. Emerging markets like Turkey, South Africa, Russia, Brazil, India, and Argentina have seen their currencies depreciate since we first started to hear about the Federal Reserve reducing the speed of its printing presses.

And as the currencies of emerging markets’ economies deteriorate further, multinational American companies will report lower profits and their stock prices will suffer. We are seeing this pressure on stock prices now as fear enters the market.

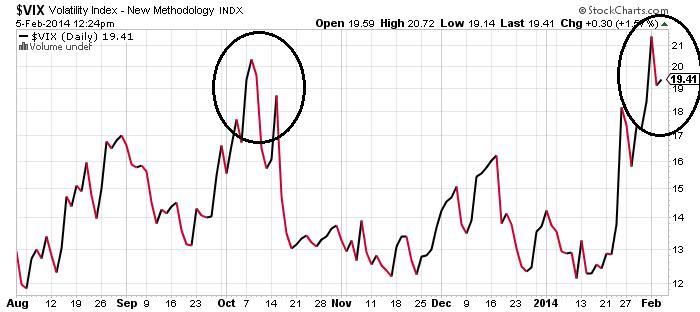

Look at the chart of the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) below. This index gauges the fear on key stock indices. After trading near record-lows (which means investors were not worried about stock prices falling) from last October to late January 2014, the chart shows big-time fear is now entering the market.

A flight to safety seems to be the next logical move. Of course, gold bullion should continue to shine as it has been in 2014. So far this year, gold stocks are up 10%, while the Dow Jones Industrial Average is down seven percent (and looking very risky).

Here’s the second chart I want to show you today. It’s of the CBOE Gold Volatility Index, a gauge of fear in the gold market. This chart shows the complete opposite of the VIX. As fear sets into the stock market this year, fear in the gold market is declining!

Back to that “trade” that’s now gone bad: uncertainty in the emerging markets is creating certainty in the gold market. Gold is setting up to reward those who are buying now.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.