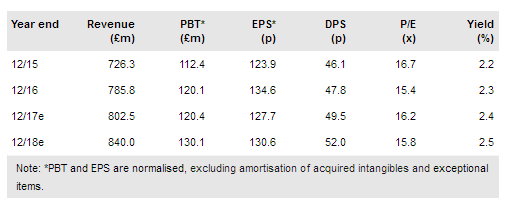

It is appropriate to describe the H117 results from Ultra Electronics Holdings Plc (LON:ULE) as flat. Revenues, operating profit, profit before tax and EPS growth (all on an underlying basis) varied by less than 0.5% when compared to the prior year. The company still anticipates a bigger skew in organic growth to H2 than in previous years. There is further fine-tuning to our EPS estimates, which we have lowered by 1%. The dilution from the placing in July depresses EPS until the reinvestment in Sparton completes, which is expected at the start of FY18. The subsequent uplift should coincide with higher organic growth following the improved momentum in H217.

Stable first half performance, improving orders

The stable H117 outcome arose from a combination of organic revenue declines of 6.7% due to a higher level of engineering activity and contract award delays primarily caused by the Continuing Resolution (CR) in the US. The organic revenue decline was exacerbated by the impact of a 2.9% decline from the disposal of the ID business in August 2016, but these declines were largely offset by a favourable FX tailwind of 9.3%. Underlying operating margins were held at 15.7%, helped by net savings from the S3 shared services programme of £2.6m (H116 net charge: £0.5m). Encouragingly, the order book grew organically by 3.9% to £807.8m in H117 and order intake by 1.5% to £390.3m, a book to bill ratio of 1.07x. Cash flow was depressed by deferred working capital flows that should unwind in H2, but the modest £3.7m net debt increase maintained the strong balance sheet even ahead of the £133.9m placing. The interim dividend increased by 2.8% to 14.6p per share.

To read the entire report Please click on the pdf File Below: