News coming out of Ukraine has many bracing for the worst. The most serious standoff between the east and the west since the Cold War has political leaders walking on egg shells. The potential for war is the most dire outcome of the actions being taken in central Europe, but other consequences are beginning to play out across the world.

Ukraine’s importance in the global grain market has grown as the country has become one of the world’s largest exporters of corn and wheat. The ambiguity that has shrouded the country over the past months, but more specifically the past week, has sent corn and wheat prices unexpectedly upward. With global stockpile levels up and production levels estimated at all-time highs, the events unfolding in Ukraine will dramatically impact the availability of grain in 2014.

Ukrainian Unrest

On November 21st Ukrainian President Viktor Yanukovych announced he was abandoning a bailout agreement with the European Union in favor of a Russian bailout proposal. This decision put into motion months of civil unrest, protests, and violence that climaxed on February 20th with the death of more than 80 Ukrainians. Following the most bloodshed in Ukraine since WWII, a new government was formed and a warrant was put out for former president Yanukovych.

Hope was held that peace and a new government would help Ukraine recover from a deep recession, but only days after intense fighting and bloodshed, Russia announced its plans to occupy the Crimea region of Ukraine in order to protect pro-Russian citizens in the region. Along with Crimea in the south, Russia has claimed the need to protect ethnic Russians in Ukraine to the area east of the Dneiper River.

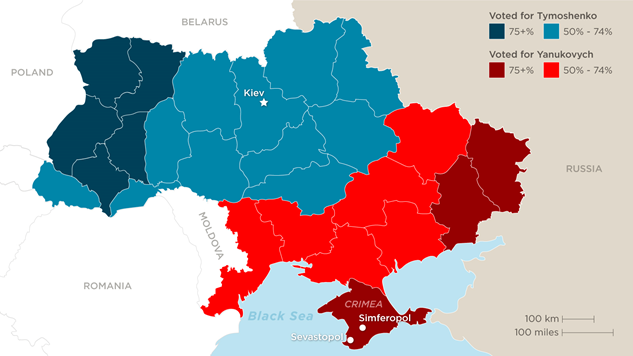

Geographically the split may seem reasonable. The majority of western and northern Ukraine are pro-EU, and a majority of the south and east are pro-Russia. The map below shows the split in the 2010 Ukrainian presidential election. The majority of northern and western Ukrainians voted for pro-EU candidate Yulia Tymoshenko, while the majority of the southern and eastern Ukrainians voted for pro-Russian candidate Viktor Yanukovych.

Source: Ukraine Central Election Commission

Economically the split would lead to trouble. The southern Crimean region holds both Ukrainian ports to the black sea and the eastern region holds the majority of the mining, metallurgy, and agricultural industry. A standoff between the two governments has left the rest of the world waiting to see what will unfold.

Global Grain Implications

Ukraine’s global role has increased significantly over the past decade. Following the collapse of the Soviet Union, Ukraine, the largest solely European country, struggled to grow as it began to unravel itself from what was left of the USSR. After a decade of little growth Ukraine entered the new millennium strong. Mechanization of their agricultural industry, improvements in mining and metallurgy, and increased infrastructure created a real rise in the growth of the Ukraine’s economy.

Ukraine’s rich soil and improved agricultural techniques made it the third largest exporter of corn and the sixth largest exporter of wheat in 2013, according to the International Grain Council (IGC). The IGC forecasted their exports to grow by almost 50% in 2014 to 31.8 billion tons, estimates that would put Ukraine second in the world in grain exports only behind the US.

The civilian unrest and ongoing feud with Russia has led to a much unexpected rise in corn and wheat prices over the past two months. Beginning Friday, on the news that Russian troops had entered Ukraine, corn prices in the US have gone up $0.17 or 3.5%. The 2.03% increase seen on Monday was one of the largest day to day gains in the past two years. Corn prices grew over $0.25 in the month of February and increasing over $0.50 since January. Similar month to month growth in corn prices has not been seen since January 2013, and two month growth has not been seen like this since the drought of 2012 when corn grew to over $8.00 a bushel.

The uncertainty over Ukrainian production has led to a redraft of global production forecasts and demand expectations for 2014. In a year where grain prices were expected to hit decade record lows an unexpected change could lead to a reversal.

Chinese Impact

China has been surprisingly quite for the amount of impact the saber rattling between Russia and Ukraine has on them. As Russia’s largest ally, China has normally been very supportive of Russia flexing its muscles supporting their belief of control and support of the region. News of China’s feelings toward the military operations in Ukraine have been mixed. The Russian foreign ministry released a statement saying China agrees with the actions taken by the Kremlin in Ukraine, but China’s foreign ministry has been much less supportive. Reports quote Qin Gang, spokesman for China’s foreign ministry, "It is China's longstanding position not to interfere in others' internal affairs. We respect the independence, sovereignty and territorial integrity of Ukraine."

It becomes complicated because China must tread softly in an effort to appease both Russia and its trading partners in the west, while still keeping in perspective their own commercial interests in Ukraine. In September of 2013 China leased 7.4 Million acres, an area larger than the state of Maryland, from Ukraine’s eastern Dnipropetrovsk region to grow grain and raise pigs. If the protesting and civil unrest didn’t complicate the matter enough, the area that China leased from Ukraine is in the eastern region that Russia is claiming rights and occupation over.

Outlook

Reverberations of the Russian military operations in Ukraine can be felt in many industries all across the world. It can be safe to say that the impact on the agriculture industry was not the focus of any arguments while military decisions were being made in Moscow.

In the short-term grain prices will continue to feed off of the uncertainty around one of the largest exporters of grain in the world. It can be expected that production estimates in Ukraine will fall, helping an already saturated grain market. In the long-term little can be speculated at this time. If Russia holds control over the eastern Dnipropetrovsk, the implications on China’s lease will create an interesting story. We cannot be sure of the outcomes of the decisions made up to this point, but we do know that the impact on the global market will be profound.