Tensions over the situation in Ukraine sent US equities lower overnight as DJIA and S&P 500 extended recent decline. DJIA lost -139.81 pts, or -0.84% to close at 16429.47 while S&P 500 lost -18.78 pts, or -0.97% to close at 1920.21. Both took out last week's low. Weakness in risk sentiments carried on in Asia and dragged down major indices. The US Dollar Index, on the other hand, extended recent rally and reached as high as 81.62, taking out last week's high, and is now trading firmly above 81.5. It's reported that Russian president Putin ordered Kremlin to prepare retaliatory measures against US and Europe on the sanctions imposed on Russia last week. Meanwhile, Foreign ministry said that eastern Ukraine is now on the verge of a "humanitarian catastrophe" as it would push for an international mission to help civilians flee the fighting. Meanwhile, it's reported that Russia massed forces on the border in the biggest military buildup since May.

New Zealand dollar also weakened today with additional pressure from employment data. Unemployment rate dropped to 5.6% in Q2 versus expectation of 5.8%, hitting lowest level in over 5 years. However, that was mainly due to a drop in the participation rate to 68.9%, down from 69.3% in Q1. Employment growth slowed to 0.4% qoq, missed expectation of 0.7% qoq, down from prior quarter's 0.9% qoq growth. RBNZ signaled last month that it will pause the tightening cycle and the employment data affirmed such stance.

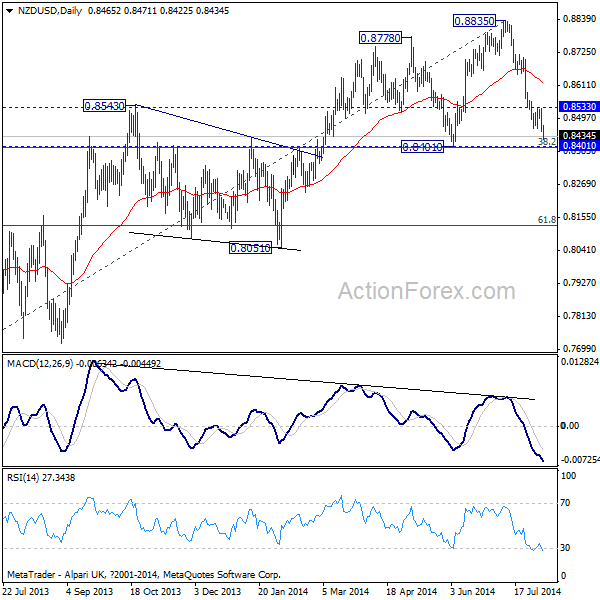

The NZD/USD extended the fall from 0.8835 medium term top to as low as 0.8422 so far today. Near term outlook stays bearish for further decline. However, consider oversold condition in daily RSI, and the pair is now pressing 55 weeks EMA (now at 0.8426). We'd expect some support from 0.8401 cluster support (38.2% retracement of 0.7682 to 0.8835 at 0.8395) to near term bottoming and consolidations. Touching of 0.8533 resistance will bring recovery.

Looking ahead, UK production data will be a main focus in European session. Swiss will release CPI. Eurozone will release retail PMI, German factory orders and Italian GDP. In US session, Canada and US will release trade balance.