As if the political storm hitting the UK was not enough, macroeconomic data is also not encouraging markets, adding pressure to the country's assets. GBP/USD has lost more than 1.4% since the start of the day on Friday, back below 1.1060, and 2.4% from Thursday's peak news of Liz Truss stepping down as prime minister.

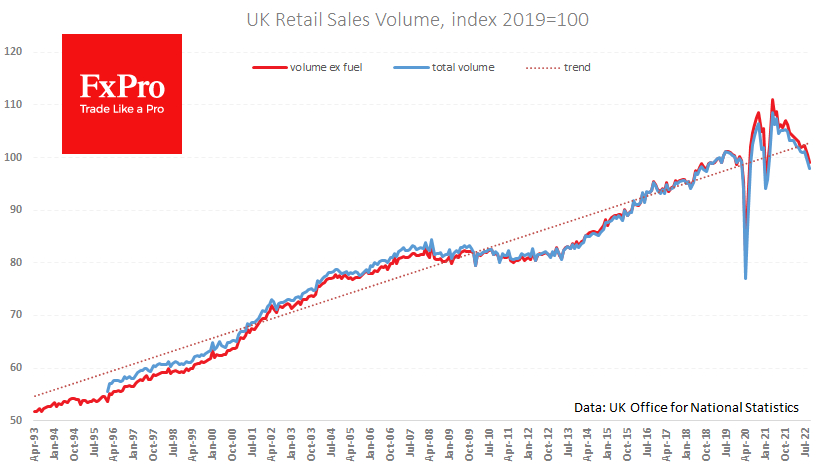

UK retail sales for September were down 1.4%, and down 1.5% excluding fuel, after falling 1.7% a month earlier. Sales were down 10% from their April 2021 peak and 10.7% ex-fuel, having lost for almost the whole of the last year and a half.

Falling consumer activity makes it harder for the Bank of England to find a balance sheet. Today's disappointing sales data is a strong case for the monetary dove camp. The weakness in the economy, as seen through the prism of falling sales and industrial production, can deter the Bank of England from raising its key rate more decisively, which is harmful to the Pound.

Should GBP/USD fall below 1.09 in the coming days, a retest of the 1.03-1.05 historic low area will be an issue, even though recently it seemed that the worst for the Pound is over.