Following Chinese GDP in the morning, there was really little else to talk about during the day’s trading. David Cameron was set to speak in Amsterdam about the future of the UK in the EU, but there was a last minute change of plan which saw the PM postpone the meeting to deal with the escalating situation in Algeria.

UK retail sales figures for December didn’t do Cameron any favours, with the potential threat of more bad news coming in the form of UK GDP this Friday. Sales dropped by 0.3% last month vs expectations of a 0.1% gain. Clothing and footwear were the worst performers. It confirmed a poor year for the UK, an annual increase of 1.1% is the weakest figure we have seen since 1998. Being the eternal optimist, early indicators for January are already pointing towards an improvement.

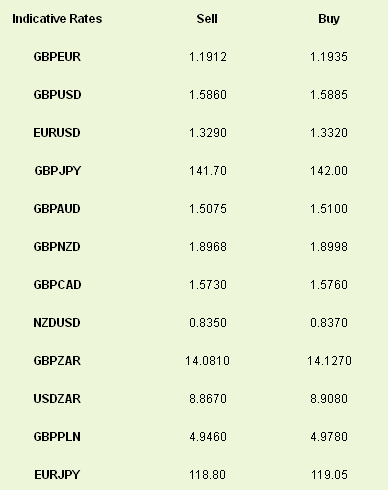

GBPEUR slipped to the low 1.19’s breaking below the 1.19 over the weekend. GBPUSD fell below 1.59 for the first time in 9 weeks. The outlook for the UK isn’t too promising at present, but I don’t think anybody expected GBP to fall so fast so quickly. One would expect sterling to find a floor around these levels for an extended period of time, but that doesn’t seem to be the case at present. The rapid devaluation we have seen of late in sterling isn’t doing much for confidence in the economy. With Q4 GDP this Friday there is a growing feeling that the powers that be need to pursue some form of damage control. It’s kind of like the anticipation of getting a slap on the face, you know it’s coming and you just want to get it over with.

We have a slow day on the cards today with the US closed for business as they celebrate Martin Luther King Day, while President Obama gets inaugurated in the afternoon. The Bank of Japan will give its monetary policy verdict on Tuesday, while we build towards UK GDP on Friday.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UK Retail Sales Confirm Slowest Growth Since 1998

Published 01/21/2013, 07:32 AM

Updated 07/09/2023, 06:31 AM

UK Retail Sales Confirm Slowest Growth Since 1998

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.