GBP/USD" title="GBP/USD" height="242" width="474">

GBP/USD" title="GBP/USD" height="242" width="474">

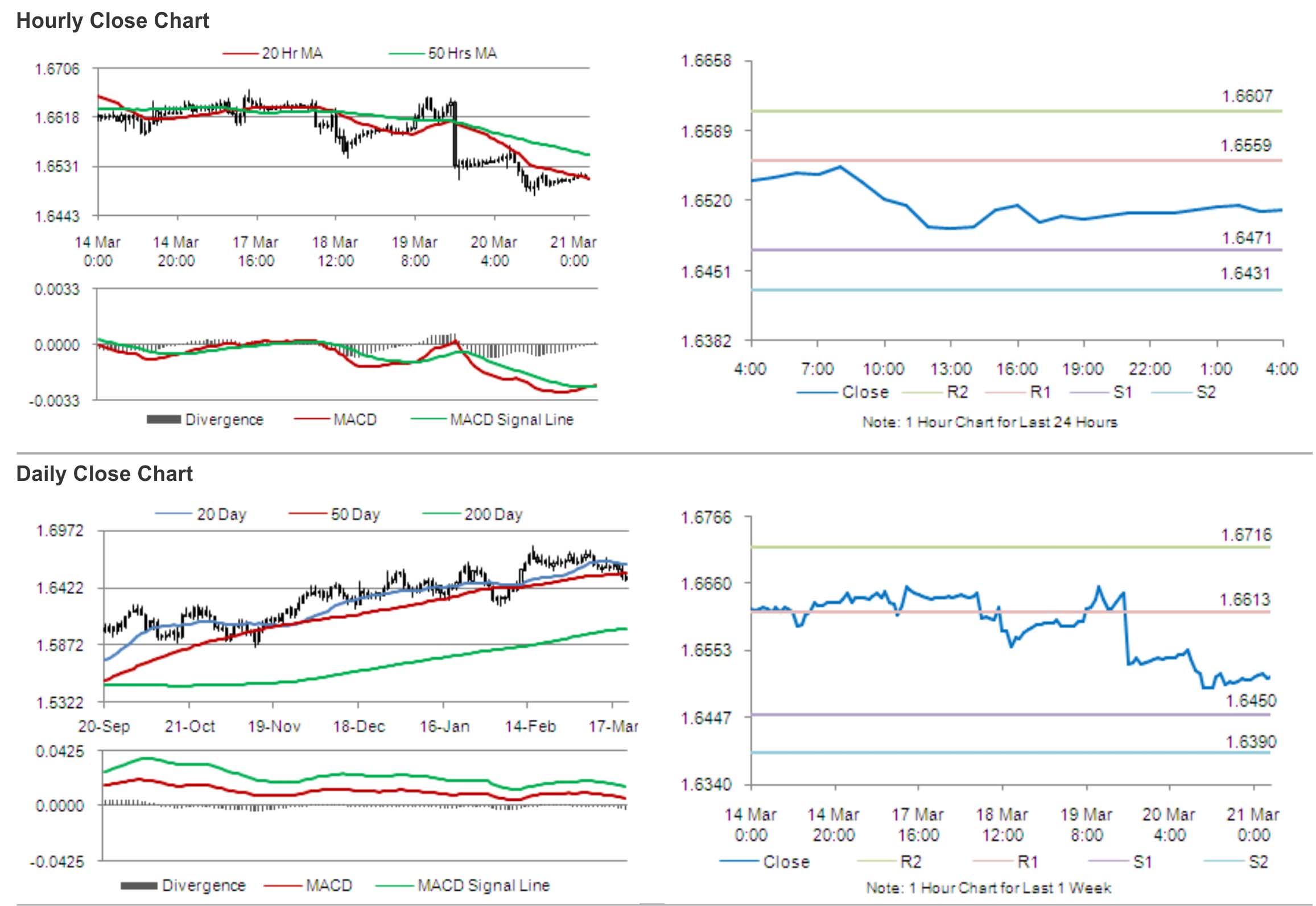

For the 24 hours to 23:00 GMT, GBP fell 0.16% against the USD and closed at 1.6507, as the US Dollar continued to benefit from the Fed’s previous day’s decision to taper the size of its asset-purchase programme by $10 billion and to project a sooner-than-expected rise in the nation’s benchmark interest rate by the mid of next year.

Meanwhile, in the UK, the Bank of England (BoE) Monetary Policy Committee member, Martin Weale opined spare capacity in the UK economy to get eroded faster-than official estimates in another 2-3 years. Furthermore, Mr. Weale highlighted his expectations for interest rates in the nation to remain low over the next two to three years but at the same time also stated that he cannot guarantee it.

On the economic front, the Confederation of British Industry (CBI) reported that its survey’s on total British factory orders rose to a reading of 6.0 in March, more than analysts’ call for a rise to 5.0, from previous month’s level of 3.0. Meanwhile, CBI Trends selling prices in the UK eased to a level of 12.0 in March from a level of 17.0 recorded in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.6510, with the GBP trading tad higher from yesterday’s close.

The pair is expected to find support at 1.6471, and a fall through could take it to the next support level of 1.6431. The pair is expected to find its first resistance at 1.6559, and a rise through could take it to the next resistance level of 1.6607.

Looking ahead, traders would keep a tab on the release of the UK’s public sector net borrowing data, for further guidance in the Sterling.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.