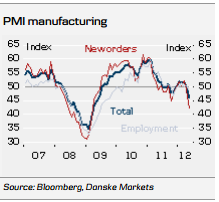

British manufacturing activity in May fell at its fastest pace since November 2008. The PMI index fell to 45.9, from a downward revised 50.2 in April. This is the lowest level in three years and substantially worse than the modest dip expected by forecasters. The new orders index fell to 42.0 – the lowest since the big recession in 2009.

Today’s numbers clearly illustrate that Britain is not isolated from the euro crisis. From being in much better shape than the average eurozone member, the UK now looks somewhat similar – in technical recession, with a bleak economic outlook, a high deficit and a growing debt burden. Investors who thought that the UK would be more resilient to the euro turmoil might think twice after this; UK data is likely to reflect the dire economic conditions in central Europe and British exporters are likely to find it harder to sell their goods if the pound keeps strengthening against a vulnerable euro.

Implications for monetary policy

Under normal circumstances, the Bank of England meeting next week should be a nonevent as the big meeting followed by the Inflation Report was last month. However, with the turmoil in the eurozone, the risk of a ‘Grexit’ and speculation about a euro break-up, one cannot exclude the Monetary Policy Committee trying to protect the UK economy and UK financials by undertaking more stimuli. When one combines this with today’s terrible data, the general darkened economic outlook and that inflation now stands at ‘only’ 3%, the probability of some pre-emptive easing is definitely present.

Bank of England (BoE) deputy governor Charles Bean said in an interview yesterday that the Bank ‘had scope to restart the asset purchase programme if things took a turn for the worse in Europe’. Adam Posen, the MPC’s arch-dove, could always vote for more easing together with David Miles, who last month preferred to lift the asset purchase target, and Paul Fischer, who has also expressed concerns about the economic outlook. Accordingly, Governor Mervyn King’s vote could become pivotal.

We think the BoE will keep the base rate unchanged at 0.5% and keep the asset purchase target unchanged at £325bn but we can imagine that the MPC is considering changing both. We have long called for more ‘real stimulus’, but we doubt that more Gilt purchases will do much good, as UK government bonds are already very popular among investors as ‘protection’ from the eurozone crisis.

Our main scenario is that the BoE remains sidelined at the 7 June meeting and awaits developments. In our view, minutes from the meeting are likely to be quite dovish. EUR/GBP has not been able to make a firm break of 0.80 on the downside but we think it will happen as the turmoil in the eurozone is not going to disappear and we believe the ECB is likely to deliver a 25bp rate cut next week. We keep our one-month EUR/GBP forecast at 0.79 and see the pair trading around 0.78 in three months.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.