- Geopolitical risks lurking, not lacking

- Kiwi may move on RBNZ statement

- BoC governor could halt loonie rally

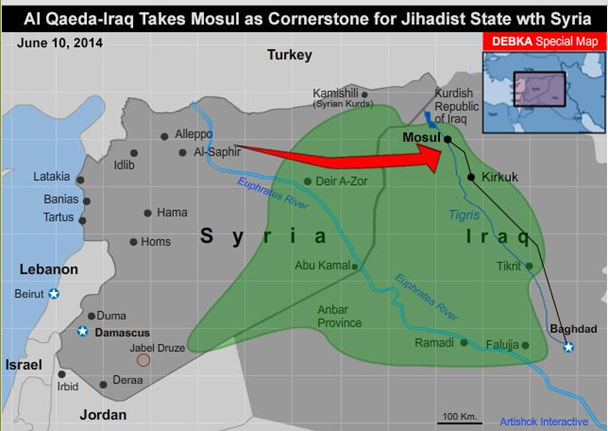

The UK Labour report gave a boost to FX land early on and USD/CAD finally broke strong support at the 1.0895-00 level. The support was reportedly due to option expiries/barriers that were either triggered or had expired today. Now they are out of the way, further USD/CAD losses are likely. That is, unless the BoC governor Stephen Poloz has something to say about it, which he will, tomorrow. Mid-week review: A lack of top-tier US data and a holiday in Australia on Monday kicked off a couple of days of lack- lustre trading sessions in FX land, even as US equity markets scratched out new highs. The Federal Reserve Bank of St Louis president James Bullard drew some attention with a speech in Florida during which he said that the "U.S macroeconomy is much closer to normal than it has been in five years". It wasn't much but U.S. 10-Year government bond yields are currently 2.62 percent after touching 2.48 percent at the end of May. In the absence of major US economic releases, markets fretted about low volatility with the Volatility Index (VIX) actually dipping below 12.0, a seven-year low. It remains to be seen how the World Cup will mess with the VIX but if everyone is watching football (soccer for us North Americans) it will be hard-pressed to rally. Labour reports JOLT One of US Federal Reserve chairman Janet Yellen's reportedly "favourite" economic measures, the Job Openings Labour Turnover Survey (JOLTS) showed job openings climbing close to a seven- year high, which supports the view of an improving labour market in the US. However, the report didn't attract much attention from FX traders. They were focused on today's UK labour report and that got some attention. The UK unemployment rate dropped to 6.6 percent, its lowest level in five years while employment rose. GBP/USD bounced about 0.0050 points and has since settled down. Kiwi rates to rise and then level off Improving Chinese data earlier in the week gave AUD/USD and NZD/USD a boost although the Reserve Bank of New Zealand (RBNZ) rate announcement later today (an increase of 0.25 percent is expected) is the main event. The devil is in the detail as a rate increase is widely expected and priced in. Weaker-than-expected economic data and falling dairy prices have raised concerns that the RBNZ may issue a doveish statement. The decline in NZD/USD from the May 7 peak at 0.8775 argues that this risk is also reflected in the current rate, giving scope for a post-announcement bounce. Poloz on the podium The Bank of Canada governor, Stephen Poloz, is holding an "unprecedented" press conference (13:15 GMT) following the release of the Financial Stability Report, according to a story in the National Post. Poloz adopted a seemingly pessimistic outlook in last week's interest rate announcement, dismissing the rise in CPI as "temporary" and focused on downside risks to the economy, despite improving economic data. The National Post story speculates that Poloz will use this podium to talk further about the economic threats facing the Canadian economy. In effect, he may be attempting to "talk the currency" down under the guise of transparency. If so, it will certainly reinforce the 1.0820-50 USD/CAD floor. Geopolitical risks lurking, not lacking There is no shortage of geopolitical risks in addition to the Russia/G7 tiff over Ukraine. Sunni militants have reportedly captured Mosul, the second largest city in Iraq and are invading the oil refinery city of Baiji. This is an expansion of what The New York Times refers to as the Islamic State in Iraq and Syria (ISIS). The US, Russia, China, France, the UK and Germany are working hard to reach a nuclear agreement with Iran by the July 20 deadline and are hoping and praying that Israel doesn't make the talks moot by bombing Iran. China is ignoring Vietnam's complaints that a Chinese oil rig is drilling in Vietnam waters in the South China Sea. China and the Philippines are arguing about the Scarborough Shoal and the Philippines has launched an arbitration case with the United Nations. Libya, birthplace of the "Arab Spring" is on the verge of civil war and pumping oil at only 10 percent of capacity. The risks are lurking, not lacking. Map:

Source: Debkafile

USD/CAD Outlook

USD/CAD spent the past week trying to grind out gains but not only could not move it through a 55-day resistance area (1.0950-60) but also a series of lower highs put pressure on the 1.0895-1.0900 floor. The floor broke this morning and USD/CAD is now threatening a test of 1.0815, which is guarding multiple support levels including the 200-day moving average at 1.0762. The major driver behind the move is from selling EUR/CAD, assisted by firm WTI oil prices and steady Canadian economic data with a dash of long USD/CAD position fatigue and option expiries tossed in. Although the break of support in the 1.0895-00 zone clearly favours additional USD/CAD weakness, the Bank of Canada governor's penchant for warning of deflation risks may quickly turn Canadian dollar bulls into hamburger meat.