U.K. labor data looks astonishingly strong for an economy that is supposedly slowing on most other measures. If the government gets a long Brexit extension, a Bank of England rate hike is clearly on the table for the summer.

Too good to be true?

The U.K. jobs report is stunningly strong looking at the headline figures.

Employment rose 222,000 in the three months to January, 102,000 more than expected! The unemployment rate dropped to 3.9% - the lowest since February 1975, while wage growth held at 3.4%YoY. With consumer price inflation running at just 1.8%, real household disposable incomes growth looks to be doing very well, helping to support consumer sentiment and spending.

This seems at odds with other data that has been suggesting the U.K. economy is slowing. Why are businesses hiring so aggressively at a time of such economic and political uncertainty? This is a question economists' have been asking for a long time. Weak productivity is usually cited, but business in Britain must still be seeing healthy demand to have the confidence to hire workers in such numbers.

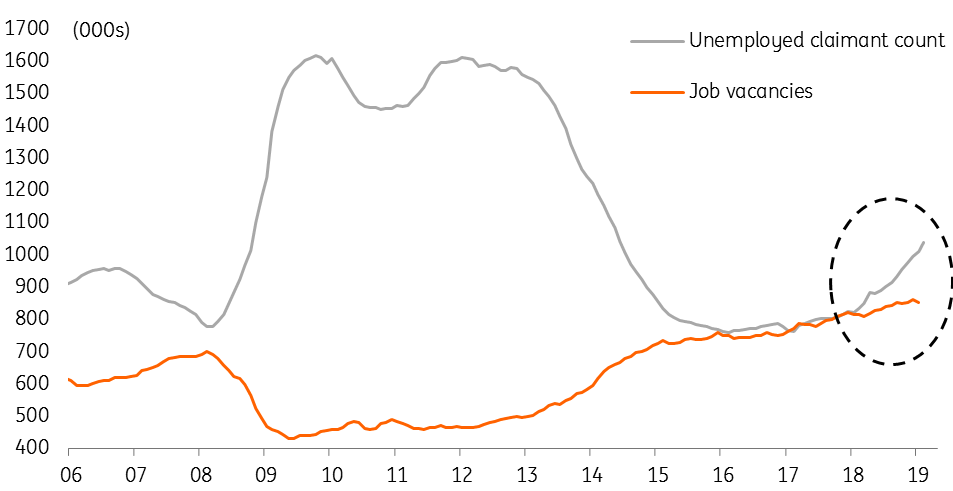

Not all the news is good.... vacancies slip, claimant unemployment rises

Claimant count hits new high

Nonetheless, the details are not universally positive. Vacancies slipped a touch, but admittedly do remain firm, while the number of people claiming unemployment benefit rose to the highest since June 2014. What we can take away from this is that if you have the right skill set you are doing well, and there are plenty of job opportunities. If you don’t, then the picture is far less rosy.

August BoE hike remains on the table

Taking it all together it suggests the U.K. economy is in better shape than many had been believing. If the U.K. gets a long term extension (nine to 12 months) to Article 50 in the coming days/weeks, this can perhaps give businesses and households a little more breathing room to relax and spend or invest. As such, the prospect of a BoE rate hike later this year remains pretty strong.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original post