The U.S. dollar index was seen trading flat on Monday with the technical pattern confirming a doji close. A bearish follow through from here on could signal a near-term correction. Economic data for the day was sparse. Still, the Turkish lira continued to plunge dragging down the euro currency rather briefly.

Economic data today will start with the release of the second revised GDP estimates for Germany. Forecasts point to no change as the German GDP growth is expected to be confirmed at 0.4%. The final inflation figures are also due which is forecast to rise 0.3% as per the flash estimates.

In the UK, the average earnings index is expected to rise 2.5% in the three months to July. The UK's unemployment rate is expected to remain unchanged at 4.2%.

The Eurozone flash GDP estimates marking the second revision is forecast to confirm that the eurozone economy advanced 0.3% in the second quarter.

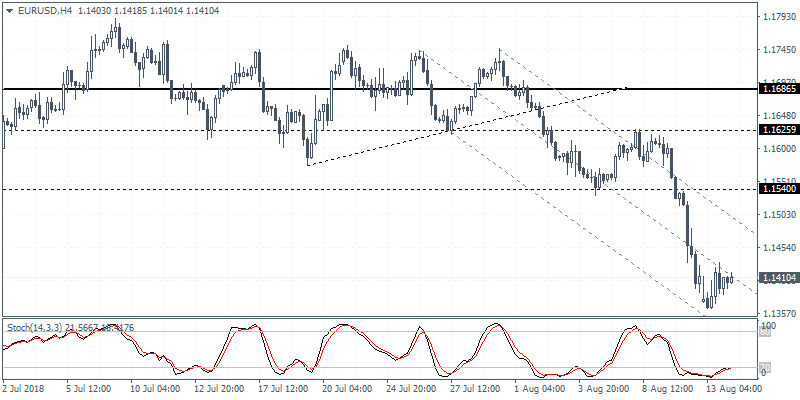

EUR/USD intraday analysis

EUR/USD (1.1410): The EUR/USD currency pair was seen closing on Monday with some modest gains after gapping lower on the open. Price action slipped below the 1.1400 technical level of support before recovering slightly. A bullish close on the day could potentially trigger some near-term upside in price action. On the 4-hour chart, the EUR/USD could be seen targeting the 1.1540 level where resistance could be established. However, this is likely to occur on a potential decline back with a higher low being formed.

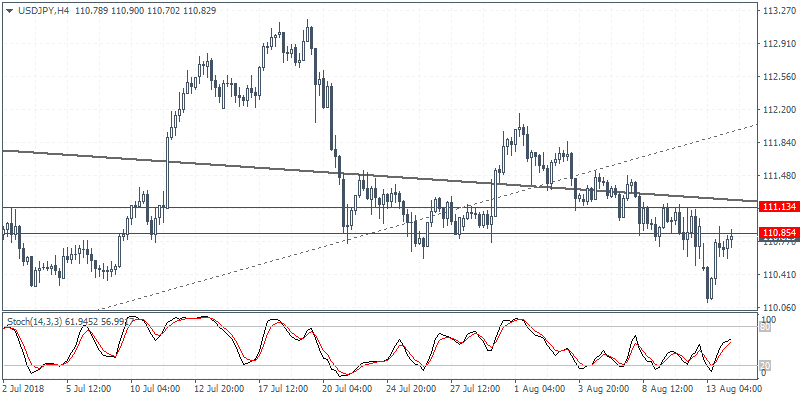

USD/JPY intraday analysis

USD/JPY (110.82): The USD/JPY currency pair gapped lower on Monday but price action managed to close with some gains. Price action was seen retracing back to the breached support level around 111.13 - 110.85 regions. A breakout above this level is required in order for USD/JPY to post further gains to the upside. Alternately, failure to break past this price level could signal further downside bias. The next lower support is seen at 109.45 which could be tested in the near term.

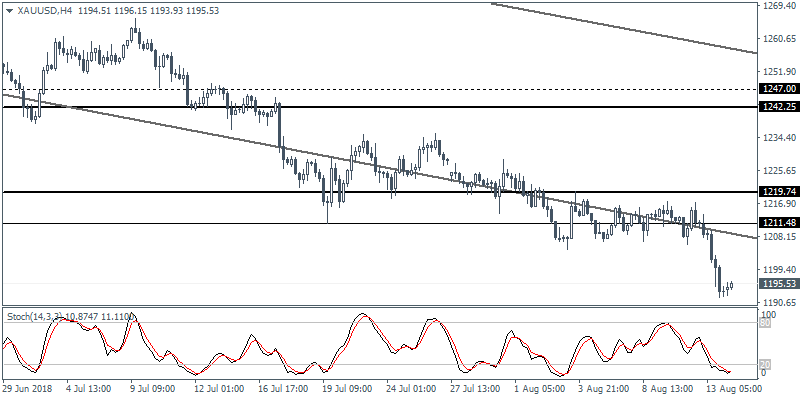

XAU/USD intraday analysis

XAU/USD (1195.53): Gold prices fell sharply on the day as price action breached below the round number support of 1200.00 to test the lows of 1191.78. The declines in gold prices come despite the rising geopolitical tensions which saw gold failing to emerge as a safe haven flow. Price action on the 4-hour chart is currently signaling a potential reversal with the formation of multiple doji candlesticks near the current low. A bullish close on the 4-hour chart could signal some modest recovery. However, price action needs to close above 1211.50 in order to confirm a retracement.