Market Brief

Japan’s trade deficit narrowed in February; the slower-than-expected increase of 9.8% (vs. 12.5% exp. & 9.5% last) was largely offset by significant fall in imports from 25% to 9%. The widely watched all industry index advanced from -0.1% to 1.0% in January and sent JPY-crosses marginally higher in Tokyo. USD/JPY advanced to 101.64 yet turned offered at this level. Option offers trail down from 101.75 to 100.90. In between, some buying interest is noted at 101.20 yet the bias remains strongly on the downside. The key support stands at 100.76 (Feb support). EURJPY remained capped below 141.48, option barriers at 141.80 are due today. The MACD (12, 26) indicator turned negative suggesting further downside. First set of support is placed at 139.83/140.00 (100-dma / optionality).

The UK has an eventful day ahead. The BoE minutes, unemployment data (at 09:30 GMT) and the budget announcement (12:30 GMT) will shape GBP-trading through the day. GBP/USD dived to 1.6546 in New York yesterday and shortly spiked to 1.6608 as Europe walked in. Trend and momentum indicators are steadily negative, support is seen above 50-dma (currently at 1.6560), then 1.6500 (uptrend channel bottom building since July). Stops are eyed below. On the upside, we see option barriers at 1.6650 and option bids back in game at 1.6685/1.6700. The latter picture suggests that supportive news has power to reverse the trend to bullish. EUR/GBP pulled out our 0.83915 Fibonacci target and tested 0.84000 overnight. The pair is close to the overbought area (RSI at 64%), some traders see opportunity on the short side at the current levels.

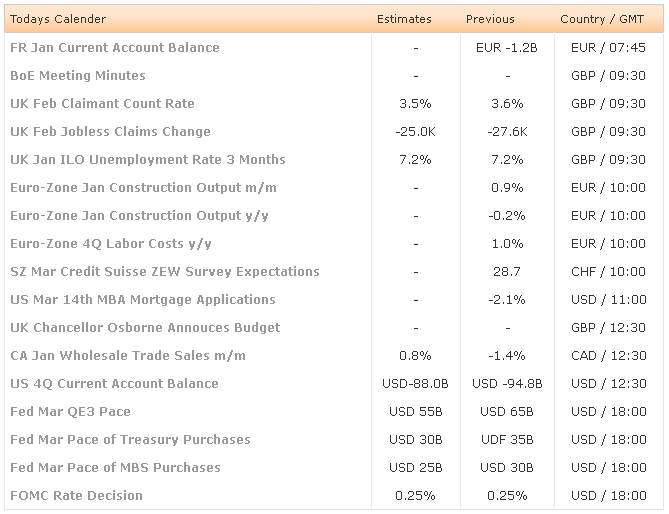

Later in the day, the focus will shift to Fed. The FOMC is expected to continue reducing the pace of its monthly asset purchases by another USD 10bn, however given the weakness in data (believed to be due to bad weather conditions) the Fed is likely to stick to its forward guidance. Any hawkish surprise should revive USD demand.

EUR/USD trades at about the mid-point of Feb-Mar uptrend channel. Technicals are steadily bullish. EUR will be subject to news/data from UK and US today. Option bids in EUR/USD are placed above 1.3880/1.3900 region for today’s expiry, offers are seen below 1.3870. The key short term supports are placed at 1.3811 (21-dma) then 1.3773 (Feb resistance to turn support).

AUD/USD extends gains on wider Yuan trading range. The pair hit the downtrend channel top and is on its way to the 200-dma (currently at 0.9147). Bullish momentum gains pace, decent option bids are to keep the downside safe above 0.9100. NZD/USD advanced to 0.8640 yesterday, given the bullish momentum we believe it is just a matter of time before the kiwi reaches the year high of 0.8676 versus USD.

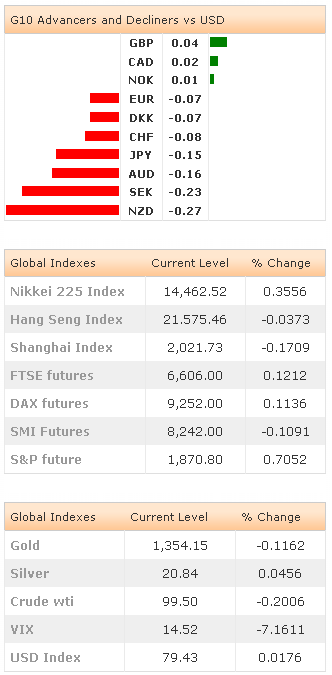

Today’s key events are BoE minutes, UK unemployment data and UK Chancellors Osborne’s budget announcement to the Parliament and the FOMC decision. The Fed should continue reducing the pace of its treasury purchases by USD 5bn & pace of MBS purchases by USD 5bn. Economic calendar consists of French January Current Account Balance, UK February Claimant Count Rate & Jobless Claims Change, UK Jan ILO Unemployment Rate 3-Months, Euro-Zone January Construction Output m/m & y/y, Euro-Zone 4Q Labor Costs y/y, Credit Suisse March ZEW Survey on Expectations in Switzerland, US March 14th MBA Mortgage Applications, US 4Q Current Account Balance and Canadian January Wholesale Trade Sales m/m.

Currency Tech

EUR/USD

R 2: 1.4000

R 1: 1.3967

CURRENT: 1.3924

S 1: 1.3810

S 2: 1.3773

GBP/USD

R 2: 1.6785

R 1: 1.6710

CURRENT: 1.6609

S 1: 1.6540

S 2: 1.6500

USD/JPY

R 2: 102.35

R 1: 101.85

CURRENT: 101.63

S 1: 101.20

S 2: 100.76

USD/CHF

R 2: 0.8930

R 1: 0.8815

CURRENT: 0.8742

S 1: 0.8700

S 2: 0.8640