Inflation in the UK exceeded forecasts, making traders and investors cautious about the prospects for policy easing in the coming months.

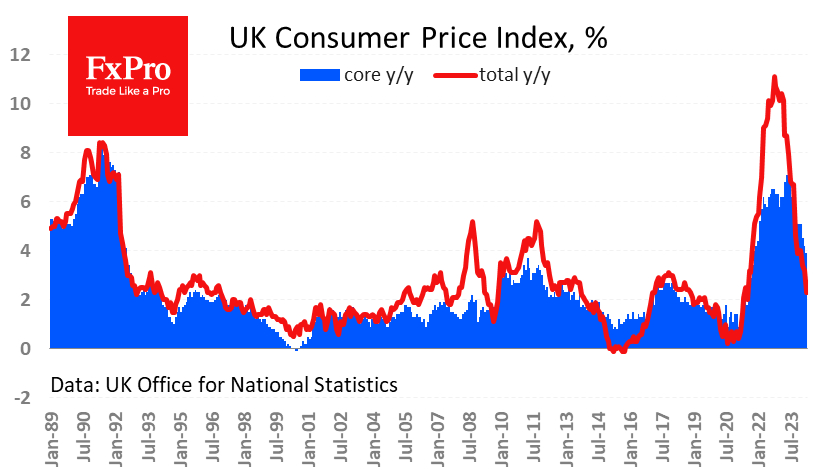

Consumer prices rose by 0.3% m/m vs. 0.2% expected. Annual inflation slowed to 2.3% last month from 3.2% in March. This is the lowest level in two years, comfortably close to the Bank of England's target but above the forecast of 2.3%.

Core inflation has been gently slowing over the past 12 months but has only fallen to 3.9% y/y from a peak of 7.1% y/y. Meaningful progress, but quite far from the desired level. In our view, the high growth rate of the core price index is the most important factor pushing forward the date of policy easing.

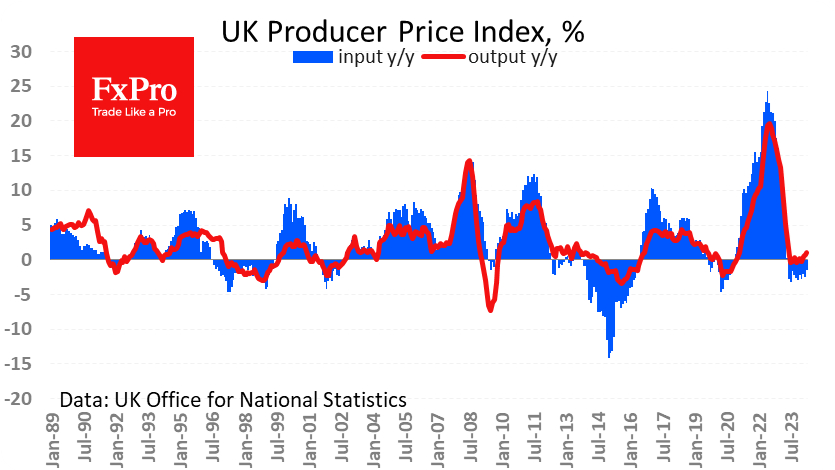

At the same time, producer prices have been at comfortably low levels for an extended period. The Input Producer Price Index loses 1.5% y/y, having remained in negative territory for the past 11 months. The Output Producer Price Index is rising at a rate of 1.1% y/y, accelerating over the past three months from a low of -0.2% in February.

Thus, the most intense inflationary pressure is centred on the retailers' stage. This is probably the result of rising labour costs or an attempt to compensate for narrow margins in previous years.

The persistence of inflation translating into tighter monetary policy is causing pressure on the UK equity market. The FTSE100 is losing around 0.75%, smoothly forming a peak during the previous week. Inflation data looks like a worthwhile reason to start a correction that could take the index back to 8200 or even 8000 from the current 8360 before we see buying activity.

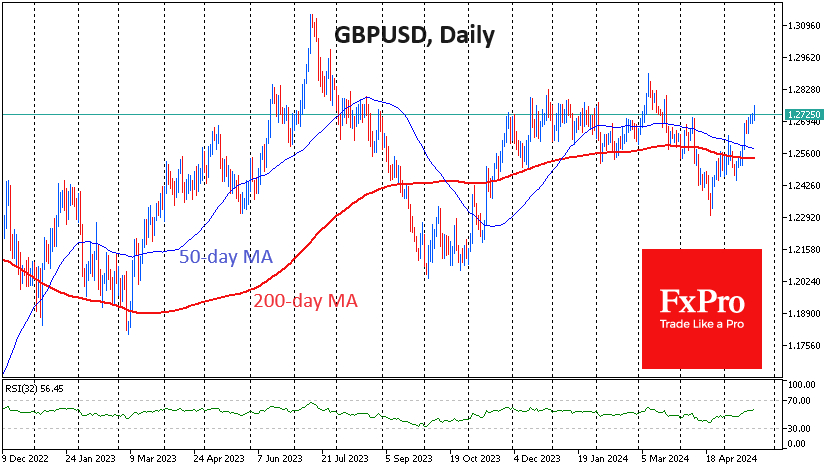

At the same time, this is good news for the pound, which hit a 2-month high against the dollar, rising above 1.2750 shortly after publication. This is an important area of resistance for the past 11 months. A further continuation of inflation higher than G10 currencies has the potential to lift GBPUSD to the next leg up to the 1.30-1.40 area.

Should the economy stumble, and with it inflation, this would remove the divergence in monetary policy and put pressure back on the pound, leaving it in the 1.20-1.27 range.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UK Inflation Throws Cold Water on Expected Rate Cut

Published 05/22/2024, 09:56 AM

UK Inflation Throws Cold Water on Expected Rate Cut

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.