The IMF met with Europe’s finance ministers in Brussels yesterday to iron out the kinks in the Greek debt reduction proposal. As expected, there were a few areas where the two parties didn’t meet eye to eye. Ms Lagarde was adamant that the original forecast of sustaining Greek debt at 120% by 2020 was still the benchmark to work towards. Mr Juncker, the chair of the finance ministers, pushed for a 2 year extension until 2022. I struggle to see how a figure cast in March can still be attainable given all that has happened in the past few months with Greece.

The pair also failed to read from the same page regarding current estimates of Greek growth, making it hard to value the burden of Greek debt going forward. The Troika report made it clear that Greece should be afforded more time to reach its shorter term targets; thankfully both parties agreed and a two year extension until 2016 was granted. Extending targets comes at a cost and both sides were reluctant to pick up the cheque, a further point of contention between the two parties. It became apparent that more time was needed to agree upon the right course of action for Greece. The much needed 31.5 billion tranche of the Greek bailout will remain under lock and key for the time being.

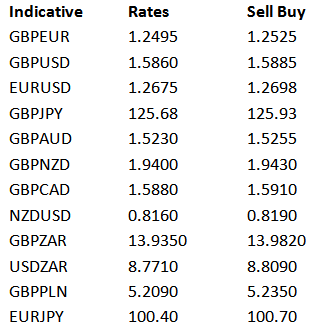

Veteran’s day yesterday in the US ensured a quiet day all around, GBPEUR and GBPUSD both traded within a 50 pip range and offered little in the way of excitement. There will be a keen eye cast on UK inflation this morning. In the past month we have seen an increase in gas and electricity prices along with food price inflation. A higher than expected figure will limit the power of the BoE in the short term and see cable fall lower pushing the 1.5850 support level.

Inflation figures for Spain, Italy and Portugal are due as well with German ZEW survey a keen indicator as to the level of economic conditions in Germany.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UK Inflation Rises To 2.7%

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.