Key Points:

- UK High Court ruling generating some positive sentiment for the pair.

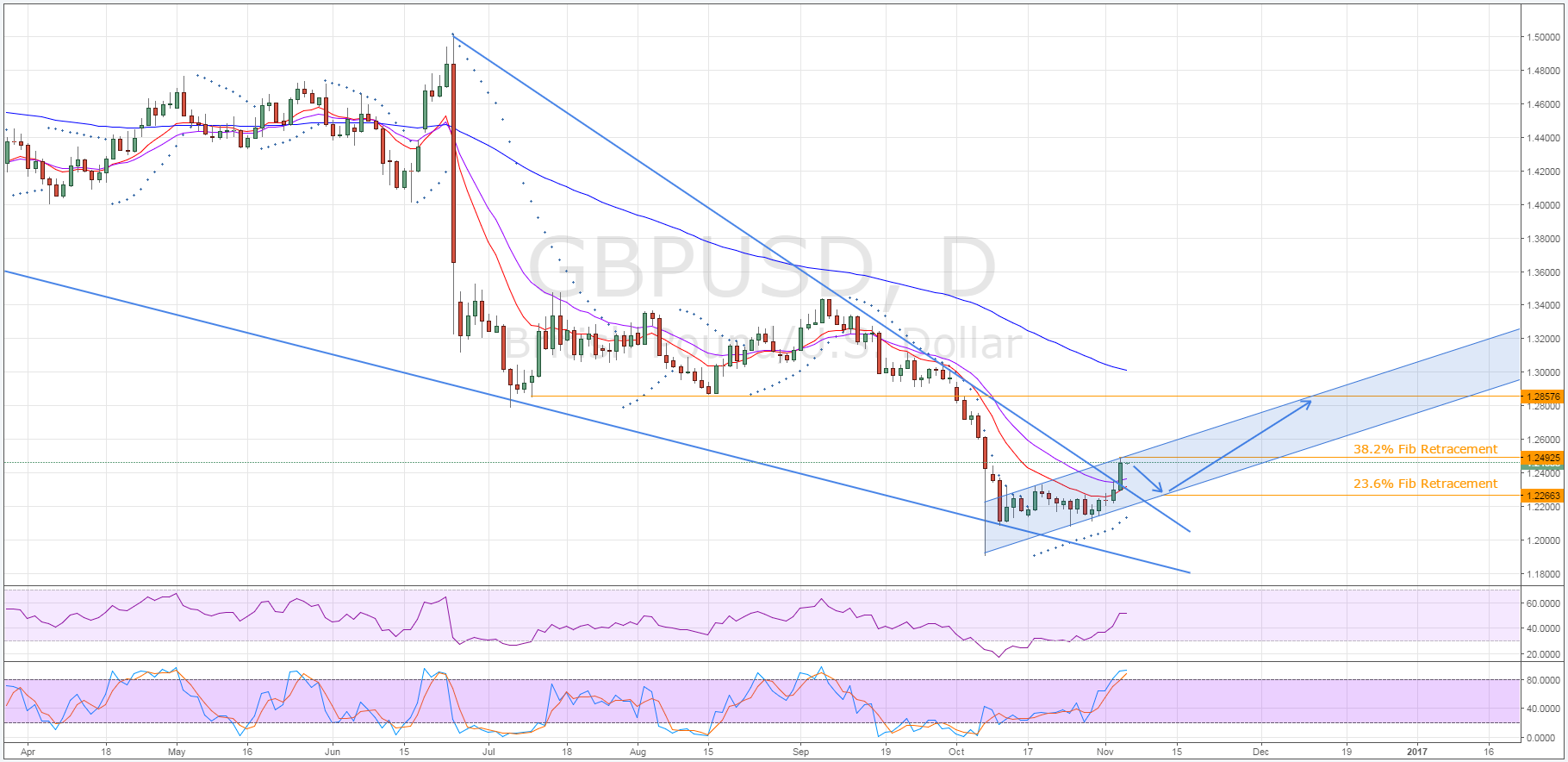

- Recent rally has seen the pair break free of the long-term falling wedge.

- May need to move slightly lower again before entering bullish phase.

In a rather sudden move to the upside, the cable seems to have finally broken free of the consolidating phase that has been constraining its price movements since the Brexit Referendum. As a result, we could be about to see a spell of bullishness for the pair which could bring the GBP higher. Specifically, the rally could move the GBP back within the price ranges seen during the sideways channel in the immediate wake of the referendum.

First and foremost, last session’s spike in price was no random swing in sentiment. Instead, we can attribute the surge in buying pressure to the BoE’s decision on rates and the news that the UK High Court has ruled parliament must vote on the triggering of Article 50. Understandably, this has given a glimmer of hope to those wishing to prevent the UK’s exit from the Eurozone which could see sentiment begin to return to the pound as time progresses.

As a result of this likely uptick in sentiment, a bullish medium to long-term technical forecast might not seem so absurd, especially given some of the pair’s current signals. Chief among the technical factors signalling the start of a bullish period is the aforementioned breakout from the falling wedge pattern. As is shown below, the cable’s recent surge in popularity has driven it above the upside constraint of the pattern which now signals that a period of gains could be on the agenda.

However, as a result of this push higher, the pair may now need a few sessions to cool itself off. Specifically, the manoeuvre has brought the stochastic oscillator firmly into overbought territory which will be capping gains as the week comes to a close. In addition to this stochastic reading, the GBP is now challenging the 38.2% Fibonacci level which could encourage a reversal in the near-term.

This being said, any imminent reversals are likely to be short-lived and rather sedate in the grand scheme of things. This is largely due to the presence of the 23.6% Fibonacci retracement level and the bullish bias currently on the Parabolic SAR. However, the recently broken upside constraint should now also limit downside risk.

Ultimately, with or without a near-term slip, it is expected that the cable continues to follow its tight bullish channel higher over the coming sessions. This channel should bring the pair up to around the 1.2857 price which is the lower bound of the ranging phase which occurred in the immediate aftermath of the Brexit referendum. However, keep an eye out for any Brexit related news as it could erode the positive sentiment generated by hopes that parliament could block the triggering of Article 50.