UK Foreign Minister Boris Johnson quits in protest

- The pressure for Theresa May is rising, as she has to face another resignation, namely of Boris Johnson who quit in protest for the new softer Brexit plans. The resignation underscored the fragility of the UK political scene as the possibility of a leadership contest is more probable. With a possible confidence vote looming over Theresa May, it might be the case that she may enter negotiations with the Labor party to get more support. Moreover the pound weakened on the news and any further headlines could provide further volatility.

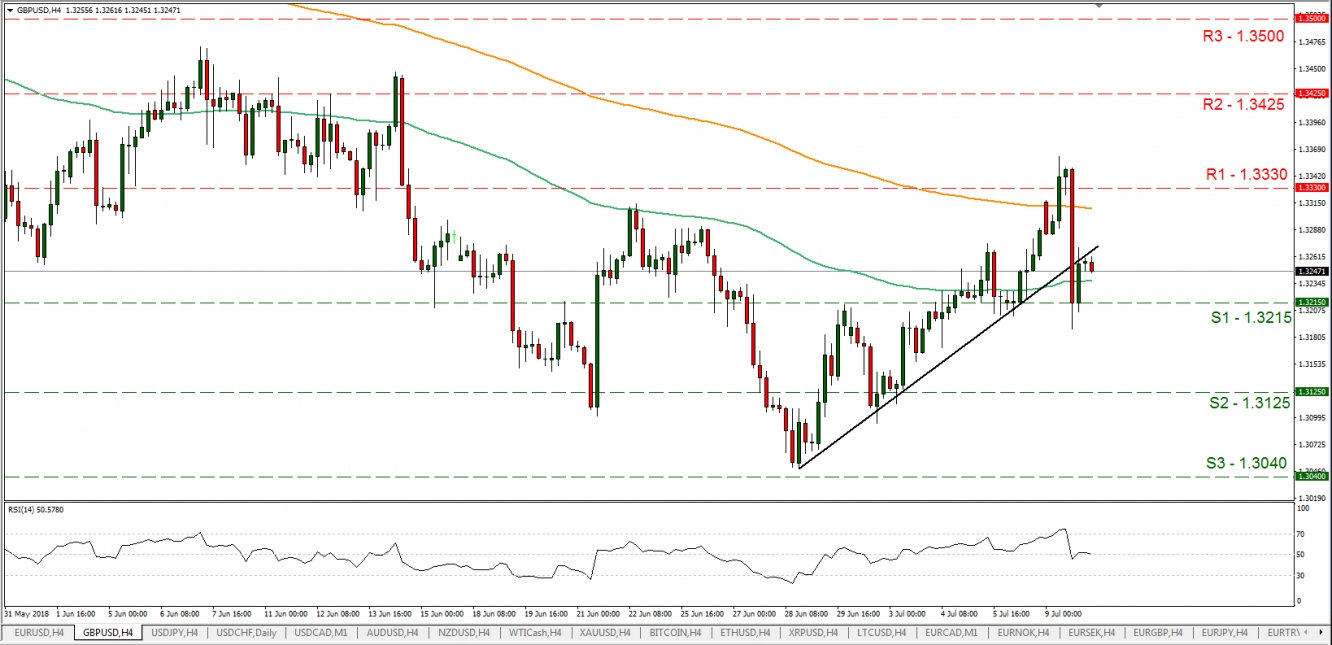

- Cable dropped heavily yesterday following Boris Johnson’s resignation breaking the upward trend-line it had incepted since the 28th of June and tested the 1.3215 (S1) support line, correcting somewhat later on. From a technical point of view, the clear breaking of the prementioned upward trend-line removes our bullish bias and we could see the pair having a sideways motion as the market may be entering a “wait and see” mode. The above argument could be supported by the RSI indicator in the 4 hour chart which is near the reading of 50 implying an indecisive market. The pair could prove sensitive to any further Brexit headlines and also the release of UK’s manufacturing output growth rate for May could influence the pair’s direction. Should the bulls take the reins we could see the pair breaking the pair aiming if not breaking the 1.3330 (R1) resistance line. If on the other hand the bears get in the driver’s seat we could see the pair breaking the 1.3215 (S1) support line and aim for the 1.3125 (S2) support barrier.

Merkel praises China on its trade conflict stance

- German Chancellor Merkel and Chinese PM Li met in Berlin yesterday and Merkel praised China’s trade conflict stance. She also expressed the hope that the upcoming EU-China summit could deliver more progress and that trade protectionism is the main risk in the economy. European officials have stated that China was putting pressure on the EU lately to issue a joint strong statement against the US trade policies. Should there be further headlines about the issue we could see the common currency gaining strength.

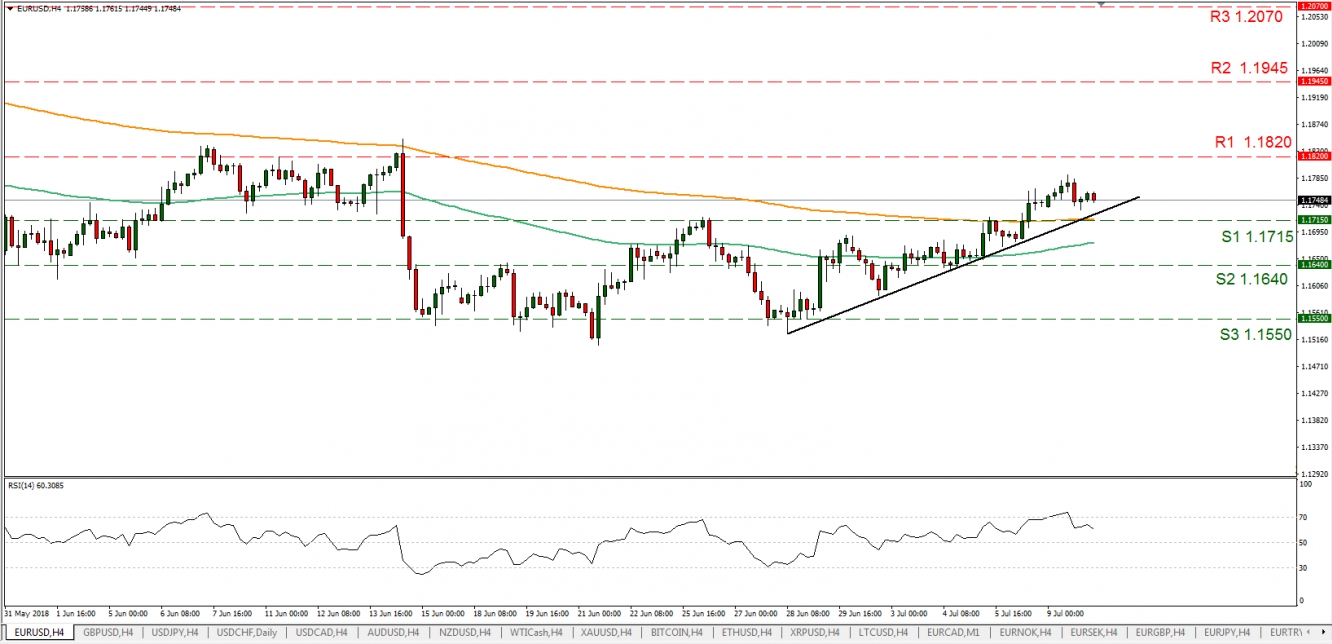

- EUR/USD entered a sideways motion yesterday above the 1.1715 (S1) support line and is threatening to break the upward trend-line incepted since the 28th of June. For our bullish bias to be removed we would require the pair to clearly break the aforementioned upward trend-line. Also it should be mentioned that the RSI indicator in the 4 hour chart has dropped from yesterday’s high reading aligning itself to the sideways motion mentioned. Please be advised that today’s release of Germany’s ZEW economic sentiment indicator could weaken the EUR side of the pair. Should the pair come under selling interest we could see it breaking the aforementioned upward trend-line, the 1.1715 (S1) support line and aim for the 1.1640 (S2) support barrier. Should the market set the pair under buying interest we could see it aiming for the 1.1820 (R1) resistance line and aim for the 1.1945 (R2) resistance barrier.

In today’s other economic highlights:

- In today’s European session, we get Norway’s inflation data for June which could support the NOK, UK’s manufacturing output growth rate for May and Germany’s ZEW economic sentiment indicator for July. In the American session we get Canada’s annualized housing starts figure for June and the API weekly crude oil stock figure. As for speakers, ECB’s Sabine Lautenschläger speaks.

·Support: 1.3215(S1), 1.3125(S2), 1.3040(S3)

·Resistance: 1.3330(R1),1.3425(R2),1.3500(R3)

EUR/USD

·Support: 1.1715(S1), 1.1640(S2), 1.1550(S3)

·Resistance: 1.1820(R1), 1.1945(R2), 1.2070(R3)