Key Highlights

- The British pound declined further below the 1.2570 support against the US dollar.

- GBP/USD could struggle to recover above 1.2570 and 1.2600 resistance levels.

GBP/USD Technical Analysis

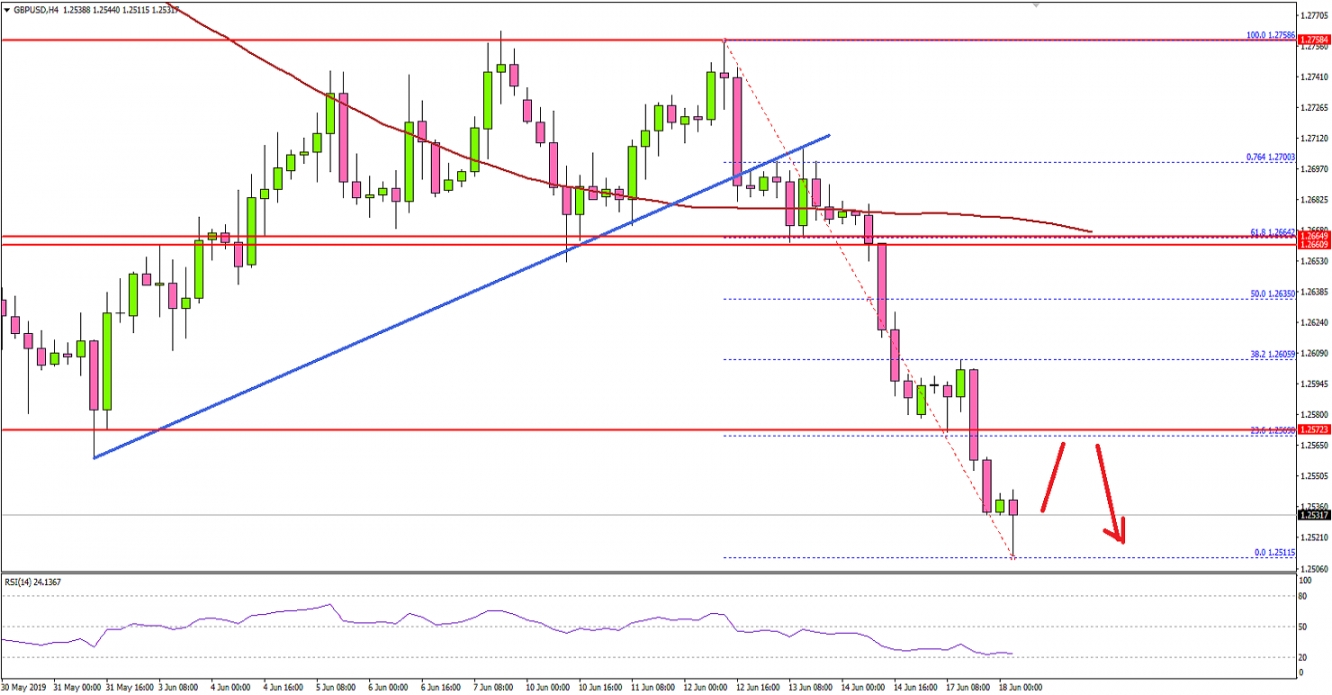

Looking at the 4-hours chart, the pair failed once again to clear the 1.2760 resistance and started a strong decline. It broke the 1.2650 support, a connecting bullish trend line, and the 100 simple moving average (red, 4-hours).

The pair even broke the 1.2600 support and the 1.2570 pivot zone. A swing low was formed at 1.2511 and the pair recently started a short term upside correction.

It traded above 1.2520 and facing resistance near the 23.6% Fib retracement level of the decline from 1.2758 to 1.2511. The current price action suggests that the pair could struggle to recover above the 1.2570 and 1.2600 levels.

Further to the upside, GBP/USD is likely to face a strong resistance near the 1.2650 level or the 50% Fib retracement level of the decline from 1.2758 to 1.2511.

On the downside, the main supports are near 1.2510 and 1.2500, below which the pair could accelerate its decline towards the 1.2460 or 1.2440 support.