Income key in world of low numbers

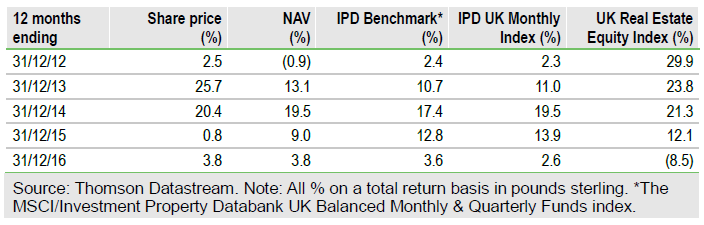

UK Commercial Property Trust (LON:UKCM) is a property investment company which seeks to generate an attractive and sustainable income with potential for capital and income growth by investing in high quality UK real estate. UKCM was set up in 2006, aiming to appeal to institutions as well as private investors by adopting a lower risk profile by focusing on prime assets and maintaining a conservative level of gearing. In April 2015, following Standard Life Investments’ (LON:SL) acquisition of Ignis Asset Management, Will Fulton became lead manager. He reshaped UKCM’s portfolio to reflect SL’s house view, while retaining the conservative approach. NAV total return was ahead of its benchmark in 2016, following the repositioning of the portfolio in 2015.

Investment strategy: Focus on income enhancement

UKCM seeks to derive a sustainable income from a diversified portfolio of c 40 UK commercial property assets. It manages the portfolio to reflect SL’s sector strategy and to maintain a bias towards prime properties with good income visibility. Reaching positive outcomes with tenants ahead of lease expiry is seen as key to optimising long-term income and minimising voids. The manager seeks to enhance income further through other asset management initiatives, such as refurbishment or applying for strategic change of use. This aims to secure the cash flows required to ensure attractive and sustainable dividend payouts to shareholders.

To read the entire report Please click on the pdf File Below