Forex News and Events:

Supportive news out of UK before budget announcement

The UK jobs data came in flat-to-positive. The ILO unemployment rate (3-months) remained unchanged at 7.2% in January. As expected the claimant count rate eased from 3.6% to 3.5% in February, with jobless claims drop from -33.9K (revised from -27.6K) to -34.6K. Data witnesses that the UK jobs market keep improving. As knee-jerk reaction, GBP/USD advanced to 1.6642 (at the time of writing). The March 5-6th meeting minutes stated that “this gradual appreciation would continue if prospects in UK continued to be seen as increasingly favorable relative to those of its main trading partners”. The BoE minutes favored continuation of the forward guidance and showed no intention to increase the benchmark rate until 7.0%-target is reached. We remind however that 7.0% is not a trigger for rate hike as made clear by Mr. Carney previously. The BoE highlighted signs of improving UK economy, adding that the weakness in US should be offset by modest recovery in Euro area. UK’s Chancellor Osborne will announce the 2014 budget to the Parliament at 12:30 GMT. OBR is expected to revise the growth forecast on the upside.

Although the technicals have been bearish over the past weeks, the supportive news out of UK have power to reverse trend in the Cable to bullish. Option offers are seen at 1.6650, option bids are to be tipped above 1.6685/1.6700 region. EUR/GBP pulled out our 0.83915 Fibo-target, yet failed to clear resistance above 0.84000. Waiting for more good news out of UK, traders continue seeing opportunity on the short side of the play.

Yuan unwind continues

USD/CNY hit 6.2038 in China, the pair traded above its 1% official fixing for the first time. Since PBoC announced the widening of Yuan’s trading band from 1% to 2% last Saturday, USD/CNY lost roughly about 0.90% (from Monday’s 6.1500 to 6.2038). The PBoC goal of injecting two-way volatility is clearly successful till now. The 1-month realized vol hikes to 3.25% (highest levels since end-2012), the 1-month implied vol spikes to 2.50% (highest since March 2012). Trend and momentum indicators are solidly positive, the next key level is placed at 6.2083 (Fibonacci 123.60% on Jan-Feb 1st rally). Traders remain however cautious given the decent amount of structured USDCNY short products sold since the beginning of 2013. It has been reported that USD 350bn worth of such products have been retailed, USD 150bn are still unsettled. Through March, option barriers are seen at 6.20/6.22, more than 5bn nominal offer is seen at 6.25. Given the overbought conditions in USDCNY (RSI above 80%), traders should expect downside correction at these levels.

Moving forward, we expect PBoC intervention to taper the recent hike in market volatility in order to keep the market confidence tight. Due to opacity, it is difficult to state what the PBoC’s real intensions are, however one thing is sure: if the trading band has been widened and two-way volatility has been generously injected, there should be a follow through. The 6.20 sees resistance at this stage. A significant break above should favor more upside volatility.

Side Note on Fed

The FOMC will give verdict today and is broadly expected to continue reducing the pace of its monthly Treasury and MBS purchases by USD 5bn each (total USD 10bn). At this stage, the Fed has no reason to disturb the course of QE exit, now that the market volatilities on Fed speculations have clearly faded. We suspect that the Chairwoman Yellen will rather concentrate on the forward guidance and keep the tone dovish regarding the future of rates. This is already priced in. A price action should be expected in the alternative case scenario of a hawkish surprise (which would boost USD demand). Pre-Fed, DXY consolidates weakness below 79.50, the 10-year US government bonds remain ranged at about the 100-day moving average of 2.7569%.

GBP/USD" title="GBP/USD" align="bottom" border="0" height="242" width="430">

GBP/USD" title="GBP/USD" align="bottom" border="0" height="242" width="430">

Today's Key Issues (time in GMT):

2014-03-19T11:00:00 USD Mar 14th MBA Mortgage Applications, last -2.1%2014-03-19T12:30:00 GBP UK Chancellor Osborne Annouces Budget

2014-03-19T12:30:00 CAD Jan Wholesale Trade Sales m/m, exp. 0.8%, last -1.4%

2014-03-19T12:30:00 USD 4Q Current Account Balance, exp. USD -88.0B, last USD -94.8B

2014-03-19T18:00:00 USD Fed Mar QE3 Pace, exp. USD 55B, last USD 65B

2014-03-19T18:00:00 USD Fed Mar Pace of Treasury Purchases, exp. USD 30B, last USD 35B

2014-03-19T18:00:00 USD Fed Mar Pace of MBS Purchases, exp. USD 25B, last USD 30B

2014-03-19T18:00:00 USD FOMC Rate Decision, exp. 0.25%, last 0.25%

The Risk Today:

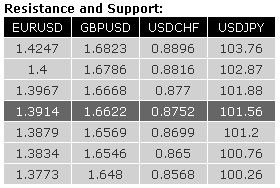

EUR/USD EUR/USD has thus far failed to make any follow-through after the move above the strong resistance at 1.3893 (27/12/2013 high). However, the short-term technical configuration remains positive as long as the support at 1.3834 (11/03/2014 low) holds. An initial support can be found at 1.3879 (17/03/2014 low). A resistance stands at 1.3915. In the medium-term, the ascending triangle formation favours a further upside potential towards 1.4368. A key resistance lies at 1.4247 (27/10/2011 high), whereas a key support is at 1.3643 (27/02/2014 low).

GBP/USD GBP/USD has moved below the support at 1.6569, but has failed to make any follow-through, suggesting a potential false breakout. A short-term bias is favoured as long as prices remain below the resistance at 1.6666 (see also the steep declining channel). Another resistance lies at 1.6718. A support now stands at 1.6546 (18/03/2014 low, see also the low of the longer term declining channel). The recent weakness still looks like a medium-term counter trend move as long as the support at 1.6569 is not decisively broken. In the long-term, the technical structure favours a bullish bias as long as the support at 1.6220 (17/12/2013 low) holds. The decisive break of the resistance at 1.6668 opens the way for a move towards the major resistance at 1.7043 (05/08/2009 high).

USD/JPY USD/JPY is trying to stabilise near the support at 101.20 (03/03/2014 low) after its recent sharp decline. Monitor the hourly resistance at 101.88/101.94 (18/03/2014 high). Another resistance stands at 102.87. Another support can be found at 100.76. A long-term bullish bias is favoured as long as the key support area given by the 200 day moving average (around 100.26) and 99.57 (see also the rising trendline from the 93.79 low (13/06/2013)) holds. A major resistance stands at 110.66 (15/08/2008 high).

USD/CHF USD/CHF continues to bounce. However, the technical structure is negative as long as prices remain below the resistance at 0.8816 (07/03/2014 high). An hourly resistance stands at 0.8770. A support stands at 0.8699. From a longer term perspective, the structure present since 0.9972 (24/07/2012) is seen as a large corrective phase. However, the break of the key support at 0.8800 (27/12/2013 low) opens the way for a further decline towards the next key support at 0.8568 (27/10/2011 low).