UBS Group AG (NYSE:UBS) has been banned by The Hong Kong Securities and Futures Commission from sponsoring initial public offerings (IPO) for a period of 18 months.

Also, a fine of HK$119 million has been levied on UBS Group. Though the bank has not specified the reason behind this penalty, in the latest annual filing, UBS Group mentioned its intentions to contest the regulators’ decision.

However, the Swiss bank has assured its employees of continuing "business as normal" via an internal memo sent by Andrea Orcel and David Chin, global and Asia-Pacific heads of UBS's investment bank, per a Reuters article.

UBS Group seeks to continue sponsoring IPOs till its appeal is heard by the authorities. Also, the bank informed the employees that it expects the full hearing of the appeal to happen in fourth-quarter 2018 and a final decision to made early in 2019.

The suspension comes when the city’s investors are anticipating to witness some potential floats in the nearterm. Hong Kong IPOs require at least one sponsoring bank that leads the work, i.e. collection of a significant proportion of the feeswhile the deal is in progress.

Further, if a company wishes to change sponsor in the middle of its IPO process due to a sponsor's suspension,the whole listing process will have to start over again, leading to months of additional work.

Moreover, the regulator is investigating works of about 15 more firms of their role as sponsors, which is likely to have resulted in losses of about billions of dollars for investors.

UBS Group’s suspension from IPO sponsoring might keep revenues under pressure as it depends significantly on its wealth management and private banking segments. Also, its profitability continues to be challenged by negative interest rates in the domestic economy.

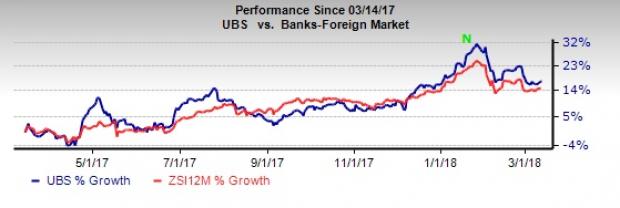

Shares of UBS Group have gained 17.1% over the past year, outperforming the industry’s rally of 14.9%.

The stock carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

KB Financial Group (NYSE:KB) has been witnessing upward estimate revisions for the last 60 days. In six months’ time, the company’s share price has gained more than 34%. It carries a Zacks Rank #2 (Buy).

HSBC Holdings (LON:HSBA) plc (NYSE:HSBC) carries a Zacks Rank of 2. Its earnings estimates for 2018 have been revised 4.2% upward over the last 60 days. Also, its shares have gained 21.2% in the past year.

ING Group (NYSE:ING) carries a Zacks Rank of 2. The Zacks Consensus Estimate for the company has jumped 7.8% for the current year, in the last 60 days. Its share price has gained 16.2% in the past year.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

UBS Group AG (UBS): Free Stock Analysis Report

KB Financial Group Inc (KB): Free Stock Analysis Report

HSBC Holdings PLC (HSBC): Free Stock Analysis Report

ING Group, N.V. (ING): Free Stock Analysis Report

Original post