UBS Group AG (NYSE:UBS) reported second-quarter 2017 pre-tax operating profit of CHF 1.68 billion ($1.71 billion) on an adjusted basis, up around 1% from the prior-year quarter.

Results displayed increase in net interest income (up 22% year over year), along with net fee and commission income (up 5% year over year), partially offset by lower trading income (down 23% year over year). Notably, the quarter benefited from the company’s consistent focus on expense management.

Further, the Swiss banking giant’s net profit attributable to shareholders of CHF 1.17 billion ($1.19 billion), up 13.6% year over year. Results included net restructuring expenses of CHF 258 million.

The company recorded improved profitability in Global wealth management, Wealth Management Americas and Wealth Management units. However, performances in Investment Bank, Asset Management, and Personal & Corporate banking units were disappointing.

Constant Cost Control Reflected, Operating Income Stable

Excluding the significant items, UBS Group AG’s adjusted operating income remained almost stable compared with the prior-year quarter at CHF 7.18 billion ($7.29 billion).

Adjusted operating expenses were almost in line with the prior-year quarter at CHF 5.5 billion ($5.6 billion). Expenses included provisions for litigation, regulatory and similar matters of CHF 9 million ($9.1 million), slumping 87.5% year over year.

Business Division Performance

Global wealth management division’s adjusted operating profit before tax came in at CHF 1.01 billion ($1.03 billion), up 15% year over year. Upsurge in client activity, US dollar interest rate rises, elevated invested assets and prudent cost management were the positives. Net new money came in at CHF 7.5 billion in the quarter.

The Wealth Management division’s adjusted operating profit before tax jumped 14% year over year to CHF 691 million ($701.4 million) in the quarter. Elevated transaction-based income and recurring net fee income, along with reduced operating expenses mainly led to the upsurge. Notably, net new money remained strong during the quarter.

Wealth Management Americas division’s adjusted operating profit before tax jumped 17.1% from the prior-year quarter figure to CHF 322 million ($326.8 million). Notably, net new money was a negative during the quarter.

The Asset Management unit’s adjusted operating profit declined 10.1% year over year to CHF 133 million ($135 million) in the quarter, marred by lower net management fees.

The company’s Investment Bank unit’s adjusted operating profit before tax came in at CHF 419 million ($425.3 million), down 6.3% from the prior-year quarter. Low volatility and reduced client activity levels led to a decrease in Foreign Exchange, Rates and Credit revenues, partially offset by higher corporate client solutions revenues.

Personal & Corporate banking division’s adjusted operating profit before tax was down 18.1% year over year to CHF 379 million ($384.7 million). Lower net interest income was recorded, partially offset by elevated transaction-based and recurring net fee income. Notably, annualized net new business volume growth for personal banking was 4.5%.

Corporate Center reported adjusted operating loss before tax of CHF 269 million ($273 million) compared with a loss of CHF 267 million witnessed in the year-ago quarter.

Capital Position

As of Jun 30, 2017, UBS AG's invested assets were CHF 2.92 trillion ($3.33 trillion), up 9% year over year. Total assets came in at CHF 890.8 billion ($1.02 trillion), descending around 10% year over year.

UBS Group’s phase-in common equity tier (CET) 1 ratio was 14.8% as of Jun 30, 2017, compared with 17.1% in the prior-year quarter. Further, phase-in CET 1 capital dipped 5.1% year over year to CHF 35.2 billion ($40.2 billion) as of Jun 30, 2017. Fully applied risk-weighted assets climbed 10.7% year over year to CHF 236.7 billion ($270.1 billion).

Outlook

Wealth management client activity levels have improved on optimism among investors. However, management remains concerned about geo-political tensions and underlying macroeconomic uncertainties, which have been contributing to client risk aversion and low-transaction volumes. Though investors’ sentiments have improved, a sustained increase in client activity levels is not visible.

The company also highlighted several concerns, including headwinds from negative interest rates, though partially mitigated by the favorable impact of increasing U.S. dollar interest rates and normalization of monetary policy. Further, the proposed changes to the Swiss bank capital standards and global regulatory framework in Switzerland, will lead to higher capital requirements and expenses. However, amid a challenging operating environment, the company remains committed to the execution of its strategies.

Our Take

Results highlight a decent quarter for UBS Group with its major units, displaying growth, though Investment Bank disappointed. We remain optimistic as the company managed to sustain profitability amid a number of headwinds witnessed in the quarter. UBS Group remains focused on building its capital levels. Restructuring initiatives, including cost control, are encouraging.

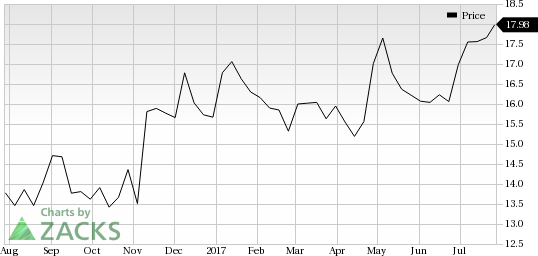

Currently, UBS Group AG carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other foreign banks, Deutsche Bank AG (NYSE:DB) reported net income of €466 million ($512.4 million) in second-quarter 2017, significantly up on a year-over-year basis. Income before income taxes more than doubled to €822 million ($903.9 million) on a year-over-year basis. Cost management and reduction in provisions were positive factors. However, lower revenues due to trading slump were an undermining factor. Notably, net new money inflows were recorded during the quarter.

Other foreign banks that are expected to release results soon include Mitsubishi UFJ Financial Group, Inc. (NYSE:MTU) and Itau Unibanco Holding S.A. (NYSE:ITUB) , which are scheduled to report results on Aug 1 and Jul 31, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

UBS AG (UBS): Free Stock Analysis Report

Deutsche Bank AG (DB): Free Stock Analysis Report

Mitsubishi UFJ Financial Group Inc (MTU): Free Stock Analysis Report

Itau Unibanco Banco Holding SA (ITUB): Free Stock Analysis Report

Original post

Zacks Investment Research