Shares of Ubiquiti Networks, Inc. (NASDAQ:UBNT) rose 16.6% in the trading session yesterday, after the company reported striking revenue growth in its fiscal fourth-quarter 2017 results, beat earnings and released an upbeat guidance which trumped market expectations.

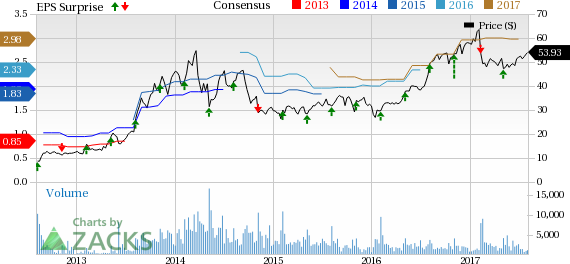

The network hardware provider reported earnings per share of 74 cents, which surpassed the Zacks Consensus Estimate of 69 cents by 7.3%.

On a non-GAAP basis, the company’s earnings per share were 75 cents, reflecting 8.7% growth year over year. Ubiquiti’s overarching business model and impressive top-line growth drove the stellar performance during the quarter.

Inside the Headlines

Total revenue of $228.6 million steered past the company’s projected range of $215–$225 million. Also, it grew 23.1% on a year-over-year basis and topped the Zacks Consensus Estimate of $216 million comfortably. Solid demand of all product lines across each end market proved conducive to top-line growth.

The company’s Enterprise Technology segment continued to fare remarkably well, with revenues soaring a whopping 48.5% year over year to $113.9 million. The striking growth was fueled by the entire UniFi product family. Disruptive pricing and higher average selling prices of recently launched products also drove the top line. Moreover, high demand for access points, switches, gateways and IP cameras and other complementary products helped increase revenues.

Even the Service Provider Technology segment grew of 5.2% year over year, generating $114.7 million. Higher sales of new offerings to the Ubiquiti community of service providers, including airMAX AC Gen2 drove sales increase of this segment.

On a geographic basis, South America charted strongest growth, as revenues surged 43.5% compared to the prior-year quarter figure. North American sales rose an impressive 18.3% year over year. In addition, Europe, Middle East and Africa, and the Asia Pacific regions grew 26.1% and 6.2%, respectively, on a year-over-year basis.

Gross margin for the quarter shrunk 320 basis points (bps) year over year to 45.4%. Recent revenue growth has been primarily driven by new product offerings, which, in turn, resulted in the reduction of gross margins.

Product Launches

During the reported quarter, Ubiquiti upgraded the UniFi ecosystem, which includes hotspot analytics and high density WLAN improvements, and added new features to the AmpliFi product family. It also, offered GPS synchronization functionality for the airMAX AC product family. This apart, Ubiquiti introduced the UFiber GPON platform, which will help service providers build high-speed fiber networks.

Also, Ubiquiti Networks launched the PrismStation AC base station radios and airPrism sector antennas. This will allow customers to enjoy high-density airMAX networks throughout the world. Moreover, the company expanded the reach of its AmpliFi product family by rolling them out into retail biggies including Best Buy, Sam's Club, GameStop (NYSE:GME) and international retailers.

Liquidity & Share Repurchases

Ubiquiti ended the fiscal fourth quarter with cash and cash equivalents of $604.2 million compared with $533.9 million as of Dec 31, 2016. At the end of Jun 30, 2017, the company’s long-term debt was $241.8 million, up from $191.6 million recorded at the end of Dec 31, 2016.

Also, during the fiscal fourth quarter, the company repurchased 50,000 shares at an average price for $2.5 million at an average price of $49.55 per share.

Guidance

The company released optimistic guidance for fiscal first-quarter 2018. This was suppoted by its solid performance in the reported quarter, favorable business trends and sturdy demand environment. Management projects revenues in the range of $230-$250 million and GAAP earnings in the band of 89–90 cents per share.

For fiscal 2018, the company expects to garner revenues of $1.0–$1.15 billion and diluted earnings per share of $3.70–$4.30. Broad-based demands for products in both its segments are likely to fuel growth. Currently, the Zacks Consensus Estimate for fiscal 2018 earnings is pegged at $3.08 a share on sales of $914.1 million.

Our Take

Ubiquiti ended fiscal 2017 on a high note and set an ambitious goal for its next fiscal year, driven by robust demand across segments. The company remains upbeat on the market traction of the newly launched products. This apart, Ubiquiti’s excellent global business model, which is highly flexible and adaptable to any kind of change in markets, has helped it steer past challenges and maximize growth.

Over the past few quarters, Ubiquiti has made significant investments in inventory to reduce lead times, meet increasing demand and support the growing number of customers. These efforts have optimized Ubiquity’s inventory with the market demand. Moreover, the company’s effective management of its strong global network of over 100 distributors and master resellers has improved its visibility for future demand. Positive industry trends and a resilient business model are likely to stoke the Zacks Rank #3 (Hold) company’s growth.

Stocks to Consider

Some stocks in the broader sector include Applied Optoelectronics, Inc. (NASDAQ:AAOI) , Red Hat, Inc. (NYSE:RHT) and Applied Materials, Inc. (NASDAQ:AMAT) . While Applied Optoelectronics and Red Hat sport a Zacks Rank #1 (Strong Buy), Applied Materials holds the Zacks Rank #2 (Buy).

Applied Optoelectronics has an average earnings surprise of 21.0% for the trailing four quarters, beating estimates all through.

Red Hat, Inc. has a robust earnings surprise history, with an average positive surprise of 11.1%, driven by consecutive earnings beats over the trailing four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

With four back-to-back beats, Applied Materials has an average positive surprise of 3.4% for the trailing four quarters.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Ubiquiti Networks, Inc. (UBNT): Free Stock Analysis Report

Red Hat, Inc. (RHT): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research