- Uber is set to report earnings tomorrow.

- Investors will be eying revenue figures alongside key metrics like bookings.

- Can the ride-sharing giant deliver?

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Uber (NYSE:UBER) steps into the earnings spotlight tomorrow, with investors focused on the ride-sharing and delivery giant's growth trajectory. Key metrics like revenue and booking figures will be under scrutiny to gauge the company's performance in the first quarter.

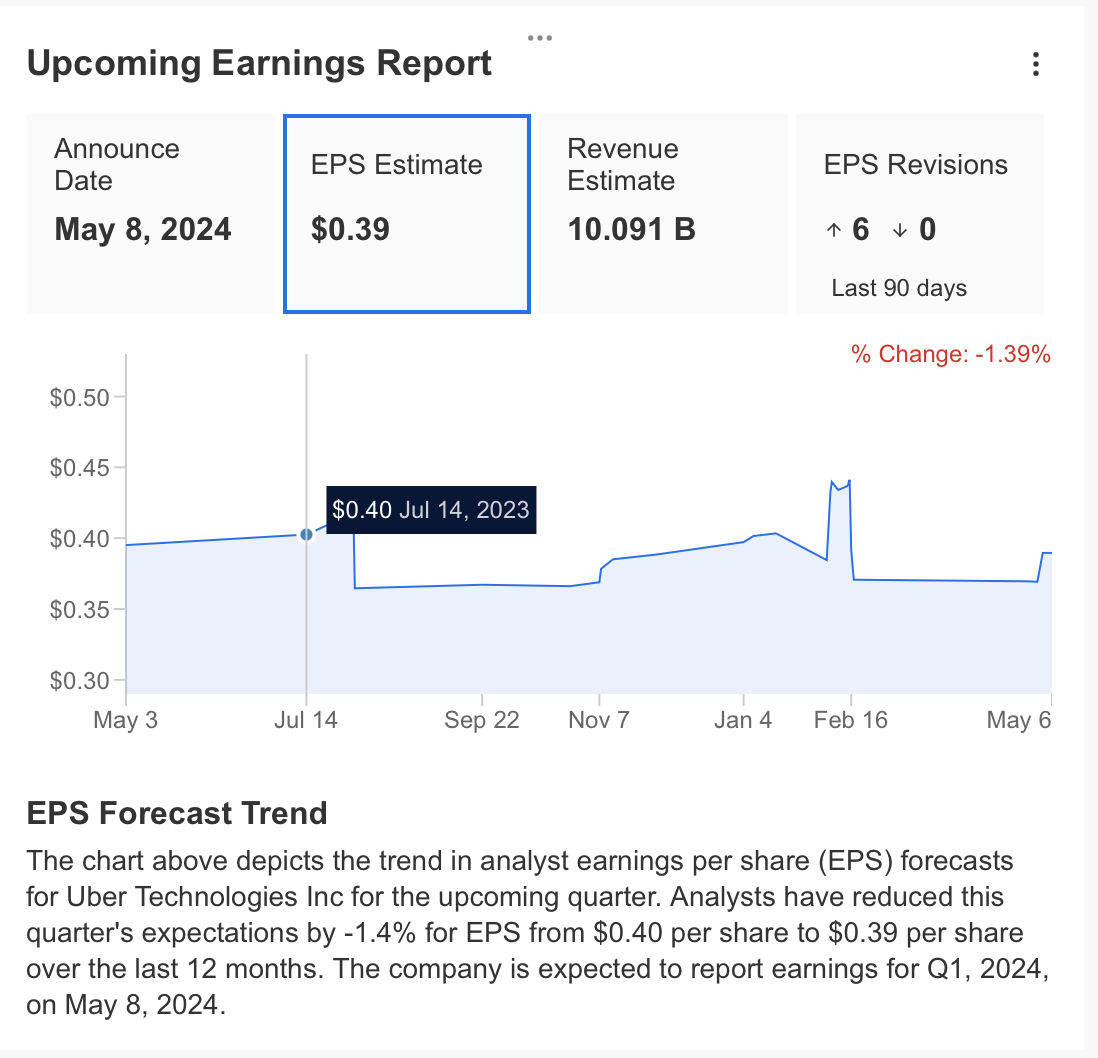

Analysts are projecting first-quarter earnings per share (EPS) to land around $0.39, with revenue reaching $10.09 billion. Notably, Uber surpassed analyst estimates last quarter with an EPS of $0.86 – a solid 110% beat.

While this quarter's EPS is expected to be lower at $0.39, it should still represent a slight year-over-year increase. Revenue growth is also anticipated, with estimates pointing to a 15% jump compared to the same period last year.

By the way, are you looking to pick quality stocks ahead of earnings? our predictive AI stock-picking tool can prove a game-changer. For less than $9 a month, it will update you every month with a timely selection of AI-picked buys and sells.

Subscribe now and position your portfolio one step ahead of everyone else!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Source: InvestingPro

Investors are eagerly awaiting Uber's earnings report, anticipating record revenue for Q1. But their focus extends beyond just revenue figures to these two key metrics:

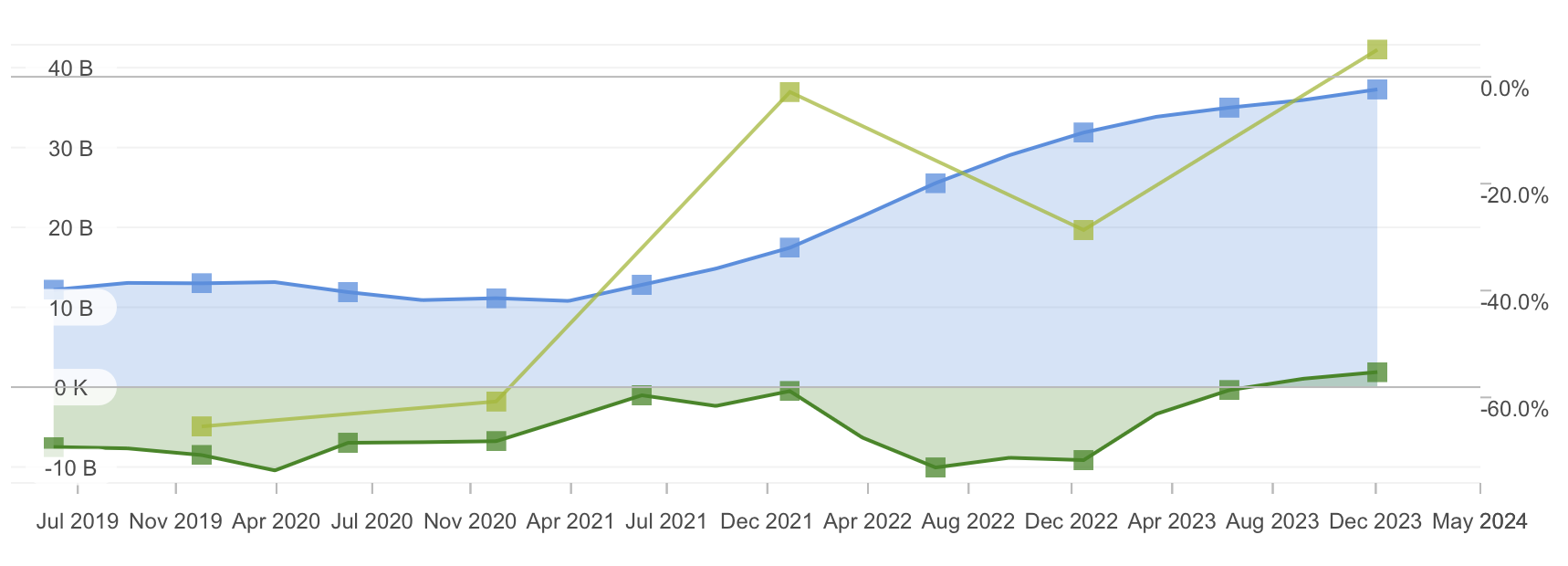

- Gross Bookings: Analysts expect a significant 20% year-over-year increase in gross bookings, potentially reaching $38 billion. This projected record not only indicates strong performance but also suggests Uber's continued growth trajectory.

- Profitability: After initial losses that are typical of many young companies, Uber has achieved net profits in most quarters since 2022. This trend is likely to be further analyzed by investors.

Source: InvestingPro

Uber's Revenue Growth Boosts Profitability

Uber's financial performance is showing a positive trend: revenue growth is translating into profitability at a much faster pace in recent years. As user adoption expands across different segments, Uber's revenue continues to climb.

Source: InvestingPro

This growth, coupled with the stabilization of fixed and variable costs, is significantly boosting profitability. Importantly, Uber's ability to manage costs effectively, including driver payments (variable) and rent, marketing, and personnel (fixed), contributes to a rapid rise in profit margins.

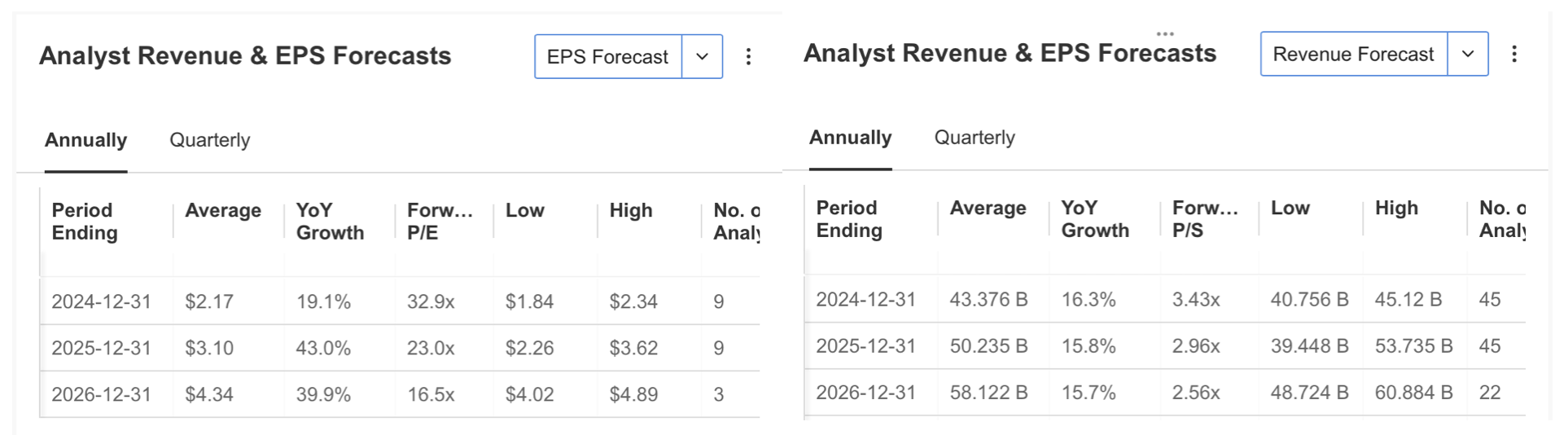

Analysts echo this optimism, holding positive long-term expectations for Uber's profitability and revenue growth. Forecasts for the ride-sharing and delivery sector are also bullish, which bodes well for Uber, the industry's most prominent global player.

What Are Uber's Strengths and Weaknesses Heading Into Earnings?

Leveraging InvestingPro's ProTips, let's delve into Uber's financial standing to assess its strengths and weaknesses as a potential investment.

Strengths:

- Profitability on the Rise: Uber has achieved profitability in the past year, and analysts expect this positive trend to continue.

- Strong Returns: The company has delivered high returns to investors over the past year, a promising sign.

Source: InvestingPro

Weaknesses:

- Potential Overvaluation: A high EBITDA valuation ratio suggests Uber's stock might be overvalued and susceptible to further correction.

- Lack of Dividends and Moderate Debt: The absence of dividend payouts and average debt levels could raise concerns for long-term investors seeking income generation and lower risk.

Source: InvestingPro

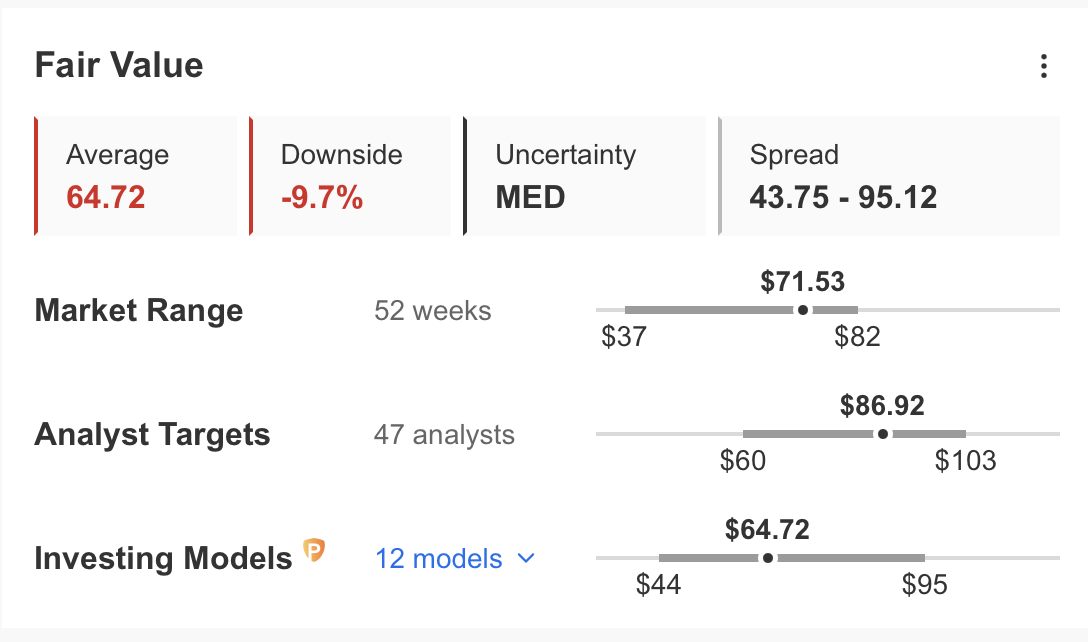

Accordingly, InvestingPro's fair value estimate for UBER is currently $64.72 based on 12 financial models. This predicts that the stock may undergo a 10% correction in the coming period.

Technical View

Uber's financial data and recent stock price surge suggest the company is on a growth trajectory. After reaching a high of $82.14 in early March, the stock experienced a decline. However, buying activity at $67 last week appears to have halted the short-term downward trend.

Looking at long-term trends, the $67 level is a crucial support zone for maintaining the upward trajectory. Weekly closes above $73 are also significant for continued growth. Following the earnings report, Uber's direction will likely be determined by breaking above or below these key price points.

On the upside, technical indicators suggest a medium-term target range of $86-$91. However, a weekly close below $67 could signal a correction, potentially pushing the stock below $60.

In conclusion, Uber maintains its potential for continued growth based on technical analysis, as long as it sustains weekly closes above the $67 support level.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.