Critics point out the tremendous amounts of debt and political dysfunction as major headwinds toward long term economic prosperity for the U.S. With massive amounts of debt incurred from two wars and the bailouts stemming from the financial crisis coupled with the lack of political will to address it, the U.S. faces an uphill battle in maintaining its position in the economic balance of power.

Despite this, the U.S. can still regain its stature as an economic power according to RBC Capital Markets Global Macro Strategy Team. In the report released on their website, “Connecting the Dots”, the U.S. has the ability to survive and prosper through its improving Demographics, its Dominance through innovation and its move toward Drilling and energy independence. These main factors should help drive a wave of growth for the U.S. in the coming years

.

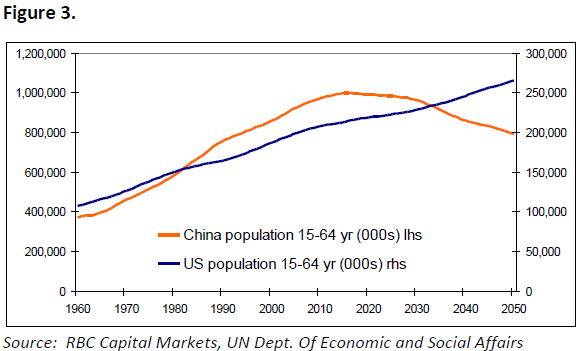

The Global Macro Team believes that demographics will be a positive development for the U.S. while at that same time should be a headwind for China. Specifically, the working-age-population between the two economies will start to diverge:

Using China as a proxy for the discussion, in 2017 the working age population in China begins to trend down while the working age population in the U.S. continues to rise (see Figure 3). It is quite possible that many countries like China respond to their weakening demographics by utilizing more automation within many of their manufacturing operations. This is already occurring at Foxconn, the main manufacturer for many of Apple’s products, which is beginning to implement the utilization of production robots within its factories. This move toward more manufacturing automation provides two main benefits: 1) efficiency and 2) lower cost to produce. This trend will only exacerbate the increasing levels of unemployment due to the workers displaced by the mechanization of off-shore manufacturing facilities. Automation does not occur overnight and currently wage growth in many of the off-shore manufacturing countries is increasing.

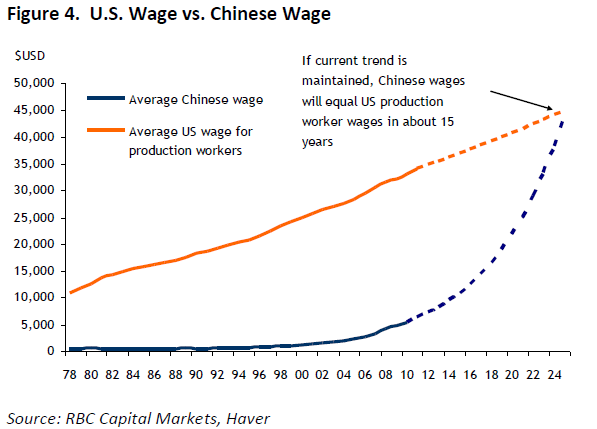

In addition, the research team believes that dominance in innovation will result in offshore jobs moving back to the U.S. The main impetus for this is the fact that wage growth in China is accelerating dramatically. In fact, RBC’s economics team believes that if this trend continues, they see Chinese wages to equal that of the U.S. by 2024. Here, they explain the implications:

When you see a “Made in China” stamp on a product, lower cost production comes to mind. The Chinese manufacturing complex is not doing anything elegant or innovative other than beating the G20’s manufacturing problems over the head with sheer numbers of workers who provide cheap labor to complete mainly repetitive tasks. The problem is that the Chinese “cheap labor” is not so cheap anymore. Looking at U.S. wages versus Chinese wages, we see that Chinese wages have risen rapidly, see Figure 5. Many U.S. companies are questioning the cost of doing business in China especially with the enormous increase in these costs. Current U.S. manufacturers that have facilities in China, will not have to wait until 2024 as their margins continue to be squeezed. Combining this with the cost of shipping of the product from China, and you have a very fertile environment to conclude that the U.S. will continue to repatriate many of its offshore manufacturing operations.

Finally, the Global Macro Team at RBC believes that developments in drilling should lead to energy independence for the U.S. which in turn should spill over into other industries. Specifically, they pointed out the significance of drilling in the Bakken and Marcellus shale oil and gas regions. Drilling activity in the Marcellus has increased by 7600 percent in a four year span beginning in 2007. The research team provided the following color on this development:

This enormous increase in drilling has had a direct impact on other industries. A recent article in the Wall Street Journal (WSJ), Steel Finds a Sweet Spot in the Shale, verified the thesis that what is “new again” is in fact old. The article stated, “the rising fortunes of a massive U.S. Steel Corporation plant in West Mifflin, Pennsylvania has much to do with what sits below it: massive deposits of cheap natural gas.” The Marcellus Shale deposit affects not only the influx of manufacturing to the U.S., i.e. re-emergence of the steel industry, but also its positive impact on margin enhancement due to increased sales of its end-product as well as the lower cost of one of the steel plant’s main input costs – natural gas.

Lower natural gas prices have had other unforeseen positive knock-on effects by creating a more robust manufacturing environment in the United States. If low natural-gas prices can be maintained, this will significantly enhance the competitive landscape of the U.S.’s manufacturing environment. “Companies that had left the U.S., in sectors like chemicals and fertilizers, are talking about coming back to take advantage of the low cost of gas,” said Don Norman, an economist for the Manufacturers Alliance for Productivity and Innovation.

Assuming it can overcome its inability to make definitive action on the political front and the massive amounts of debt in the next political cycle, prospects appear bright for the U.S. Changing demographics, dominance in innovation via a repatriation of jobs from abroad, and drilling should add to a wave of growth for the U.S. Through these channels, the U.S. should gain momentum toward regaining prominence as an economic power in the global marketplace.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Will Regain Prominence As Economic Power According To Research Team

Published 10/18/2012, 07:52 AM

U.S. Will Regain Prominence As Economic Power According To Research Team

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.