The U.S. 10-Year Treasury yield has fallen from 3% to start the year down to 2.5% yesterday. The decrease was unexpected for most people, especially since inflation and growth expectations both appear to have increased in 2014.

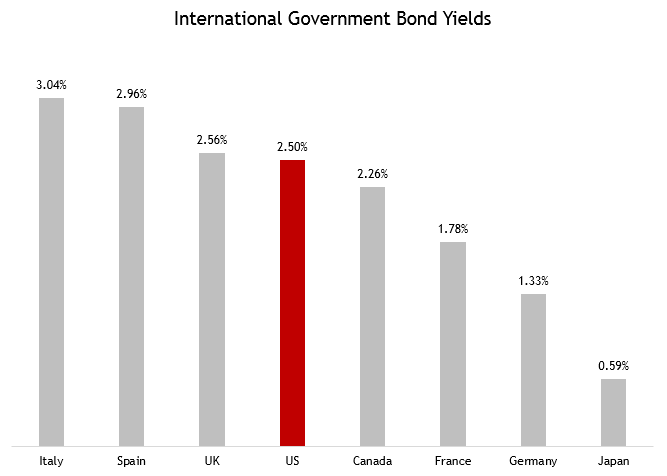

One explanation for why US rates continue to fall may be that US long-term rates are still relatively high compared to the rest of the world. Of the eight countries listed below, the US has the 5th highest 10 year government bond yield. The only two that are materially higher are Spain and Italy, both of which had perceived credit issues just a few years ago. Germany and Japan each have much lower long-term interest rates than the US.

Interest rate traders may be looking at the sovereign bonds of those countries and wondering what separates us from them. Given that all of our short term rates are effectively at zero, the answer may be “not much”.

If you take that view, that there isn’t much difference between Germany, Japan and us, then it’s conceivable that the 10 year Treasury yield could go back to trading with a one-handle. Let’s all hope that it doesn’t happen though. There doesn’t seem to be much empirical evidence that low interest rates boost economic activity. Instead, low rates seem to be more of a symbol of economic stagnation.

If the Fed wants to support psychology, it might be wiser to start raising short-term rates, and signal that they feel the economy is stronger, rather than to let long-term rates continue to drift lower, anchored by expectations that the Fed intends to keep rates low forever.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.