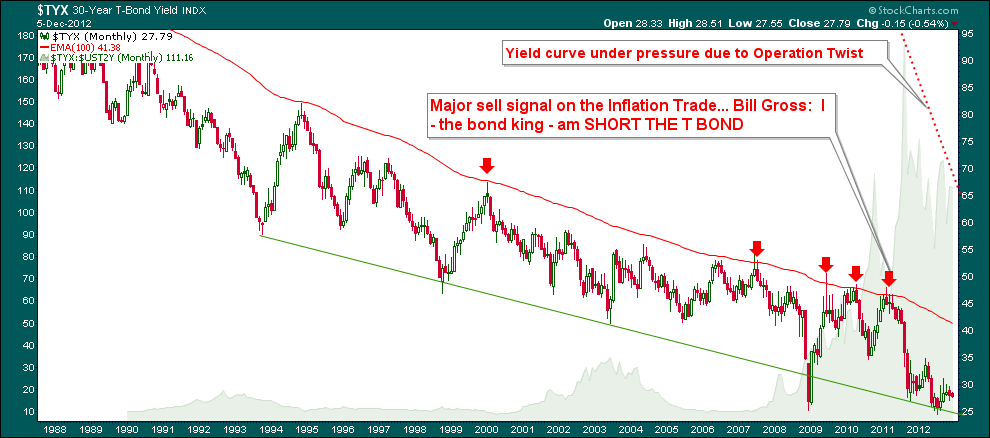

The long-term T bond could be a great short even if it remains within its secular uptrend (interest rates in a secular downtrend) because as the big picture monthly chart of the ‘Continuum’ shows, there is a long way up to the 100-month EMA where another theoretical red arrow would be painted on long-term interest rates.

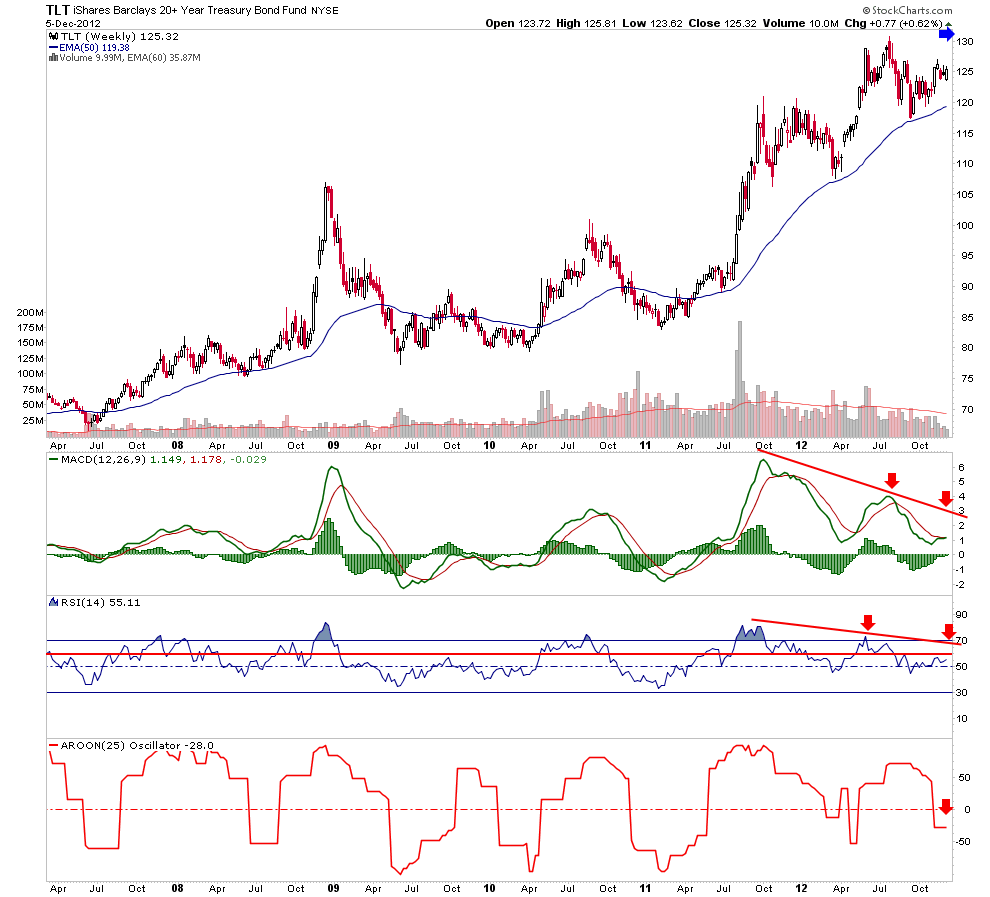

Dialing in to a weekly view of the iShares long-term T bond ETF, MACD and RSI have been sporting ongoing negative divergence for a year now.

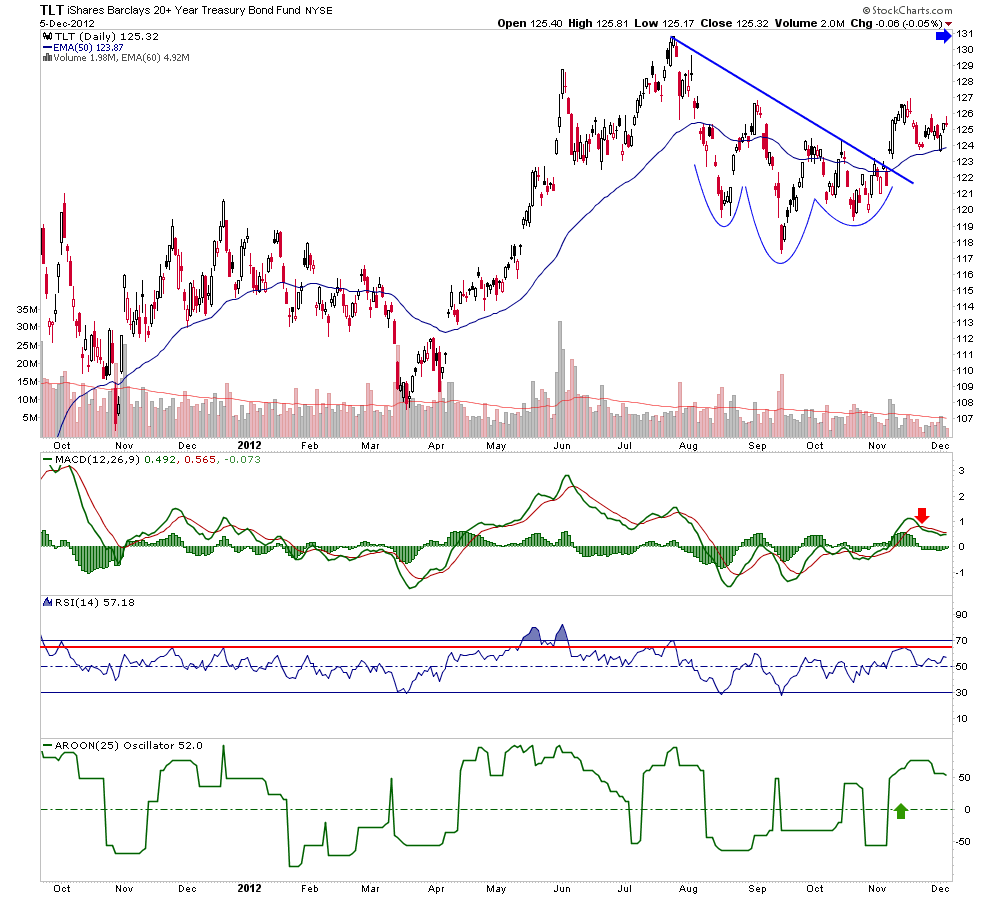

TLT is in a weekly downtrend by AROON, but it is in a daily uptrend. We have have a projected 2012 target of just above 130 based on a pattern we have been following by daily charts.

Depending on next week’s FOMC and the likelihood that the manipulators of the macro economic environment will choose ‘inflation’ as the easy fix to unfixable structural problems, the bond could get its final bump up to target.

By stating they will outright buy a hopelessly indebted nation’s debt obligations, without the sanitizing effects of Operation Twist, the herd could knee jerk into the bond amid the Fiscal Cliff uproar, get nice and comfy and then wait to be sheared as the inflationary effects (which would erode any perceived ‘value’ of these bonds) of such actions become apparent in 2013.

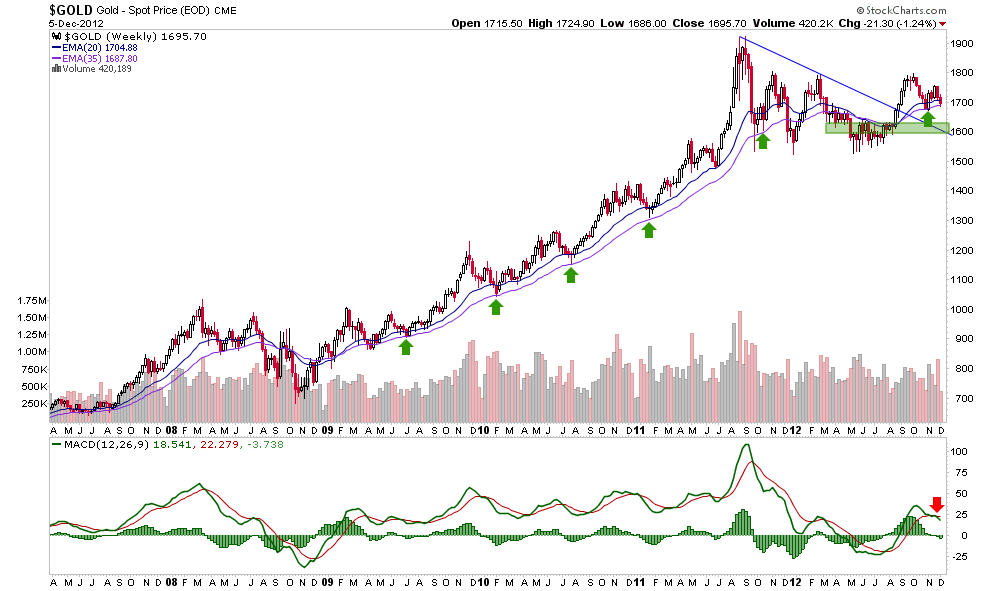

This is a valid setup that would go against many people’s expectations. After all, gold is forecasting no inflation, right? Yeh, right. The other side of this trade is that where ever gold bottoms, a chance to acquire monetary insurance would once again be at hand for people who need such insurance. Want to bet the herd will once again choose not to own this insurance if gold visits 1625 again?

That is a level that has been on radar all along. Here, let’s update the weekly charts.

Gold is clinging to the critical 1690 parameter. If it should lose this level and get the majority of technicians wrangling even more obsessively, it is going to the green shaded support zone. It’s only 70 bucks lower after all. Gold could do that with one hand tied behind its back.

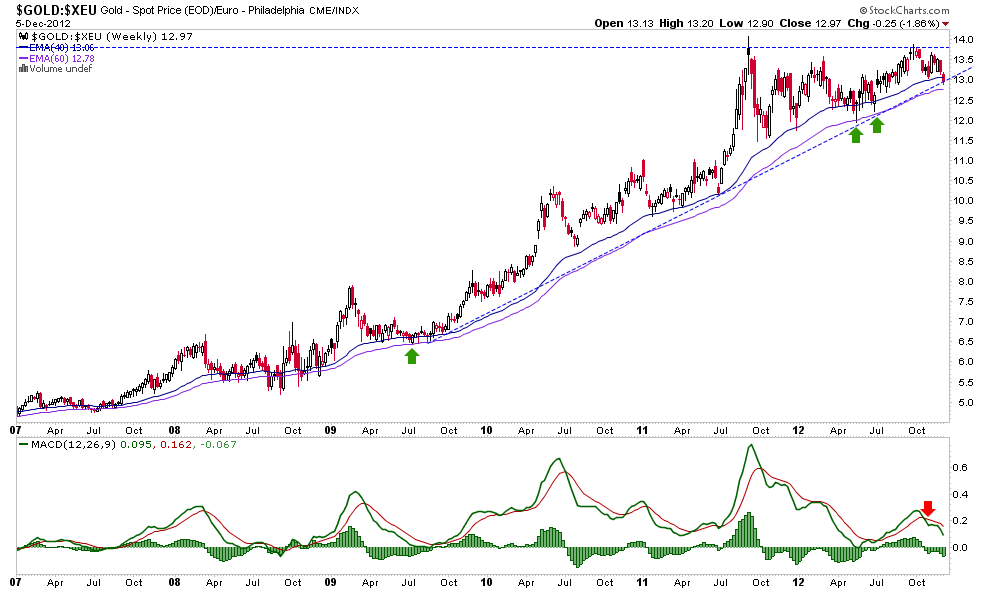

Meanwhile, gold is at the lower limit of the Ascending Triangle in Euros. The Euro is getting over bought by a global herd that, if it could just step outside of itself and observe itself objectively, would appear quite absurd. Wasn’t it just last summer that Europe was ending? You see the hilarity of course.

But technicals are technicals and gold would preferably stabilize in Euros now at the lower triangle limit. Of even more importance is the purple weekly-EMA 60, which has supported Au-Euro on previous breakdowns below the EMA 40.

This was going to be a quick post on the long bond and inflation. Then it expanded, I guess because I find it really interesting to see the role gold is playing in the run up to FOMC; the same FOMC that has stated that Op/Twist is ending this month, which would leave any future inflationary operations unsanitized. You see?

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Treasury Bonds: The Short Of 2013?

Published 12/06/2012, 07:08 AM

Updated 07/09/2023, 06:31 AM

U.S. Treasury Bonds: The Short Of 2013?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.