Yesterday, traders looked to invest in riskier assets, strengthening the euro and devaluing the dollar. A lack of significant overall news had investors looking to today's news for clues as to the level of risk appetite in the marketplace.

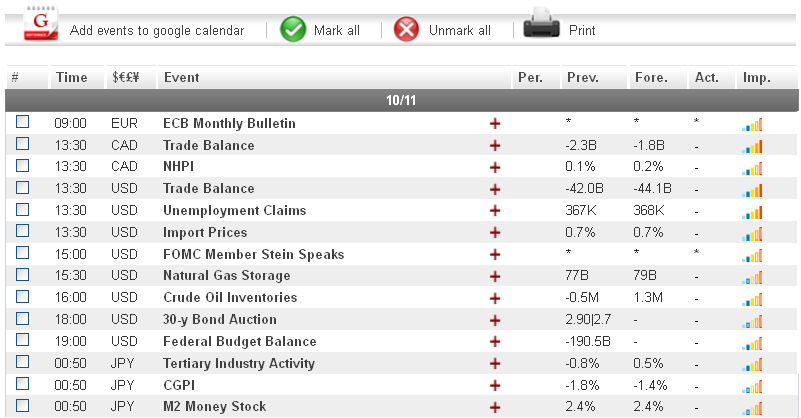

Investors will want to note that the U.S. Trade Balance and Unemployment Claims will likely have an impact on overall trading when the numbers are released at 12:30 GMT. Better than expected Trade Balance and Unemployment Claims figures may mean the dollar can gain back some of the ground it lost yesterday.

Economic News

USD - U.S. Unemployment Claims set to Generate Volatility

The U.S. dollar devalued in yesterday morning's trading against other currencies as investors looked to trade riskier assets. The AUD/USD had a morning low of 1.0182 before reaching a high of 1.0254. The USD/CHF fell during this morning's trading from a high of 0.9430 to a low of 0.9387.

Today the release of the U.S. Trade Balance and Unemployment Claims figures at 12:30 GMT may have a significant impact on trading. If the numbers are positive, the dollar may regain some of the ground it lost from yesterday morning's trading.

EUR - Risk Taking Gives Euro Moderate Boost

Yesterday, as investor shifted their funds to riskier assets, the value of the euro improved. The EUR/USD and EUR/JPY made quick rallies during morning trading and both pairs gained around 60 pips to reach as high as 1.2900 and 101.07, respectively.

Euro traders will want to watch major new releases out of the U.S. today. If the U.S. Trade Balance and Unemployment Claims figures come in below expectations, the euro may be able to extend yesterday's bullish momentum.

CAD - Canadian Trade Balance Figure may Boost CAD

After risk aversion brought the USD/CAD down to 0.9767 during morning trading, the pair was able to recoup most of its losses later in the day to trade as high as 0.9794. Also, due to traders investing in riskier assets, the EUR/CAD rose significant during mid-day trading by more than 50 pips to reach the 1.2620 level.

Today, investors in the Canadian dollar will want to note that the Canadian Trade Balance will be released at 12:30 GMT, the same time as the U.S. Trade Balance figure. If the Canadian data comes in above expectations and the U.S. Trade Balance numbers are negative, the CAD could see significant gains today.

Crude Oil - U.S. Crude Oil Inventories to Be Released in Afternoon Trading

Supply side fears in the Middle East caused the price of crude oil to spike in afternoon trading yesterday. By the afternoon session, the commodity shot up close to $2 a barrel to come within reach of the $94 level.

Today, commodities traders will want to note the release of U.S. economic news, including the Crude oil Inventories figure, set to be announced at 15:00 GMT. If the U.S. inventories data comes in higher than expected, the price of oil might trend downward during the afternoon session.

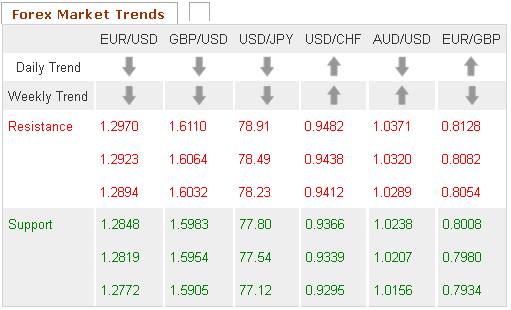

Technical News

EUR/USD

While the weekly chart's Williams Percent Range has crossed over into overbought territory, most other long-term technical indicators place this pair in the neutral zone. Traders may want to take a wait and see approach for this pair, as a clearer picture is likely to present itself in the coming days.

GBP/USD

A bullish cross on the daily chart's Slow Stochastic indicates that this pair could see an upward correction in the near future. Furthermore, the same chart's Williams Percent Range has dropped into the oversold zone. Traders may want to open long positions ahead of possible bullish movement.

USD/JPY

The Bollinger Bands on the weekly chart appear to be narrowing, signaling that this pair could see a price shift in the coming days. Furthermore, the MACD/OsMA on the same chart has formed a bullish cross, indicating that the price shift could be upward. Going long may be the preferred strategy for this pair.

USD/CHF

The Williams Percent Range on the weekly chart is currently in oversold territory, indicating that an upward correction could occur in the near future. Additionally, the Slow Stochastic on the same chart has formed a bullish cross. Traders may want to open long positions for this pair.

The Wild Card

Soybeans

The Relative Strength Index on the daily chart is approaching the oversold zone, indicating that an upward correction could occur in the near future. Furthermore, a bullish cross has formed on the same chart's MACD/OsMA. This may be a good time for forex traders to open long positions ahead of possible bullish movement.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Trade Balance And Unemployment Claims May Impact Trading

Published 10/11/2012, 04:11 AM

Updated 02/20/2017, 07:55 AM

U.S. Trade Balance And Unemployment Claims May Impact Trading

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.