Looking back, in the race for financial dominance, the U.S. economy sprinted out to a relatively quick recovery from the 2008-2009 financial crisis injury compared to its other global competitors. The ultra-loose monetary policies implemented by the Federal Reserve (i.e., zero percent Fed Funds rate, quantitative easing – QE, Operation Twist, etc.) and the associated weakening in the value of the U.S. dollar served as tailwinds for growth. The low interest rate byproduct created cheaper borrowing costs for consumers and businesses alike for things like mortgages, refinancings, stock buybacks, and infrastructure investments. The cheaper U.S. dollar also helped domestically based, multinational companies sell their goods abroad at more attractive prices.

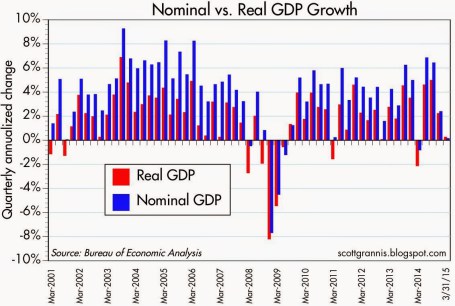

However, those positive dynamics have now changed. With the end of stimulative bond buying (QE) and threats of imminent interest rate hikes coming from the Federal Reserve and its Chairwoman Janet Yellen, the tailwinds for the U.S. economy have now transitioned into headwinds. The measly +0.2% growth recently reported in the 1st quarter – Gross Domestic Product (GDP) results are evidence of an economy currently sucking wind (see chart below).

As it relates to the stock market, the Dow Jones crept up +0.4% for the month of April to 17,841, and is essentially flat for all of 2015. Small Cap stocks in the Russell 2000® Index (companies with an average value of $2 billion – IWM), pulled a muscle in April as shown by the index’s -2.6% tumble. A slight increase in the yield of the 10-Year Treasury to 2.05% caused bond prices to contract a modest -0.5% for the month.

Beyond a strengthening dollar and threats of rising interest rates, debilitating port strikes on the West Coast and abnormally cold weather especially back east also contributed to weak trade data and sub par economic performance. Although a drop in oil and gasoline prices should ultimately be stimulative for broader consumer and industrial activity, the immediate negative impacts of job losses and declining drilling in the energy sector added to the drag on 1st quarter GDP results.

Source: Scott Grannis (Calafia Beach Pundit)

The good news is that many of the previously mentioned negative factors are temporary in nature and should self-correct themselves as we enter the 2nd quarter. One positive aspect to our country’s strong currency is cheaper imports. So, as the U.S. recovers from its temporary currency cramps, foreigners will continue pumping out cheap exports to Americans for purchase. If this import phenomenon lasts, these lower priced goods, coupled with discounted oil prices, should keep a lid on broader inflation. The benefit of lower inflation means the Federal Reserve is more likely to postpone slamming the brakes on the economy with interest rate hikes. The decision of when to lift interest rates will ultimately be data-dependent. Due to the lousy 1st quarter numbers, it will probably take some time for economic momentum to reemerge, and therefore the Fed is unlikely to raise interest rates until September, at the earliest.

The great thing about financial markets and economics is many of these swirling monetary winds eventually self-correct themselves. And during April, we saw these self-correcting mechanisms up close and in person. For example, from March 2014 to March 2015 the U.S. dollar appreciated in value by about +25% versus the euro currency (FXE). However, from the peak exchange rate seen this March, the value of the U.S. dollar declined by about -7%. The same self-correcting principle applies to the oil market. From the highs reached in mid-2014 at about $108 per barrel, crude oil prices plunged by about -60% to a low of $42 per barrel in March. Since then, oil prices have recovered significantly by spiking over +40% to about $60 per barrel today.

Competitors Narrow the Gap with the U.S.

As I’ve written many times in the past, one of the ultimate arbiters of stock price performance is the long-term direction of corporate profits. And as you can see from the chart above, profits have hit a bump in the road after a fairly uninterrupted progression over the last six years. The decline is nowhere near the collapse of 2008-2009, but given the rise in stock prices, investors should be prepared for the bears and skeptics to become more vocal.

And while the U.S. has struggled a bit, European and Asian shares have advanced significantly. To that point, Asian equities (iShares China Large-Cap (ARCA:FXI)) spiked an impressive +16% in April (see chart below) and European stocks jumped a respectable +4% (Vanguard FTSE Europe (ARCA:VGK)) over the same timeframe.

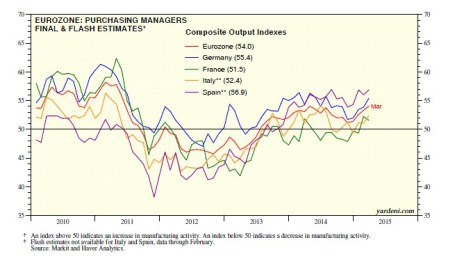

Bolstering the advance in China’s shares has been the Chinese central bank’s move to cut the amount of cash that banks must hold as reserves (“reserve requirements”). The action by the central bank is designed to spur bank lending and combat slowing growth in the world’s second largest economy. The Europeans are not sitting idly on their hands either. European central bankers have taken a cheat sheet page from the U.S. playbook and have introduced their own form of trillion dollar+ quantitative easing (see Draghi Provides Beer Goggles) in hopes of jump starting the European economy. Given the moves, how is the European business activity picture looking? Well, based on the Eurozone Purchasing Managers’ Index (PMI), you can see from the chart below that the region is finally growing (readings > 50 indicate expansion).

The economic winds in the global race for growth have been swirling in all directions, and due to temporary headwinds, the dominating lead of the U.S. has narrowed. Fortunately for long-term investors, they understand investing is a marathon and not a sprint. Holding a globally balanced and diversified portfolio will help you maintain the stamina required for these volatile and windy economic times.

Disclaimer: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), FXI, VGK, and a short position in FXE, but at the time of publishing, SCM had no direct position in IWM, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.