U.S. stocks have been resilient in their response to bad news throughout the year. They may sink at the start of a trading day, but they’ve been able to recover quickly and finish strong.

Consider the most important headlines on Friday, April 12. Consumer confidence unexpectedly dropped to its lowest level in 9 months. Retail sales dipped by 0.4% in March. And the IMF intends to cut back U.S. growth forecasts for 2013 from 2% GDP to a sickly 1.7%. The market’s reaction? The S&P 500 shed nearly 1% of its value out of the gate, only to close the session a modest 0.3% lower.

Of course, the negative stories have not been confined to a single morning. Developed countries have either slipped into recessions or they show signs of falling further into the abyss. Emerging country stock ETFs have been hit with outflows due to a slowdown in economic expansion in those countries. What’s more, both the employment rate (i.e. labor force participation) as well as productivity are stuck in 1979; that is, it has been 34 years since we’ve seen 3 straight quarterly declines in productivity as well as witnessed a meager 63.3% of eligible workers in the workforce.

At the same time, U.S. stock ETFs are a fraction of a percent off the all-time record highs that they set on Thursday. This is not a mere case of climbing the proverbial “Wall of Worry.” This is akin to receiving immunity on the reality TV show hit, “Survivor.”

Granted, the Federal Reserve’s emergency-driven policy of printing trillions of dollars, buying U.S. bonds and forcing interest rates lower has succeeded at reflating demand for homes and stocks. Without question, those who have the money have benefited from the “wealth effect” that accompanies higher prices. What is harder to justify, however, is connecting the dots between this “wealth effect” and the future well-being of businesses or consumers.

For instance, we already know that negative pre-announcements this earnings season are higher than at any point since 2001. In other words, neither earnings nor corporate guidance will impress. It follows that we may be looking at a situation where the “P” of stock prices has pole-vaulted higher, while the “E” in earnings may fail to grow. Fundamentally, that’s an unattractive combination.

The question needs to be asked… At what point will the Fed’s trillion dollar money printing campaign fail to shelter U.S. stock investors from a pullback, sell-off or bearish downtrend? Or is the opposite true; that is, will we fail to see a pullback, sell-off or bearish downtrend until the Fed puts the brakes on its quantitative easing?

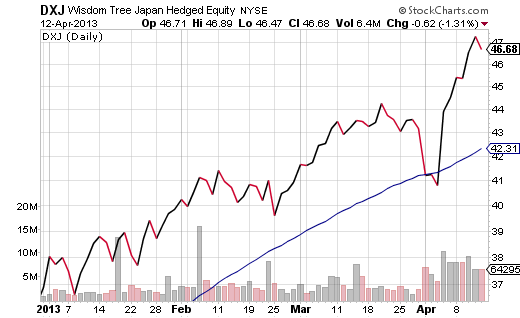

At least for the time being, investor faith in central bank bailouts is so strong, the Bank of Japan went ahead with a massive asset purchasing plan of its own. Not too surprisingly, the yen lost significant value and Japanese stocks surged skyward. Note: I anticipated the run-up for WisdomTree Hedged Japan Equity (DXJ) in this commentary from 2012.

Under different circumstances (a la 2003), the Fed’s over-stimulative policy might normally create a stock or real estate bubble. Yet it’s difficult to look at stocks as ridiculously overpriced. Overbought… certainly…. but not overpriced. And while real estate affordability indexes are showing some signs of excess, they are nowhere near the bubbly levels of 2007.

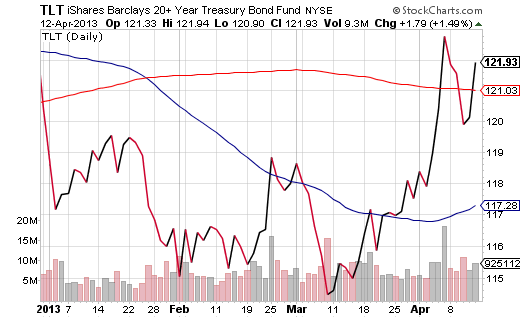

In sum, it’d be foolish to dismiss euro-zone anti-austerity, declining global GDP, geo-political tensions in the Middle East or North Korea, stagnant corporate earnings, poor job prospects stateside or any number of additional issues that I discussed earlier. U.S. stock ETF investors will need to keep their eyes on the ball, as the recent price gains for U.S. Treasury Bond ETFs like iShares 20+ Year Treasury (TLT) may be forecasting an eventual shift away from riskier stock assets. In essence, make certain that you have your exit strategy ready to go.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Stock ETF Investors Need To Keep Their Eyes On The Ball

Published 04/14/2013, 01:46 AM

U.S. Stock ETF Investors Need To Keep Their Eyes On The Ball

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.