As I pointed out two weeks ago, U.S. steel prices had no choice but to decline as the spread between U.S. and international prices had widened to unsustainable levels.

That’s exactly what I’ve seen so far in May, and I suspect that the recent price decline is just the beginning of a deeper correction that could easily extend to the rest of the second quarter.

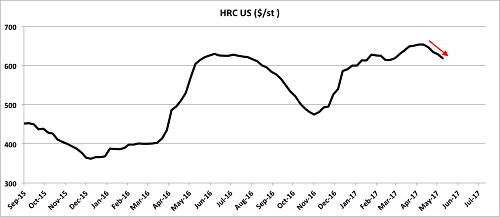

U.S. hot-rolled coil prices fall in May. Source: MetalMiner IndX

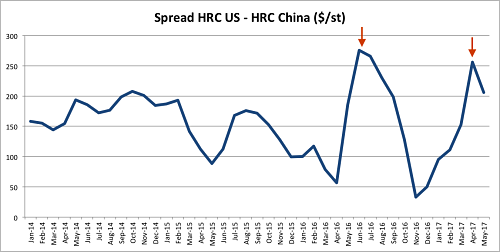

Hot-rolled prices have fallen around 5% since they peaked in April. Meanwhile, steel prices in China have started to stabilize after a slump during March/April. As the chart below shows, the price spread appears to have peaked near the same levels as it did last summer. U.S. steel prices will likely continue to fall, bringing this price arbitrage down.

Hot rolled coil price spread US vs China. Source: MetalMiner IndX

U.S. Steel Imports Hit a Two-Year High

Although the U.S. doesn’t import steel directly from China, Chinese steel prices set the floor for international prices. Therefore, when China’s steel prices fall, imports become more appealing to U.S. buyers. That’s exactly what’s happening now. In March, U.S. steel imports rose 31% year-over-year, hitting the highest level since May 2015.

While the international price spread looks attractive, imports will continue to rise, bringing U.S. steel prices down. The only thing that might change that is the new investigation that President Donald Trump ordered to see whether steel imports pose a threat to the U.S. national security.

If the investigation proves the allegation right, and the U.S. imposes broad steel taxes on steel imports, U.S. steel mills will gain purchasing power to raise prices. However, we will have to wait a while before we see findings from this investigation.

China Steel Supply Up Despite Capacity Cuts

What could limit the downside in U.S. steel prices is a recovery in Chinese prices. However, I suspect that might not happen. Prices in China surged last year because markets expected Chinese steel capacity cuts to reduce global steel production. However, China is cutting capacity but output continues to rise.

China’s production reached a record level in April. For the first four months of 2017, production was up 4.6% compared to last year. On top of that, China has already accomplished around 63% of this year’s targeted cuts on steel. Most of the plants that are being closed were already idle, while open plants are increasing output to profit from high prices.

Demand Slowdown?

Another factor that helped prices go up last year was robust demand from the top customer, China. However, things seem to be turning around.

Recently, China announced intentions to halt credit growth, which could potentially hurt demand for industrial metals. Commodity markets fell as investors feared that demand could slow down in China. The ongoing slump in iron ore and coking coal prices haven’t helped matters either. These developments could weigh on Chinese steel prices, hurting U.S. prices as well.

What This Means For Metal Buyers

U.S. steel prices might keep falling over the next few weeks until the international price spread comes down to normal levels. In the long term, prices will recover if Chinese prices rebound, but this now appears less likely given the latest figures coming out of China.

To conclude, steel buyers should be in no rush to purchase steel.