U.S. Steel Corp. (NYSE:X) plans to sell shares in a public offering that’s expected to generate $439 million for the metal producer. The sale of 17 million new shares will be managed by banks including JPMorgan Chase & Co. (NYSE:JPM) , Goldman Sachs (NYSE:GS) , and Barclays (NYSE:BCS) . U.S. Steel will grant underwriters a 30-day option to buy as many as 2.55 million additional shares. The company currently has 147 million shares outstanding.

The steelmaker said Monday that “The company intends to use the net proceeds from the offering for financial flexibility, capital expenditures and other general corporate purposes.” The company joins miners including Freeport-McMoRan Inc. (NYSE:FCX) and Iamgold Corp. (TO:IAG) in tapping into the stock market after metal producers’ shares have rallied this year as commodity prices were able to stabilize from the biggest rout in a generation. U.S. Steel is also benefitting from government efforts to stem a tide of cheap imports at a time when its costs are declining in the wake of a streamlining push.

Last month, Freeport-McMoRan announced plans to sell as much as $1.5 billion in new stock, in what would be its third stock issuance in the last year. In addition, Iamgold just yesterday announced a bought deal for 38.9 million shares priced to raise about $200 million on the back of gold bullion prices jumping 26% this year.

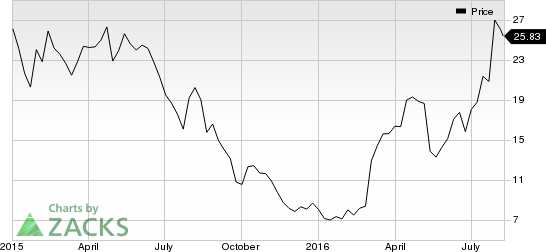

Shares of U.S. Steel Corp. have gained around 217% year-to-date, after losing more than 70% in 2015. After South Africa’s Kumba Iron Ore Ltd. (OTC:KIROY) , U.S. Steel is the best performer on the Bloomberg World Iron/Steel Index. U.S. Steel Corp. is currently a Zacks Rank #3 (Hold) stock, and shares of the company were trading around 3% lower in Tuesday morning trade.

JPMORGAN CHASE (JPM): Free Stock Analysis Report

BARCLAY PLC-ADR (BCS): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

IAMGOLD CORP (IAG (LON:ICAG)): Free Stock Analysis Report

KUMBA IRON ORE (KIROY): Free Stock Analysis Report

FREEPT MC COP-B (FCX): Free Stock Analysis Report

UTD STATES STL (X): Free Stock Analysis Report

Original post