United States Steel Corp. (NYSE:X) just released its second quarter fiscal 2017 financial results, posting earnings of $1.07 cents per share and revenues of $3.14 billion. Currently, X is a Zacks Rank #3 (Hold), and is up almost 9% to $26.62 per share in trading shortly after its earnings report was released.

U.S. Steel:

Beat earnings estimates. The steel giant posted earnings of $1.07 cents per share, soaring past the Zacks Consensus Estimate of 40 cents per share. This number excludes non-recurring items of 41 cents. Net earnings for the quarter came in at $261 million.

Beat revenue estimates. The company saw revenue figures of $3.14 billion, surpassing our consensus estimate of $2.98 billion and growing 21.7% year-over-year.

U.S. Steel’s Flat-Rolled segment improved significantly from Q1, coming in at $218 million for the second quarter thanks to higher results from its mining operations and a second consecutive quarter of increasing average realized prices and shipments.

Its European segment, however, declined compared with last quarter due to an unfavorable first-in-first-out (FIFO) inventory impact; U.S. Steel Europe posted $55 million in segment earnings for Q2.

U.S. Steel’s Tubular and Other Businesses segments reported earnings of $(29) million and 9 million, respectively.

Looking ahead, U.S. Steel expects net earnings of $300 million for fiscal 2017, or $1.70 per share, and 2017 adjusted EBITDA of approximately $1.1 billion.

U. S. Steel President and Chief Executive Officer Dave Burritt said, "Our facilities performed better in the second quarter, particularly in our Flat-Rolled segment…We are focused on our strategic priorities: driving operational excellence across our business – from our plants to our support teams; investing in our facilities through our asset revitalization program; and providing our employees with the resources they need to implement positive, substantive changes.”

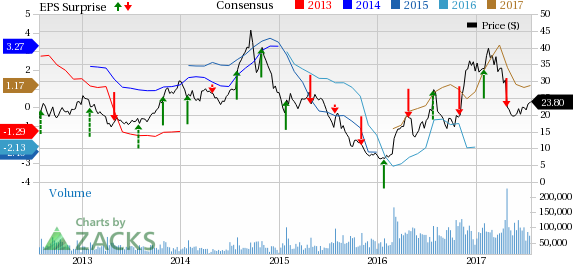

Here’s a graph that looks at United States Steel’s price, consensus, and EPS surprise:

United States Steel manufactures and sells a variety of steel mill products, coke and taconite pellets. Primary steel operations are the Gary (Indiana) Works, the Fairfield (Alabama) Works near Birmingham, the Mon Valley Works (which includes the Edgar Thomson steelmaking and Irvin finishing operations) on the Monongahela River near Pittsburgh, and U. S. Steel Kosice in the Slovak Republic.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without.

Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

United States Steel Corporation (X): Free Stock Analysis Report

Original post

Zacks Investment Research