So much for the forecasting powers of the ADP whose strong number had raised hopes earlier about the employment situation. But the labour market remains fragile as evidenced by the weak nonfarm payrolls (only 96K jobs added in August, with downward revisions of 41K to the prior two months) and a second successive employment decline in the household survey (-314K in the last 2 months).

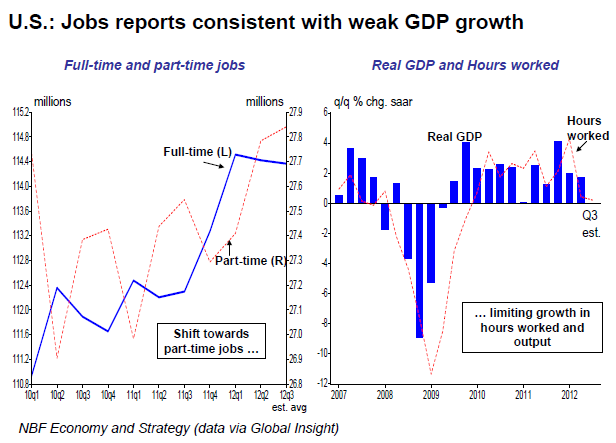

True, the unemployment rate fell to a four-month low of 8.1%. But that’s entirely due to people giving up the job search as reflected by the drop in the participation rate to 63.5%, the lowest since 1981. The small gains in full-time jobs in August did little to significantly alter a trend that’s been apparent since Q2, with a move away from full-time and towards part-time jobs.

That has contributed to limit growth in hours worked to less than 0.5% annualized over the Q2-Q3 period. We haven’t seen such weakness since 2009. As today’s Hot Charts show, barring a spectacular increase in productivity, that should translate into weak GDP growth in Q3 as well.

Given Chairman Bernanke’s emphasis on labour markets, this general weakness in employment suggests the Fed will downgrade its forecasts at the FOMC’s September meeting. That’s not to say that QE3 will be dispatched this month, but it’s clear that the probability of QE action sooner rather than later, has increased significantly.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Jobs Reports Consistent With Weak GDP Growth

Published 09/09/2012, 06:37 AM

Updated 05/14/2017, 06:45 AM

U.S. Jobs Reports Consistent With Weak GDP Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.