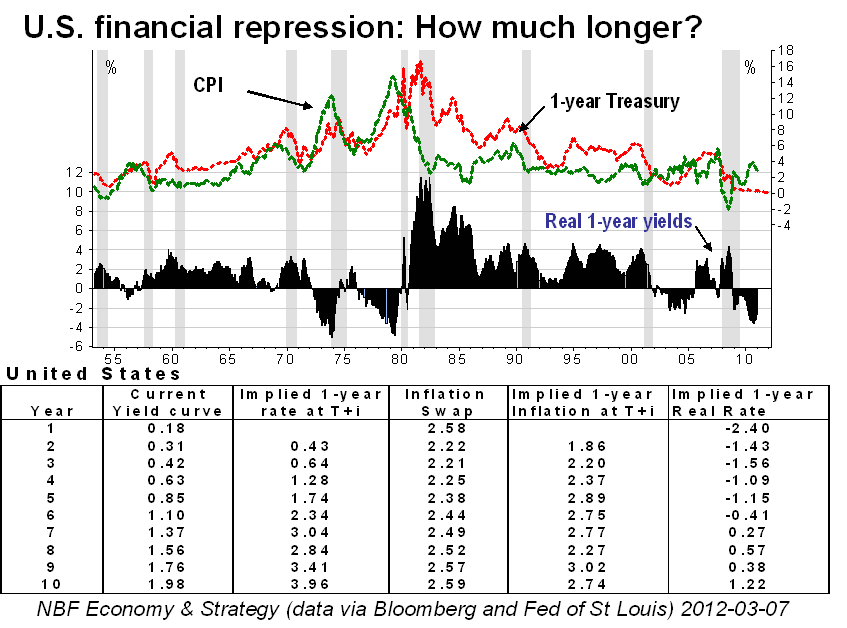

From the mid 1950’s up to 1979, real interest rates were significantly lower than in the 20 years that followed Chairman Volker’s cold-turkey policy to cure the economy from high inflation. During the era of the Great Moderation, monetary policy maintained real rates relatively high in order to opportunistically keep inflation trending down and to anchor low inflation expectations. In contrast, some would argue that the low rates seen 50 years ago were part of a deliberate policy of financial repression aimed at reducing the real debt servicing costs (and debt/GDP ratio) of an indebted U.S. government. In the aftermath of the sub-prime crisis, public debt has surged and the unsustainability of fiscal policies around the world has been exposed. Although we applaud the resolve and ingenuity of the Fed in managing the financial crisis, current low rates make many fixed income investors feel that financial repression is back. Assuming long rates are some form of averages of expected short term rates, one can derived the implied 1-yearr rates from the current U.S. yield curve. Doing the same with the inflation swap curve, leaves the impression that fixed income investors could be facing negative real rates for 6 more years. While real wealth was transferred from borrowers to lenders during the Great Moderation, the pendulum has swung in the opposite direction and for the time being seems stuck in its new position.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Financial Repression: How Much Longer?

Published 03/13/2012, 02:06 AM

Updated 05/14/2017, 06:45 AM

U.S. Financial Repression: How Much Longer?

A look behind the curve

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.