Equity markets in the U.S. jumped higher after the Federal Reserve Board announced the beginning to taper its stimulus package. They say the labor market will keep improving and promised to keep interest rates low. The S&P 500 and the Dow Jones each closed at new record highs.

Investors are not looking just at the paper but at the overall wellness of the economy. In this case, the fed did a good job letting the markets know what they were going to do and then pulled the trigger. They did the right thing. The Fed will now reduce its asset purchases from $85 to $75 billion per month. Shaving off and equal amount in Treasuries and mortgage backed securities. During his press conference, Ben Bernanke, who is stepping down in early 2014, said the Fed could reduce more in the months ahead if economic conditions warrant such a move. He also said the lending rate will remain very low well into the labor market hitting its target unemployment rate of 6.5 percent.

STOCKS

The DJIA jumped 292.71 points, a gain of 1.8 percent, to close the day at 16,167.97. This has broken its previous record high set on November 27, 2013. The S&P 500 rose nearly 30 points or 1.7 percent to close at 1,810.65. This is also a new record high. The healthcare sector led gains as all 10 of the indexes sectors were up. The tech heavy Nasdaq Composite soared 46.38 points or 1.2 percent ending the day at 4,070.06. This is a 13 year high for the Nasdaq.

We should mention the U.S. Dollar strengthened after the Fed announced the tapering and the 10 year Treasury note was up 3 basis points to 2.87 percent. The 10 year note is used in helping to calculate Consumer mortgage rates.

Asian markets are mixed this morning as we are also watching emerging markets closely. The Nikkei is up nearly 240 points and near its highest levels seen last May 23. We are closing in out its six year high. Investors are cheering the USD/JPY currency pair as it is trading at 104.36. This is very close to its five year low.

In Sydney, the ASX 200 is rallying for a 1.5 percent gain as the AUD/USD recovered from a three and a half year low near 0.8829 overnight. The Shanghai Composite is flat so far today. This comes after reversed all gains to hit a new one month low. Investors are fearing another liquidity crunch in China.

Indonesia’s Jakarta index soared one percent, while the Philippine benchmark was up 0.50 percent. The Indonesian Rupiah has hit a new low versus the Dollar at 1,290 and the Philippine peso is at its lowest level in over three months.

CURRENCIES

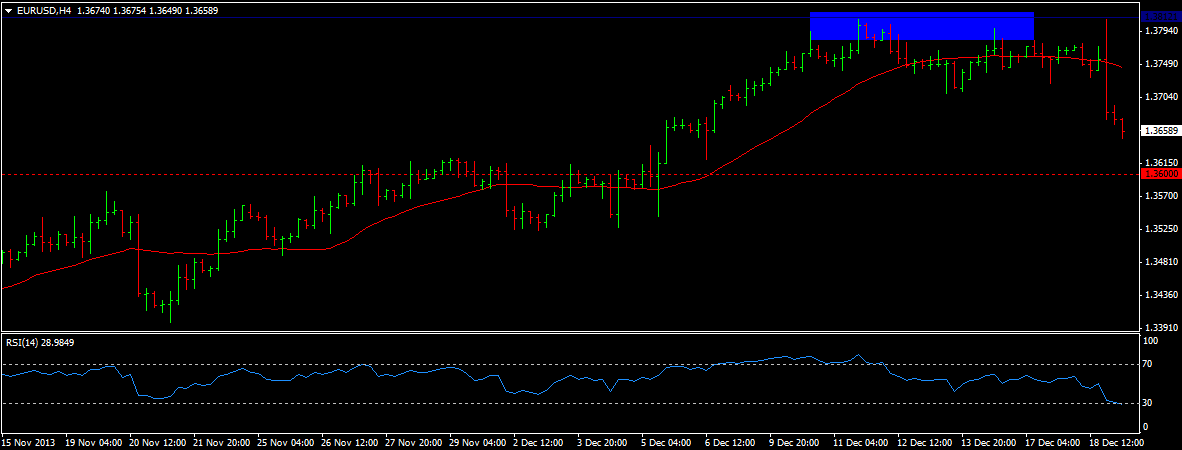

EUR/USD (1.3658) came crashing down after the Fed’s announcement. Technically speaking, resistance at 1.3820/1 is proving to be stiff and hard to crack. We have to stay above 1.36 or the bears come calling for 1.3520 and even 1.35.

USD/JPY (104.82) jumped higher and broke the range trading that we had been stuck in as it crashed above resistance turned support at 103.372. Should we close this week above 104 then we target 105.50. A break above that aims for 109 and higher. Weakness comes in below 102.50.

AUD/USD (0.8834) hit a three year low then recovered a bit. Do not concern yourself about support levels as we remain very weak and could dip further. Instead look at resistance at 0.8870 and also at 0.8910.

COMMODITIES

Let us look at gold and the other metals.

Gold (1219.10) as expected gold is falling after the Fed announced the beginning of the end to QE. We are firmly below 1225 and now even below 1220. We are targeting 1120 even though we could see a bounce to 1225 if we have a weekly close at or near 1220.

Silver (19.54) is also lower and we are bearish on this precious metal as well. We are are targeting 19.20 and even 18.75 at this point.

Copper (3.3485) has also fallen as 3.35 held. We can now dip to 3.25 which could signal the end of the current rally. However, while above 3.30 we can still bounce to 3.35.

TODAY’S OUTLOOK

Europe will open soon and look for traders to digest the news we got yesterday from the FOMC. We also get data from the U.S. like initial job claims and leading indictors.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Equities Higher After Fed Tapers

Published 12/19/2013, 04:02 AM

Updated 05/14/2017, 06:45 AM

U.S. Equities Higher After Fed Tapers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.