A rudimentary lesson of Economics 101 is that unwarranted taxes always hinder productivity to some degree or other, for taxes are a disincentive to produce. The more taxes government implements to remove money from the pockets of wage earners, the less incentive they have to work hard and make even more money. Thus the velocity of money decreases, which is the basis behind a sluggish economy (as we’ll see here).

The Obamacare penalty must certainly rank as one of the biggest tax increases in U.S. history. One simply cannot tax the American middle class like that and expect to that economic growth will continue unimpeded. This is a big reason why the Democrats lost big in the latest election: it was the middle class’s repudiation of the Obamacare tax more than perhaps any other factor.

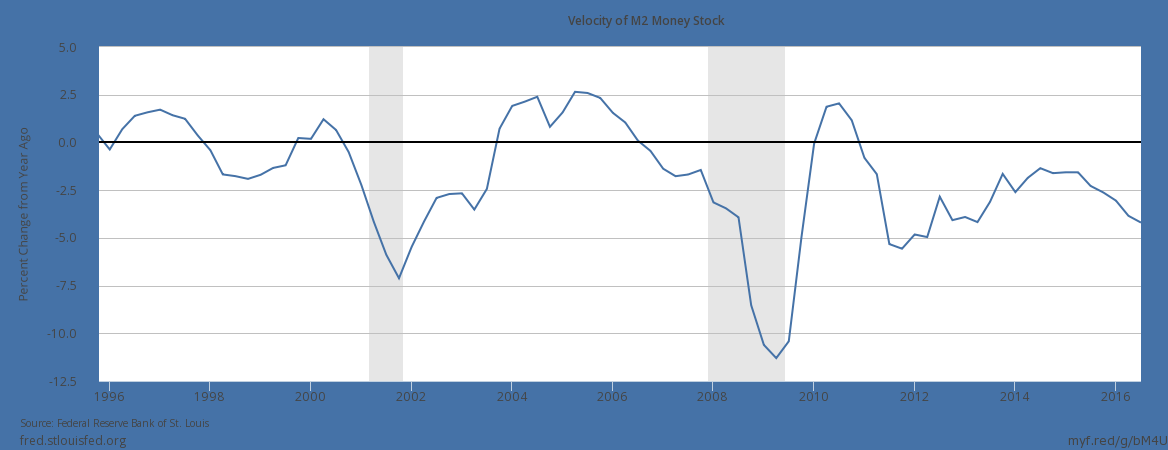

Although the economy has certainly made significant strides since the depths of the Great Recession, there’s no denying that it hasn’t regained its luster from the heady years prior to the crash. Economists often lament the lack of money velocity in the U.S., which is depicted in the following graph.

Velocity is simply a measure of how quickly money is changing hands in the U.S. The above chart is a snapshot of the annual percentage change in money velocity. The picture speaks for itself and is a perfect reflection of the residual anxiety still very much present within the middle class economy. Money simply isn’t changing hands fast enough among typical wage earners and this has kept the economy from what could have been a vigorous expansion.

The blame for that can be put largely on the biggest tax increase in decades previously mentioned. As long as the Obamacare tax remains on the shoulders of non-healthcare consumers it will continue to create a drag on the economy and prevent the kind of efflorescence historically associated with the strongest rebounds.

Beyond the impact that the Obamacare penalty laid upon millions in the middle class, it has also had repercussions for investors and business owners. The drag created upon business by Obamacare requirements has almost certainly contributed to the lack of forward momentum in the stock market these last two years. It can be seen most clearly in the NYSE Composite Index (NYA), below, which is the broadest measure of the U.S. equity market.

The breakout to new highs in several of the major indices, excluding the NYSE Composite, may indeed prove to be an anticipatory move in response to expectations that the Trump Administration will relieve business of its excessive tax and regulatory burden. In order for the breakout to give way to a continued boom, however, this expectation should become reality.

Now that Republicans control both chambers of Congress they have a chance to redeem themselves from their lack of a concerted effort against the Obamacare vote. Regardless of whether they support the law remaining intact, to acknowledge the middle class constituents who voted for them they can, and should, send an undeniable message of support. By eliminating, or at least significantly lowering, the penalty for not buying health insurance they will have given the middle class the best possible gift they can give. In doing so they will be lifting a huge hindrance to the economy and allow it to truly take off in 2017.

The 60-year economic cycle of inflation/deflation which bottom a couple of years ago hasn’t had a chance to work its magic on the U.S. economy by lifting the deflationary currents from the last two decades. The early years of the new 60-year cycle tend to exert a benign inflationary impact by gradually lifting prices without creating the problems associated with too much inflation. The up-phase of a new 60-year cycle also tends to stimulate consumer spending and investment within the economy due to the gradual increase of benign inflation. Yet the cycle hasn’t been allowed to do its work thanks to the grievous burden of taxation imposed by Obamacare.

If this tax is reversed by the incoming Congress, it’s highly likely that we’ll witness a magnificent flowering of the economy in the years that follow. While the economic recovery since 2009 can be likened to foliar growth in a fruiting plant, the second and most important phase of the recovery must involve flowering. Only then can the plant bear its fruit. To date there has been much leafy growth, yet little flowering. The stimulant required for this flowering is the lifting of the excessive burdens placed upon it by the previous caretakers.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. Far more than a simple trend line, it’s a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you’re trading in.