Investing.com’s stocks of the week

Three members of the U.S. Federal Reserve (the Fed) spoke on Wednesday and all of them indicated that a rate hike could be in the cards in the short term, although they remained vague as to the specific date. In an interview with CNN, highly influential Fed member William Dudley, who is usually against rate increases, noted that the U.S. economy has been showing signs of robustness since last fall’s elections.

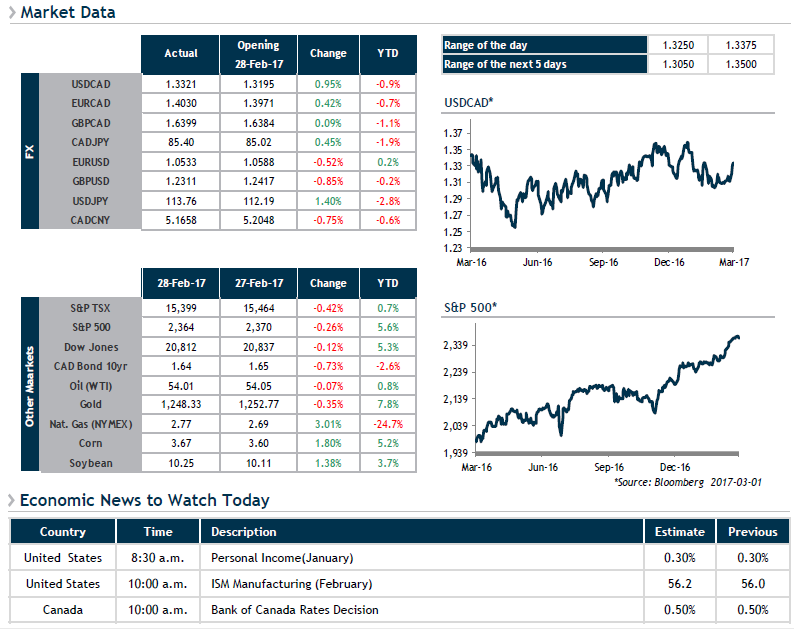

Further to these encouraging comments, the U.S. dollar continued to soar on Tuesday. The likelihood of a rate hike at the March 15 Fed meeting is now priced at 80%.

This morning, we’ll be keeping an eye on a number of major economic indicators in the United States, including Personal Income and Personal Spending and the ISM Manufacturing Index for February. In Canada, we are awaiting the Bank of Canada’s (BoC’s) key rate decision at 10 a.m., with no change in policy expected. We believe that the BoC’s monetary policy statement will maintain its dovish tone.

Last night, President Trump gave a poised speech that was short on major details regarding tax cuts. Investors appear more focused on upcoming yield increases as the greenback and stock markets are looking up this morning.