NZD: Trade Deficit narrows slightly, but well above the negative expectations to help support NZD/USD above 80.50. Fronterra reduces milk forecast 2014-15 payout to $5.30 from $6.00

AUD: Government cut Iron Ore forecasts following the 40% slump, seeing it downgraded to US$94/ton average for 2014, down from US$105 last quarter.

CNY: Goldman cuts China 2015 GDP outlook to 7.1% vs 7.6%

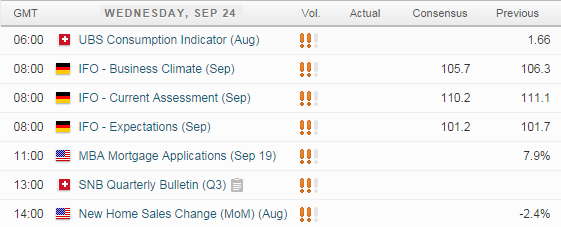

UP NEXT:

TECHNICAL ANALYSIS:

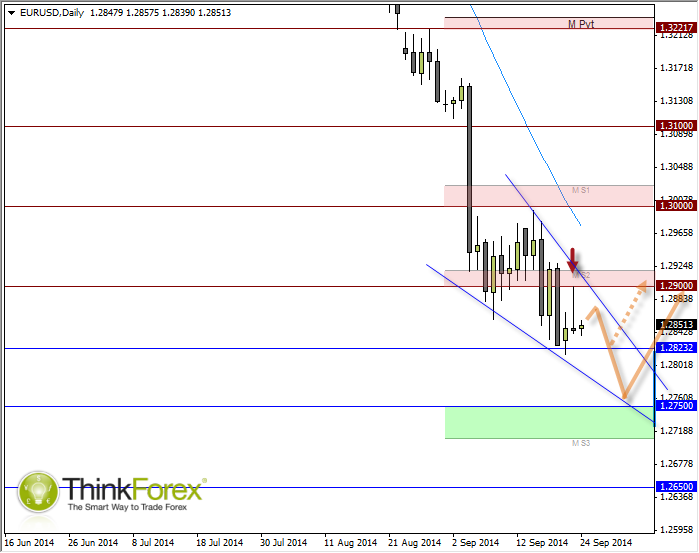

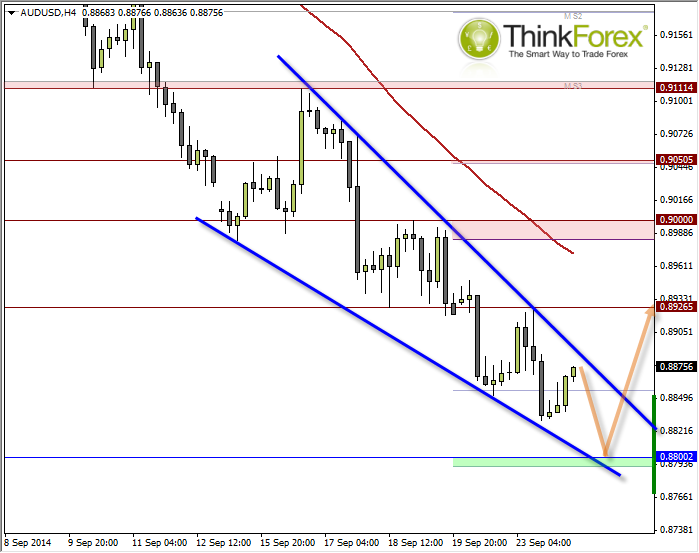

Looking at the Dollar Index I suspect there is still chance of modest highs before we reach the expected reversal (pullback). This leaves room for further downside on both EUR/USD and AUD/USD, which are yet to reach their 'critical' support levels.

In both cases they leave room for potential Bullish Wedges, whilst at the same time leaving room for lows before reversing.

EUR/USD:

Take note of yesterday's high which firmly rejected 1.29 resistance . One approach is to hope for a retracement within yesterday's range and set a sell-limit yo anticipate a downside break.

Alternatively seek to enter short below yesterday's low.

1.275 is a significant level which I expect to be heavily defended, so we may see some aggressive price action near this level and the eventual bullish break.

AUD/USD:

If yesterday's price action is anything to go by it will be 'bullish Asian' bearish US' session to suit bearish setups as we approach the upper resistance line.

My target for AUD/USD remains 88c where I expect some profit taking and / or brave longs to enter, resulting in a sizeable retracement against the bearish trend.