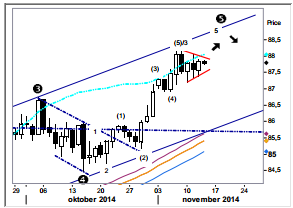

US Dollar Index: The fifth wave advance is certainly running late but given the fact that we seems to be creating a small bull triangle it is also fair to assume that there will be one more top to be put in place before it’s time to turn to the downside. Theoretically the top should be set at 89.94 but anything above 88.19 will fulfill the requirements for a top in place so caution urged as soon as trading at a fresh high. Breaking 87.36 and we’ve already turned the corner.

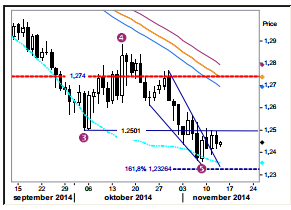

EUR/USD: Should soon continue higher. The exit from the fifth wave falling wedge (a terminating pattern) is expected to cause more short covering as prices are set to move higher. The best fitted hourly wave pattern calls for a minor setback to have been completed yesterday at 1.2419 and that the next step now should be a break of 1.2498 initiating the next move up to the mid 1.25’s. The correction case will turn obsolete if we pass the 1.2394 support.

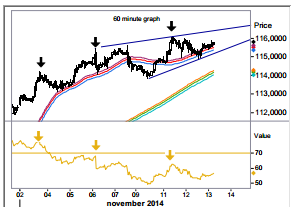

USD/JPY: Probably one more top. Compared to €/$’s already completed (and exited) falling wedge the rising one in $/JPY still seems to lack its final leg higher. A move above 116.11 will (ideally 116.45/55) will however complete the wedge which thereafter is seen being exited to the downside. A move lower will also be underpinned by the still growing RSI bear divergence.

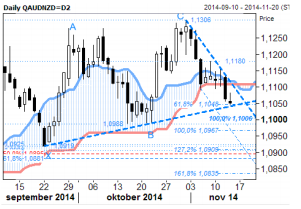

AUD/NZD: Below 1.1050 targets 1.1005/0965. Price action remains bearish and the thinned “Cloud” was convincingly broken yesterday. Trendline support at 1.1045 is a small hurdle, but once violated, extension should be penciled in towards the next target at 1.1005/1.0965 – not ruling out additional losses later. Local resistance seems to be building fast around 1.1095. Current intraday stretches are located at 1.1015 & 1.1125.