Yesterday the US Dollar Index continued to move in a neutral trend for the third consecutive day. The U.S. economic data were better than the preliminary forecasts again. The number of new unemployed people this week continues to be near the lowest levels since September 2007. The Philadelphia Fed manufacturing rose and peaked since last September. We believe that the fundamental positive for the U.S. Dollar is gradually accumulating throughout this week, which may lead to its growth in the future. Now it is hampered because of investors' fears that the Fed may extend the smooth monetary policy. This was mentioned in the speech on Wednesday by its president, Janet Yellen. Most of financial markets, including the United States, are closed today because of Good Friday. Accordingly, any strong movements in the Forex market are not expected for now. However, in our opinion, they are inevitable in the near future. The Volatility Index, calculated by the Deutsche Bank AG NA O.N. (NYSE:DB) on the basis of the dynamics for quotations of nine major currency pairs within three months has dropped to its lowest level since July 2007. On Monday the United States will reveal the leading indicator for March. It is forecasted to rise by 0.7%, the highest level since last November. This can be a positive factor for the U.S. Dollar.

Quotes of the CAD remained almost unchanged as inflation rose slightly in March and almost coincided with the forecast. Some separate inflation indices showed a clear growth. This increases the likelihood of rising in interest rates and supports the CAD. The Bank of Canada raised its own inflation forecast for the entire first quarter from 0.9% to 1.3%. It reaffirmed the commitment to raise this figure up to 2% by the end of next year, and kept it acceptable range at (1%-3%). The Governor of the Bank of Canada, Stephen Poloz said yesterday that the March inflation increase is temporary and its general trend is neutral.

The quotes of the ETFS Soybeans (SOYB.LSE) rose to the 10-month maximum, due to the record high domestic demand in the United States. This country is the second largest exporter of beans. Consumers fear the decrease in supply amid rising domestic consumption. According to the National Oilseed Processors Association, the soybean purchases in March increased by 12% compared with last year and reached the highest level since 1998 amounting to 153.8 million tons. The USDA lowered its forecast for U.S. soybean stocks at the end of August by 10 million tons to 135 million tons. This is 4.2% below the last year's level. Meanwhile, the Soyb market also has negative factors that may affect the quotes in the future. China may refuse to buy up to 5 million tons of soybeans from the United States. The main reason for this is the sharp demand decline due to the mass destruction of Chinese poultry which has previously been identified with avian influenza. Soybean is the main feed for broiler chickens. Recall that last year China imported 63.4 million tons of beans. This is just about 60% of the world market. Earlier this year, China turned away from the purchase of 500 tons of Brazilian soybeans, for the first time in 10 years.

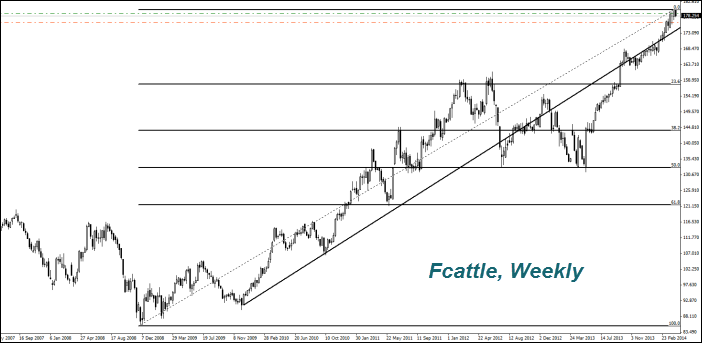

We do not rule out a downward correction of futures prices for frozen beef (Fcattle). The U.S. Department of Agriculture (USDA) said that the beef price will go up by 4% in 2014 and it already has grown since the beginning of the year by almost 8%. Some market participants do not exclude any USDA steps to settle the situation. Now the total number of cattle in the U.S. is at the minimum since 1951 and the country imports meat. We do not exclude that it may happen because of subsidies to farmers for growing the biofuel crops.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Demand Drives Soybeans

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.