Domestic corn supplies crept lower due to increased export expectations in today’s World Agriculture Supply and Demand Estimates (WASDE) report. Global corn production was lowered due to significant production decreases in South Africa. The report was otherwise bland with little happening as analysts wait for the Grain Stocks and Prospective Plantings reports on March 31st.

Corn

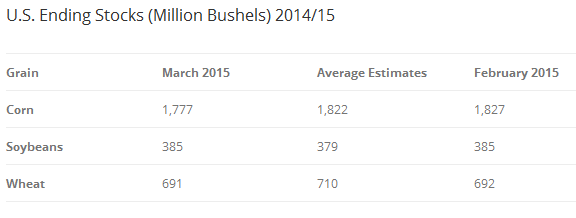

US Corn ending stocks for 2014/15 were reduced 50 million bushels to 1.777 billion bushels. Domestic corn used for ethanol production was estimated 50 million bushels lower, but the increase was more than offset by an increase in feed, residual, and export expectations. Augmented commitments and higher than expected global demand increased exports 50 million bushels. U.S. corn production for 2014/2015 was estimated at 14.216 billion bushels, unchanged from last month.

The projected season-average price range for corn in 2014/2015 was up 5 cents at the midpoint to $3.50 to $3.90 per bushel.

Global course grain supplies were estimated 1.6 million tons lower due mainly to a reduction in South Africa's production. South Africa has experienced dry and hot weather, significantly decreasing their annual production.

US Soybeans

U.S. soybean ending stocks for 2014/2015 were unchanged, remaining at an eight year high of 385 million bushels. The U.S. season-average price forecast for soybeans in 2014/2015 was unchanged at $9.45 to $10.95 per bushel. Global soybean production was unchanged at a record 315.1 million metric tons (mmt).

US Wheat

Domestic wheat ending stocks were decreased 1 million bushels to 691 million due to an increase in expected seed use for the expanded planted area projections released in February. Projected 2014/2015 season-average price was narrowed 5 cents on both the high and the low end to $5.90 to $6.10 per bushel. World wheat production was lowered slightly due to reduced production from Brazil.

Outlook

By this time next month, farmers in the southern U.S. will be busy planting crops while northern areas hope to be completing pre-planting field work. Planting expectations are leaning towards soybeans as most analysts’ project farmers will take advantage of the high soybean-to-corn price ratio. U.S. crop prices remain suppressed and analysts expect prices to remain low through the beginning of the planting season as large production from Brazil and Argentina will keep the market fed.